Litigation is very common in America.

On November 17, some information spread on social networks saying that two private law firms in the US, Robbins Gelleer Rudman & Dowd and Pomerantz, were collecting information from clients to open an investigation into the possibility of violating US securities laws by VinFast Auto Company. These two companies also called for information focusing on the fact that VinFast's senior leaders did not announce important information or made misleading statements to investors.

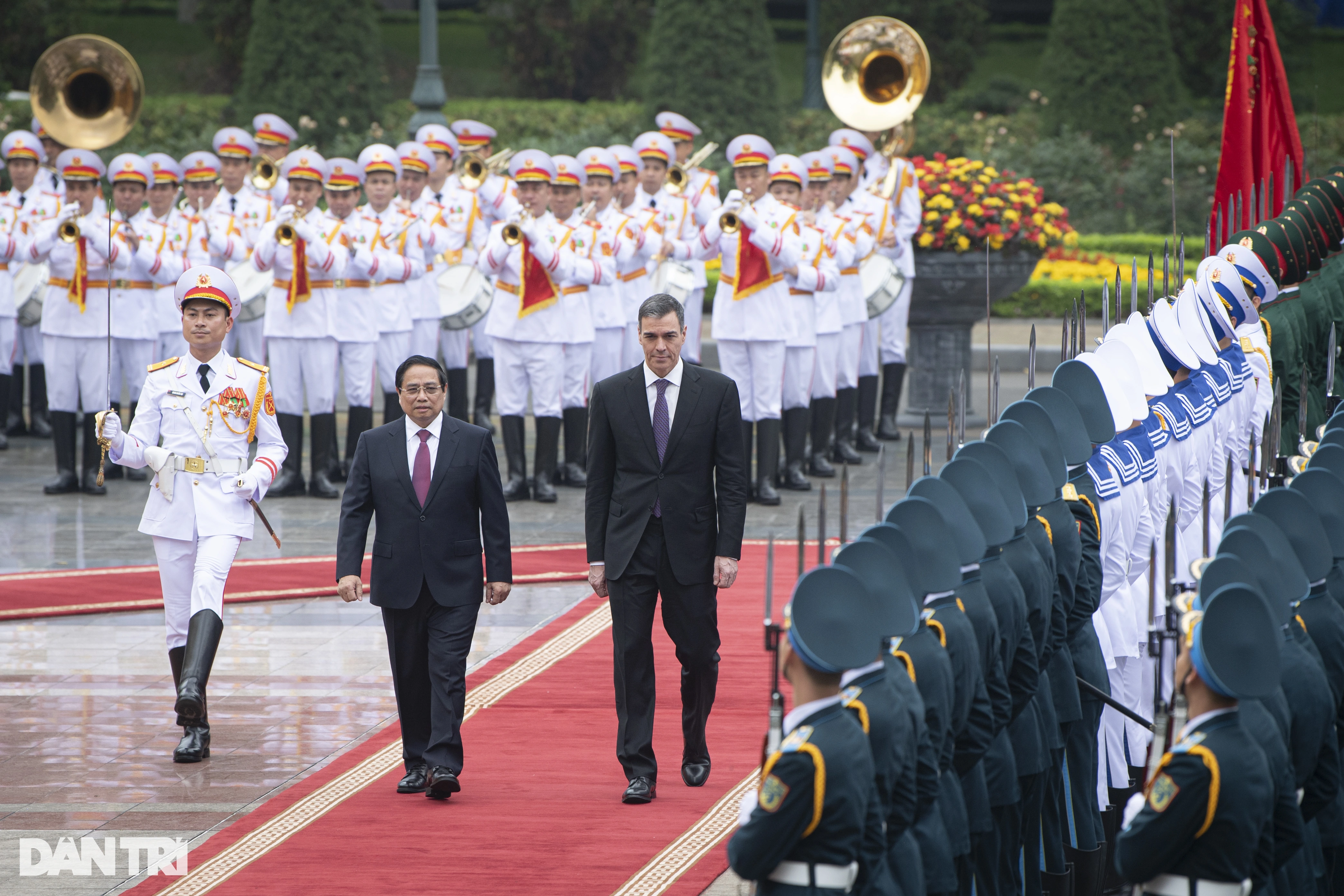

Perspective of VinFast factory in the US

Notably, the above information was released through the PR Newswire portal self-published by two law firms. Speaking with Thanh Nien , Ms. Ho Ngoc Lam, Head of the Legal Department of Vingroup Corporation and Deputy General Director in charge of legal affairs of VinFast Company, affirmed: "VinFast always aims to disclose transparent information to investors in the market. And currently, VinFast is still operating completely normally in the US. However, litigation is very normal and frequent in the US, so we are always ready to face this since deciding to deploy business activities in the US market".

