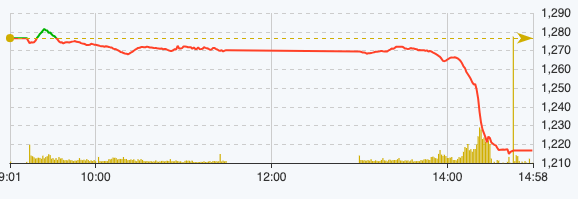

The first trading session of the week was volatile as widespread selling pressure caused the VN-Index to drop 59.99 points, or 4.7%, to 1,216.5 points. This was also the sharpest decline in nearly 2 years, since May 12, 2022.

This decrease also caused the Vietnamese stock market to have the biggest drop in Asia in the session of April 15. The capitalization value also evaporated by VND244,000 billion to VND4.95 million billion at the end of the session on April 15.

The large-cap group was the "culprit" causing the market to fall sharply when 10 big companies took away more than 27 points from the general index. Especially the banking group when 4 codes BID, VCB, CTG, TCB led the decline and took away a total of 14.6 points, BID alone took away 5.2 points. VPB code was also in the top 10 pulling down the market when taking away 2.15 points. The remaining 5 codes in the top 10 weighed down the index, respectively VHM, GVR, GAS, HPG, MSN.

Why?

According to Mr. Nguyen The Minh - Director of Analysis of Yuanta Vietnam Securities Company, the decline of the Vietnamese stock market occurred in the context of the US CPI being higher than expected for the third consecutive month, which may slow down the Fed's interest rate cut roadmap. Bond yields and the USD increased sharply again, causing pressure on the exchange rate to increase.

In addition, the overnight attack over the weekend, dubbed "Operation True Commitment" by Tehran, marked the first time Iran has attacked Israeli territory, despite decades of hostility between the two countries. Iran said it was in response to an airstrike it blamed on Israel. The story also made investors more cautious and concerned.

However, Mr. Minh said that the level of reaction to this conflict is not too significant. The reason is that initially investors thought that the risk could spread to the Middle East, but the fact that Israel has not responded has significantly reduced this risk.

Another sign is that the average liquidity of the last 5 sessions (from April 8 to 12) has been out of breath, falling nearly 32% to VND16,260 billion/session. In addition, since the beginning of April, foreign investors have also increased their net selling, contributing to the negative sentiment of domestic investors. This expert predicts that the pressure of foreign investors to net sell is still quite large.

In summary, the market's sharp decline in today's session was due to many factors such as exchange rate pressure, rising bond interest rates, lack of liquidity, increased foreign net selling, and Iran's unprecedented attack on Israel.

VN-Index performance on April 15 (Source: FireAnt).

Sharing the same view, Mr. Bui Van Huy - Director of DSC Securities Branch commented that the world context is relatively negative when the US CPI is higher than expected for the third month and bond yields and the USD also increased strongly again. Meanwhile, geopolitical conflicts are pushing the commodity market up sharply and causing potential inflationary pressure.

Mr. La Giang Trung - CEO of Passion Investment said that normally in uptrend periods of about 5 - 6 months, there will be adjustments. When approaching the 1,300 point area, the cash flow seems a bit weak, some short-term factors are no longer too good. Therefore, there is a high possibility that the market can adjust 12 - 15% from the 1,300 point area, before creating a short-term bottom to continue to go up and surpass the old peak.

"This is a healthy adjustment of the market in an uptrend, in which there are usually two adjustments every year," said expert La Giang Trung.

Should I buy the bottom at this time?

Regarding the market forecast in the coming time, Mr. Minh said that the worst case scenario is that VN-Index could return to the 1,200 - 1,210 point mark. VN-Index is unlikely to "break" 1,200 points because the risk is not big enough to trigger such a deep downtrend.

With the shocking decrease in one trading session, Yuanta Vietnam experts believe that bottom-fishing cash flow will soon enter the market. Because stocks are still an attractive investment channel when other investment channels are facing difficulties and the amount of cash flow waiting to enter the stock market is very large.

For investors who are still holding high-weight stocks, if there is no margin pressure, they should not sell off. Investors with high cash should not rush to disburse, instead they should wait for the equilibrium in the 1,200 - 1,210 range to buy tentatively with low weight.

Experts from DSC believe that the current trend is still adjustment and accumulation. Even if the index increases, liquidity and breadth will be difficult to spread. The current support zone is around 1,240 - 1,250 points.

Regarding trading strategy, in the current context with many short-term risk factors and the market may not have fully discounted the information, the stock ratio should be maintained at a moderate level, while avoiding a state of tension, especially limiting the use of high leverage.

During the earnings season, sectors with positive prospects such as banking, securities, industrial real estate, upstream oil and gas, import and export or steel can be considered. However, increasing the proportion should only be done in the price base areas, avoiding buying excitedly in the high price area .

Source

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

Comment (0)