On the morning of November 29, with 462 National Assembly deputies in favor (93.52%), the National Assembly voted to pass the Resolution on applying additional corporate income tax according to regulations against global tax base erosion (global minimum tax).

According to the resolution, Vietnam will apply a global minimum tax from January 1, 2024. The applicable tax rate is 15% for multinational enterprises with a total consolidated revenue of 750 million euros (about 800 million USD) or more in two of the four most recent years. Taxable investors will be required to pay the global minimum tax in Vietnam.

This tax rate does not apply to: Government organizations; International organizations; Non-profit organizations; Pension funds; Investment funds that are ultimate parent companies; Real estate investment organizations that are ultimate parent companies. Organizations that have at least 85% of their assets owned directly or indirectly through the above organizations are also not subject to the 15% tax rate.

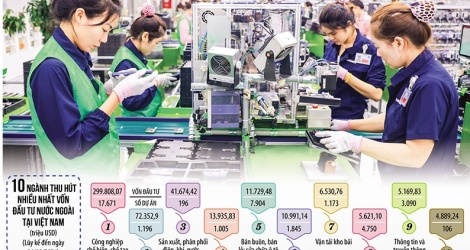

Through a review by the General Department of Taxation, there are about 122 foreign corporations investing in Vietnam affected by the global minimum tax.

The imposition of a global minimum tax will directly affect the interests of foreign-invested enterprises during the tax exemption period, with an effective tax rate lower than 15%.

Before the National Assembly passed the resolution, the National Assembly Standing Committee said there was a possibility that businesses that had to pay the global minimum tax in Vietnam would file a lawsuit if they wanted to remit this tax to the "mother country".

Therefore, in addition to issuing a resolution, the National Assembly Standing Committee believes that the Government needs to proactively prepare, have appropriate solutions and handling plans if disputes and complaints arise to ensure the investment environment. The Government is assigned to prepare conditions and roadmaps for implementing multilateral cooperation activities with other countries and domestic apparatus organizations to ensure the implementation capacity of tax authorities and taxpayers when Vietnam collects this tax from the beginning of 2024.

According to the resolution, the taxable payments below the minimum level effective from January 1, 2025 will be included in the amended Law on Corporate Income Tax. The National Assembly assigned the Government to promptly prepare the draft Law on Corporate Income Tax (amended), adding it to the 2024 law and ordinance making program so that it can be applied from 2025.

This is to ensure that Vietnam retains the right to tax payments below the minimum tax rate under the global minimum tax rules.

| The global minimum tax is a tax initiated by the Organization for Economic Cooperation and Development (OECD). Currently, 142/142 member countries, including Vietnam, agree. With this tax, large corporations and companies with revenues of 750 million euros or more will have to pay a 15% tax, regardless of which country they are in. |

Global minimum tax and efforts to attract FDI

Vietnam is looking for ways to remain competitive and attractive to foreign investors amid the impending implementation of a global minimum tax.

In danger there is opportunity when applying global minimum tax

Global minimum tax is the new rule of the world economy that Vietnam has joined and does not have many choices.

Source

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)