The market was negative at the beginning of the session but rebounded at the end of the session thanks to increased bottom-fishing demand. Green dominated, VN-Index closed up 4.07 points to 1,251.02 points.

Green returns, bottom-fishing demand increases as VN-Index loses 1,240 points

The market was negative at the beginning of the session but rebounded at the end of the session thanks to increased bottom-fishing demand. Green dominated, VN-Index closed up 4.07 points to 1,251.02 points.

Entering the trading session on January 8, the market continued to be quite tense when selling pressure increased strongly across the board, pushing the VN-Index down deeply and losing the 1,240 point mark. The bluechip group caused strong selling pressure at this time and was the main factor causing the VN-Index to continue to decline. Although there were efforts to recover at the end of the morning session thanks to bottom-fishing demand, it was not enough excitement to pull the main index above the reference level.

The afternoon session was more positive as selling pressure was somewhat exhausted while demand at low prices was still maintained, helping many stocks change from red to green on the electronic board. After about half an hour of trading in the afternoon session, VN-Index regained its green color. However, the recovery momentum was still relatively weak as the cash flow had not really entered the game. VN-Index fluctuated in light green for the rest of the session.

At the end of the trading session, VN-Index increased by 4.07 points to 1,251.02 points. HNX-Index increased by 0.89 points (0.4%) to 221.87 points. UPCoM-Index increased by 0.54 points (0.58%) to 93.54 points. Green dominated with 410 codes, while only 277 codes decreased and 885 codes remained unchanged/not traded. Today's session recorded 23 codes hitting the ceiling and 14 codes hitting the floor.

|

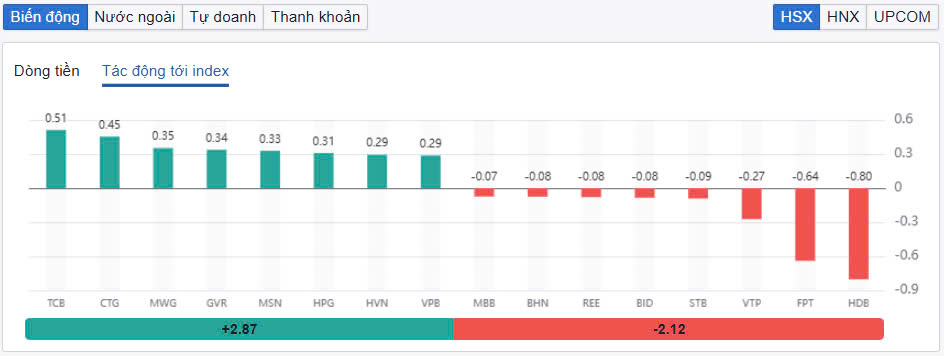

| Top stocks affecting VN-Index |

Stock groups that have fallen sharply in recent sessions, including real estate, steel and securities, have recovered in today's session, which is also the main factor helping to relieve pessimism in investor sentiment.

In the real estate group, DXG rebounded by 3.45% after falling nearly 16% in 2 trading weeks. NHA also rebounded by 2.8%, PDR by 2.4%, DPG by 2.35%. In the steel group, TVN rose sharply by nearly 6.7%. In addition, VGS also increased by 3%. NKG and HSG had a weaker recovery, increasing by 1.85% and 1.4%, respectively. The "big guy" in this industry, HPG, also recovered slightly with an increase of 0.77%.

|

| Technology stocks perform negatively in the session of January 8 |

Meanwhile, the technology group had a relatively negative performance when FPT decreased by 1.2%. In addition, CMG also decreased by nearly 2%. Viettel stocks had a relatively strong adjustment when VTP decreased by nearly 6%, VTK and VGI both decreased by more than 2%. CTR had the most modest decrease in this group with 1.15%.

In the VN30 group, the number of codes increased overwhelmingly with 17 while only 6 codes decreased. TCB, CTG, MWG, GVR... were the names that contributed the most to the VN-Index and helped the index recover. TCB increased by 1.3% and contributed the most with 0.51 points. CTG increased by 0.93% and contributed 0.45 points.

