Many institutions and policies will be amended, thereby facilitating Vietnam's attraction of foreign investment.

Many institutions and policies will be amended, thereby facilitating Vietnam's attraction of foreign investment.

|

| More incentives are needed to facilitate attracting foreign investment. Photo : Duc Thanh |

More incentives to welcome "eagles"

The provisions on special investment incentives have been summarized in the Draft Law on Corporate Income Tax (Draft), which is being discussed at the 8th Session of the 15th National Assembly. Previously, these provisions were institutionalized in the Investment Law 2020. Thus, with this amendment, the contents on special investment incentives have been "officially and formally" included in the Law on Corporate Income Tax, although this law is expected to be discussed only, not approved at the 8th Session.

Along with that, the contents of investment incentives for expansion investment projects are also regulated more clearly. Current regulations require separate accounting of income from expansion investment projects with the initial investment projects, but according to the Government, this is inappropriate and inappropriate. Therefore, the Draft has been amended in the direction that the additional income from expansion investment is entitled to incentives according to the remaining time of the initial project and does not have to be accounted for separately.

These regulations are expected to facilitate investors, especially when they invest in new projects or expand projects, especially large-scale projects, in fields that enjoy expanded investment incentives, such as high technology, research and development (R&D)...

Regarding the above content, when examining the Project, as well as when discussing, the Finance and Budget Committee of the National Assembly and a number of National Assembly deputies also expressed concerns about the effectiveness of the special incentive policy, especially when the global minimum tax policy is applied. However, in reality, this is still what foreign investors expect. Because, only investors with a global consolidated revenue of 750 million EUR are subject to special consumption tax and must pay additional tax, in case the actual corporate income tax paid has a tax rate of less than 15%.

Some National Assembly delegates even said that it is necessary to redesign and add new incentive mechanisms to facilitate attracting "eagles".

Delegate Nguyen Thanh Trung (Yen Bai) said that instead of setting up easy tax incentives for investors as it is now (every investment is exempted from tax), tax incentives and other direct support policies of the state should be designed with a number of conditions, such as investment in high technology, green technology, breakthrough industries, or the rate of using domestic investors.

During the review, the Finance and Budget Committee also appreciated the fact that in addition to income-based incentives, the Draft also stipulates a number of cases where cost-based incentives are applied. This is the form of incentive that many economic experts have recently said should be applied to facilitate investment attraction in the new context.

Also according to the National Assembly's Finance and Budget Committee, currently, corporate income tax incentives based on R&D costs have been stipulated in a number of National Assembly resolutions on specific mechanisms for pilot application in a number of localities, but have not yet been implemented in practice to be able to evaluate as a basis for general application.

"The Government is requested to urgently put these contents into practice," the National Assembly's Finance and Budget Committee expressed.

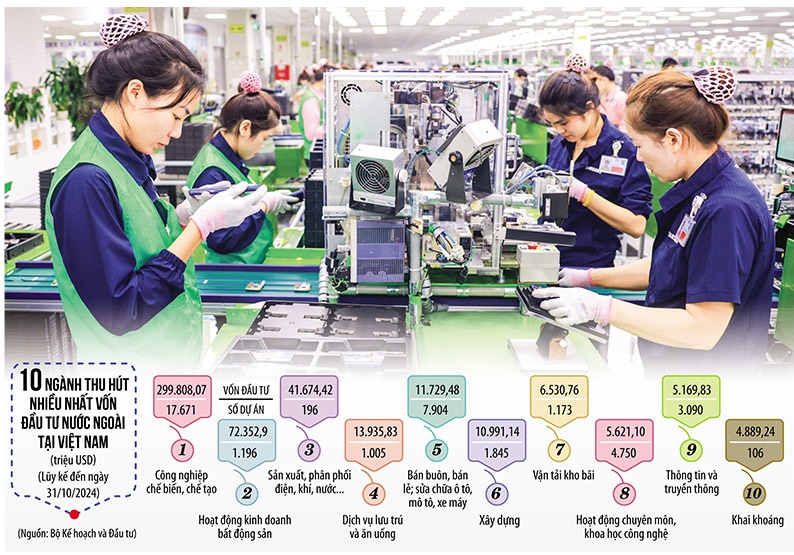

|

| Vietnam's efforts to improve the business and investment environment will facilitate foreign enterprises to develop projects in areas that enjoy expanded incentive mechanisms such as high technology, research and development, etc. Photo: Duc Thanh. Graphics: Dan Nguyen |

Creating a “green channel” for FDI projects

In addition to tax incentives, some institutions and policies revised this time are also expected to facilitate Vietnam in attracting investment. The regulation on applying 0% value added tax to export processing enterprises is an example.

Redesigning incentives for foreign investors is more urgent than ever, as global minimum tax rules come into effect next year.

Redesigning incentives for foreign investors is more urgent than ever, as global minimum tax rules come into effect next year.

- Delegate Nguyen Thanh Trung (Yen Bai)

In fact, this is the current regulation. However, when the Law on Value Added Tax was expected to be revised, this regulation was proposed to be amended in the direction of abolishing the application of the 0% value added tax rate for services provided in the non-tariff zone. Immediately, many foreign investors, including Samsung, Canon, etc., spoke out about this issue. Many economic experts also said that narrowing the scope of the 0% tax rate will affect businesses in the non-tariff zone, export processing zone, and industrial zone.

After discussion by the stakeholders, the current regulation will ultimately remain in place.

Another important regulation proposed for reform this time is that, in the Law amending and supplementing a number of articles of the Law on Planning, the Law on Investment, the Law on Investment under the public-private partnership (PPP) model, the Law on Bidding, the Government has proposed the application of special investment procedures for projects in the fields of innovation, R&D; semiconductor integrated circuit industry, design technology, manufacturing of components, integrated electronic microcircuits, chips, high-tech fields, high-tech products that are prioritized and encouraged for investment according to the Prime Minister's decision... in industrial parks, export processing zones, high-tech zones and economic zones.

According to Minister of Planning and Investment Nguyen Chi Dung, this is the Government's design of a "green channel" for foreign investment projects. When discussing this content, Minister Nguyen Chi Dung mentioned the story in China, building a billion-dollar automobile factory in just 11 months... to emphasize the urgency of creating a favorable environment, attracting investment, and prioritizing post-audit. This is also the reason why the Government added regulations on special investment procedures.

Once passed, these regulations will certainly facilitate attracting foreign investment, especially investment projects in the fields of semiconductors and AI from the "eagles".

Source: https://baodautu.vn/sua-luat-de-them-uu-dai-don-dai-bang-d230788.html

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Reliving the heroic memories of the nation in the program "Hanoi - Will and belief in victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19ce7bfadf0a4a9d8e892f36f288e221)

Comment (0)