VIC's ceiling price still cannot "save" VN-Index

The stock market session on August 1 received great attention from investors because in the first session of the week, VN-Index maintained the 1,200-point mark with soaring liquidity, surpassing the billion-dollar mark even on the HoSE floor alone.

The highlight of the July 31 stock session was Vingroup's VIC stock. After Vingroup achieved a pre-tax profit of more than VND7,000 billion, VIC unexpectedly hit the ceiling. In the August 1 stock session, VIC still shined when it closed at a purple price.

Closing the stock market session on August 1, VIC continued to hit the ceiling, increasing by VND3,800/share to VND58,900/share. Vingroup's market capitalization increased by about VND14,500 billion. Trading volume reached 12.2 million shares, up from 10.6 million shares on July 31. Previously, VIC's daily liquidity only reached about 2 million to 4 million units.

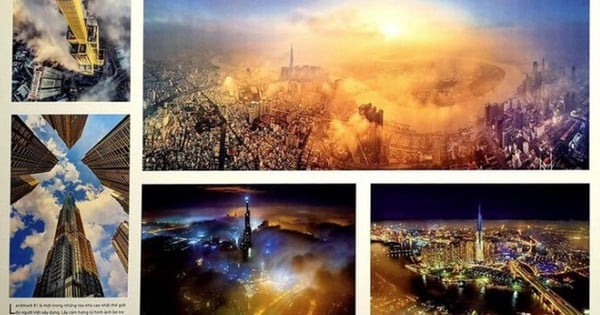

In the August 1 stock market session, despite maintaining the ceiling price increase, stocks could not "save" the VN-Index. Signs of distribution were evident. Illustrative photo

Although VIC still maintains its attractiveness, VIC's efforts alone are not enough to help the August 1 stock market escape the red. Cash flows strongly into VIC, but selling pressure is widespread across the electronic trading board.

Closing the stock market session on August 1, VN-Index decreased by 5.34 points, equivalent to 0.44% to 1,217.56 points; VN30-Index decreased by 8.63 points, equivalent to 0.7% to 1,222.18 points.

The highlight of the August 1 stock market session was that liquidity continued to set a record. Nearly 1.3 billion shares, equivalent to VND26,404 billion (about USD1.1 billion), were successfully traded. The VN30 group also received a huge cash flow when 356 million shares, equivalent to VND10,258 billion, were traded.

The index fell as liquidity surged, showing signs of a distribution session emerging on the stock market on August 1.

On the Hanoi Stock Exchange, blue-chips still maintained their strength but were not strong enough to pull the whole market up.

Closing the stock market session on August 1, HNX-Index decreased by 0.2 points, equivalent to 0.08% to 239.35 points; HNX30-Index increased by 0.95 points, equivalent to 0.2% to 477.97 points.

Construction stocks fluctuate strongly

Currently, the bidding package of 35,000 billion VND at Long Thanh Airport is gradually coming to an end. Therefore, the "fate" of the members of the 3 consortiums participating in the bidding has received great attention from stock investors. Therefore, the stocks of each side have had great ups and downs.

In the August 1st stock market session, CTD shares of Coteccons Construction Joint Stock Company suddenly hit the floor, down 5,000 VND/share to 66,900 VND/share. Previously, in the July 28th session, CTD even hit the ceiling. Over the past week, CTD has either increased sharply or decreased sharply.

Coteccons is embroiled in a scandal with a debt of more than 300 billion VND at Ricons.

HBC shares of Hoa Binh Construction Group Joint Stock Company did not hit the floor but also fell very far, decreasing by VND550/share, equivalent to 5.14% to VND10,150/share.

On the other hand, VCG shares of Vietnam Construction and Import-Export Joint Stock Corporation increased sharply, up 1,800 VND/share, equivalent to 7% to 27,550 VND/share.

PHC shares of Phuc Hung Holdings Construction Joint Stock Company hit the ceiling, up 650 VND/share to 10,050 VND/share.

Source

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)