VN-Index increased by nearly 6 points, stock prices "flew high" thanks to expectations of new Circular

A series of stocks increased sharply, helping investor sentiment continue to be positive in the session on September 18.

Entering the trading session on September 18, the excitement from yesterday afternoon was no longer maintained, but instead, caution continued to take place. The indices fluctuated narrowly. However, after about half an hour of somewhat tug-of-war trading, buying power gradually increased and helped the indices expand the green color. Trading in the afternoon session was somewhat less excited, instead, selling power was activated and caused the increase of the indices to narrow.

The focus of the market today is the securities group, thanks to investors' expectations that the Circular amending 4 circulars related to foreign institutional investors being able to trade and buy stocks without requiring sufficient funds (Non Pre-funding solution - NPS) will soon be issued.

By late afternoon, Circular 68/2024/TT-BTC amending and supplementing a number of articles of circulars regulating securities transactions on the securities trading system; clearing and settlement of securities transactions; activities of securities companies and information disclosure on the stock market was officially announced by the Ministry of Finance.

HCM and SSI are two stocks with very strong increases in today's session. HCM increased by 3.97% and SSI increased by 2.14%. The strong increase of the two "big guys" in the securities industry has helped the cash flow spread to the entire group, in which, VDS increased by 3.91%, MBS increased by 2.55%, SHS increased by 2%, BSI increased by 1.5%.

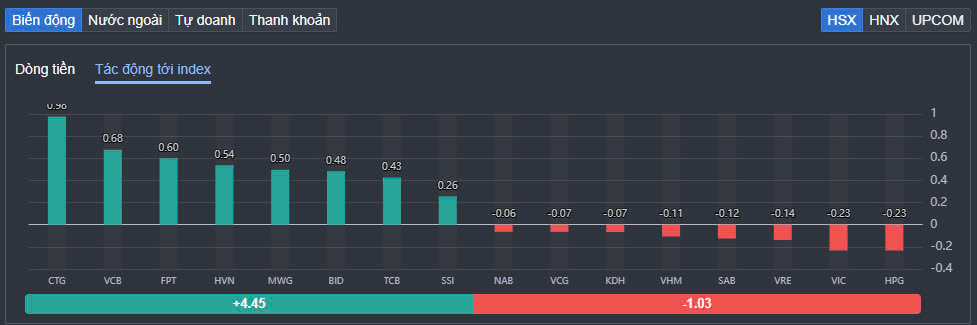

In the group of large-cap stocks, CTG, VCB, FPT, MWG... increased sharply and were the stocks that contributed the most to maintaining the green color of VN-Index. CTG increased by 2.15% to 35,700 VND/share and contributed 0.98 points to the index. VCB increased by 0.55% and contributed 0.68 points.

Notably, HVN had a strong breakout session when it increased by nearly 4.8% and was also in the top 5 stocks with the most positive impact on the VN-Index when it contributed 0.54 points.

The Viettel group of stocks also had a positive trading session when they all increased sharply in price, in which, CTR hit the ceiling price of 133,300 VND/share. It is known that on September 30, Viettel Construction - code CTR will close the list of shareholders to receive 2023 cash dividends at a rate of 27.2% (each 01 share receives 2,720 VND). The expected payment date is October 18, 2024.

VTP closed the session at VND79,000/share, up 6.33%. The Ho Chi Minh City Stock Exchange (HoSE) recently removed VTP shares of Viettel Post Corporation (Viettel Post) from the list of securities ineligible for margin trading. The reason is that VTP has been listed for 6 months, meeting the conditions for margin trading.

Similar to VTP, Viettel Global (VGI) shares increased by 9.8% and Viettel Design Consulting Joint Stock Company (VTK) increased by 8.63%. Another stock that attracted investors' attention was IMP when it hit the ceiling for the second consecutive session right after closing the right to split bonus shares at a ratio of 1:1 on September 17.

On the other hand, market pressure came from some large stocks such as HPG, VIC, VRE, SAB or VHM. Of which, HPG decreased by 0.59% to VND25,100/share and took away 0.23 points from the VN-Index. Then, VIC also took away 0.23 points when it decreased by 0.58% to VND43,900/share.

|

| CTG, VCB and FPT led the increase on September 18. |

At the end of the trading session, VN-Index increased by 5.95 points (0.47%) to 1,264.9 points. The entire floor had 231 stocks increasing, 148 stocks decreasing and 87 stocks remaining unchanged. HNX-Index increased by 0.65 points (0.28%) to 232.95 points. The entire floor had 78 stocks increasing, 75 stocks decreasing and 67 stocks remaining unchanged. UPCoM-Index increased by 0.35 points (0.38%) to 93.47 points.

The total trading volume on HoSE alone reached nearly VND800 billion (up 26% compared to the previous session), equivalent to a trading value of VND18,546 billion, of which negotiated transactions accounted for VND3,745 billion. The trading value on HNX and UPCoM reached VND1,126 billion and VND450 billion, respectively.

|

| Foreign investors returned to net buying for 3 consecutive sessions. |

Foreign investors continued to net buy 311 billion VND on HoSE. This was the third session that foreign investors returned to net buying. Of which, this capital flow net bought the strongest code SSI with 137 billion VND. FUESSVFL and FPT were net bought 115 billion VND and 105 billion VND respectively. On the other hand, HPG was net sold the strongest with 87 billion VND. KDH and VPB were net sold 66 billion VND and 62 billion VND respectively.

Source: https://baodautu.vn/vn-index-tang-gan-6-diem-co-phieu-chung-khoan-bay-cao-nho-ky-vong-thong-tu-moi-d225279.html

![[Photo] President Luong Cuong hosts state reception for Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/56938fe1b6024f44ae5e4eb35a9ebbdb)

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

![[Photo] Flower cars and flower boats compete to show off their colors, celebrating the 50th anniversary of Da Nang Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/086d6ece3f244f019ca50bf7cd02753b)

![[Photo] Prime Minister Pham Minh Chinh meets with Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/41f753a7a79044e3aafdae226fbf213b)

Comment (0)