In fact, the fact that the two law firms are calling for clients to file a lawsuit does not mean that VinFast has violated the law or has been sued in the US. Some experts familiar with US law say that this may be a form of client search that law firms in the US or some other countries often apply. The common method is to target large brands or listed companies, find a reason to launch a class action lawsuit and post a notice to find clients through advertising. In the past, electric car companies Tesla, Lucid electric cars, American software development company Amplitude, biopharmaceutical company Morphic, food development and processing company Hormel, etc. have also been called upon by the above law firms to file lawsuits in a similar way.

Dr. Chau Huy Quang, CEO of Rajah & Tann LCT VN Law Firm, said that such advertising activities are strictly prohibited in Vietnam but are quite common in common law markets such as Australia, the UK, the US, etc. Depending on the state, there are different regulations, but basically, law firms are allowed to collect information from clients, calling for investigations into possible violations of the law by businesses. The target audience is often businesses listed on the stock exchange because the information is public and transparent. They will rely on that public information, see the potential for problems, then assume violations of the law to find clients who are investors who are doing business with the business. However, when advertising information, law firms in the US must also strictly adhere to principles of professional ethics such as prohibiting the act of drawing conclusions from assumptions that affect second and third parties; Do not claim to be an expert in that field to avoid misleading investors about the possibility of the assumption...

According to Lawyer Quang, the case of VinFast is similar. This is just an assumption of the law firm for the purpose of advising and finding customers - investors who they assume could be victims. There is no such thing as VinFast being sued in the US. After such information, if there is no need for investors or no damage from investors, the matter will stop. If a business believes that the assumed information is defamatory in nature, affecting its brand and operations, it can sue the law firm to protect its rights.

Not being calm is a loss to yourself

From the US, Professor Ha Ton Vinh affirmed that there are many law firms like the two above. The US is a country that respects the rule of law, so everything is resolved through the courts and the law. Usually, when an individual or company feels disadvantaged or pressured or deceived by another organization or individual, they seek a lawyer to present a lawsuit. "Remember that the US legal system respects the presumption of innocence and no one has the right to accuse anyone or conclude guilt for anyone before the court has pronounced a verdict," Professor Ha Ton Vinh said, emphasizing that it must be clearly stated that VinFast has not been sued, the law firm is collecting documents. If a lawsuit is filed, whether the court accepts it or not is another matter. "Investors in Vietnam, when hearing bad news about a company, do not need to know right or wrong to sell off. However, in the US, lawsuits are common, so selling off does not happen easily. Because if you rush, you will suffer the loss yourself. New investors who have just accessed preliminary information should research carefully to avoid causing damage to their assets," Professor Ha Ton Vinh advised.

Currently living in the US, Mr. Ho Quoc Tuan, senior lecturer and Director of the Master of Finance and Accounting Training Program at the University of Bristol (UK), wrote on his personal page: "Calling for lawsuits in the US is very normal and what these law firms are doing is just a step to find evidence and advertise to find customers. Therefore, listing in the US will provide better monitoring for shareholders."

Previously, in October, along with the VN-Index's downward sessions, there were some rumors about listed companies such as the story of "Vingroup having to sell shares" or the foreign shareholder from South Korea of Masan "divesting all capital"... The rumors were baseless but still made individual investors worried, rushing to sell shares even though the third quarter business results of the above-mentioned units were all higher than before.

Experts warn that there will always be rumors in the stock market. Especially when the market declines and investor sentiment is low, just a small piece of information can be rumored and widely interpreted as many negative issues about the company's operations. "It is difficult to expect to eliminate rumors in the stock market, because all information has two sides. Many groups of investors will exaggerate certain aspects according to their own interests. When participating in the market, individual investors must understand and accept as well as learn to be calm. Do not pay too much attention to rumors because you should not choose stocks based only on certain information or stories. Because when one rumor ends, it is normal for another rumor to appear," securities expert Nguyen Hong Diep warned.

In the US market, complaints, disputes, and lawsuits are an inevitable part of trading activities. Therefore, when receiving information, investors should stay calm, learn carefully, and not be confused or manipulated because the more confused they are, the more they risk causing more damage to themselves and the market due to false rumors.

Dr. - Lawyer Chau Huy Quang

Source link

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)