In contrast, HDB was the stock with the worst impact on the VN-Index, taking away 0.8 points from the index. At the end of the session, HDB fell 3.92%. FPT ranked second in terms of negative impact on the VN-Index, taking away 0.64 points. Codes such as VTP, STB, BID and REE also fell. BID fell 0.12% to VND40,350/share despite information that it was preparing to privately offer nearly 124 million shares at VND38,800/share.

|

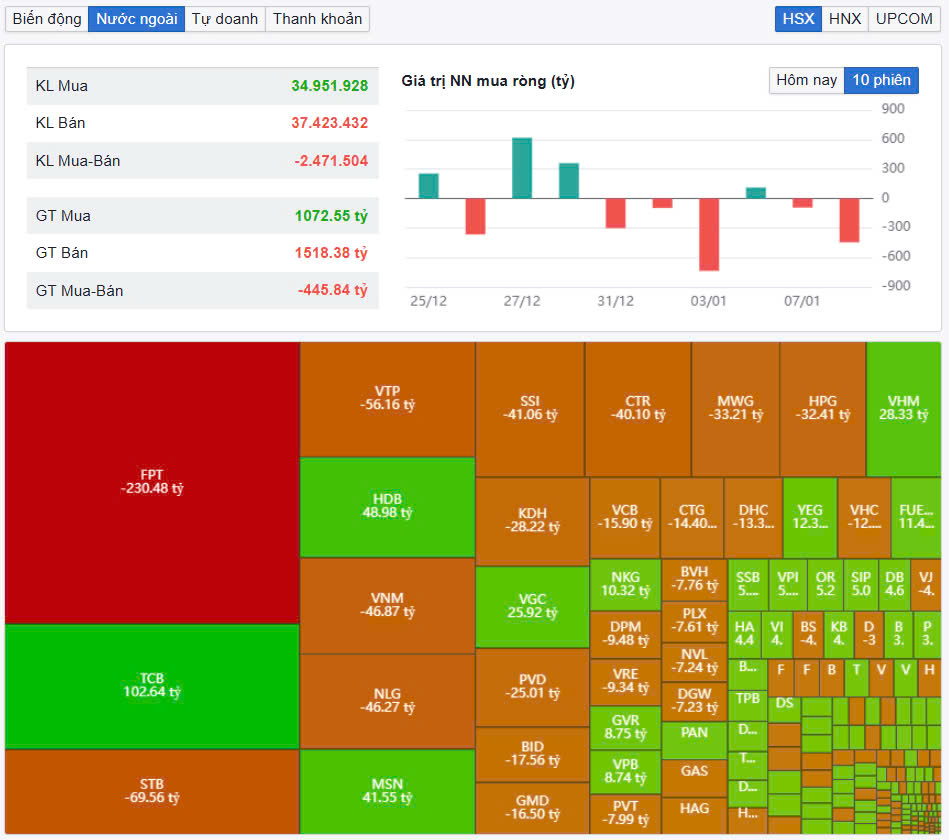

| Foreign investors net sold for the second consecutive session |

Total trading volume on the HoSE reached VND446 billion, equivalent to a trading value of VND10,206 billion (down 23% compared to the previous session), of which negotiated transactions accounted for VND1,700 billion. Trading values on the HNX and UPCoM reached VND606 billion and VND880 billion, respectively. FPT ranked first in terms of trading in the entire market, but the value was only about VND576 billion. HDB and HPG traded VND433 billion and VND338 billion, respectively.

Foreign investors increased net selling of about 460 billion VND across the market. Foreign investors sold the most FPT code with 230 billion VND. STB and VTP were net sold 70 billion VND and 56 billion VND respectively. Meanwhile, TCB was the strongest net buyer with 103 billion VND. HDB was also net bought 48 billion VND.

Source: https://baodautu.vn/sac-xanh-tro-lai-luc-cau-bat-day-gia-tang-khi-vn-index-mat-muc-1240-diem-d239929.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)