Queuing to buy fuel in Chennai, India. Rising oil prices will negatively impact oil-consuming economies - Photo: AFP

Crude oil prices fell sharply earlier this week due to a confluence of factors that had a strong impact on market sentiment. Concerns about weak demand, especially from China, and easing supply risks in the Middle East were the two main factors that put downward pressure on prices. This trend is expected to continue in the short term.

Geopolitical risks

Oil prices remained stable on October 21 after a slump last weekend, with Brent crude at around $73.49 a barrel and West Texas Intermediate (WTI) crude at $69.7 a barrel in the US, according to Reuters. Last week, oil prices closed at $73.06 and $69.22 a barrel, respectively, after falling 7% during the week.

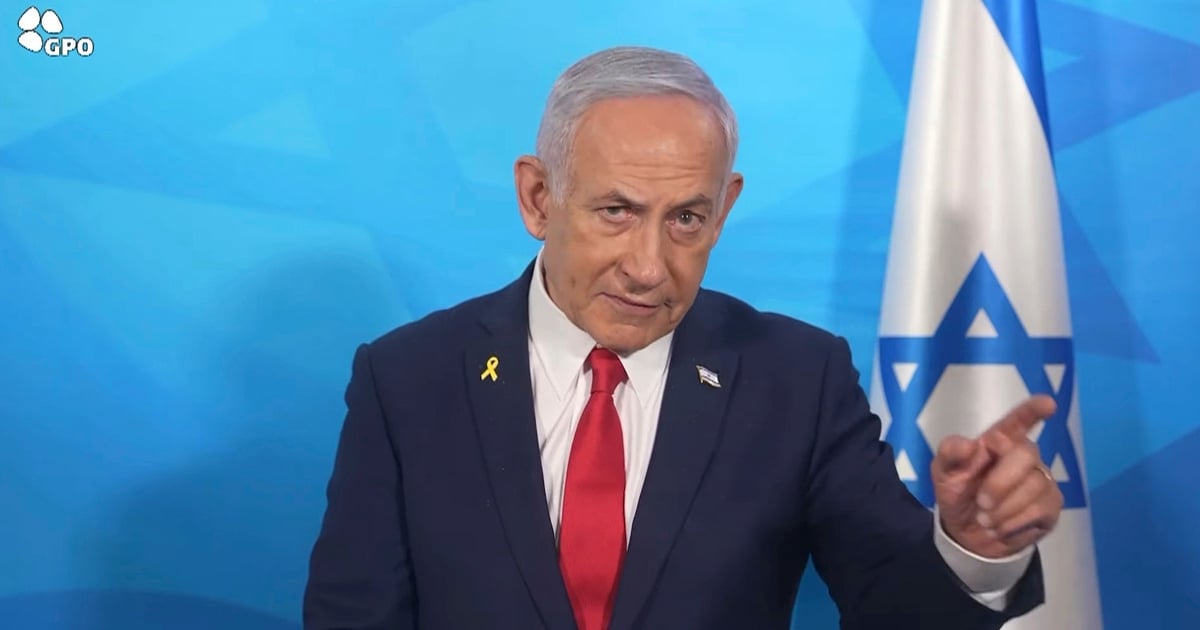

Geopolitical risks played a significant role in oil price volatility this week. The past few days have been the most tense and belligerent in the Middle East since the Gaza war broke out a year ago.

Israel expanded its war against the Iran-backed Hezbollah group into Lebanon, leading to Tehran launching missile strikes on Israel in early October. Markets were on edge as Tel Aviv threatened to retaliate against Iranian oil facilities, disrupting global oil flows, sending oil prices up more than 9% the following week.

After Israel killed Hamas leader Yahya Sinwar, Hezbollah announced last weekend that it was moving to a new phase and would escalate its fighting with Tel Aviv's army. This development dispelled hopes of a thaw in tensions in the Middle East.

However, investors were less nervous after news that the US had persuaded Israel to avoid attacking Iran’s oil infrastructure. On October 18, US President Joe Biden said he had a good idea of when and how Tel Aviv would strike back, but he still saw an opportunity to resolve the conflict.

"In my view and the view of my colleagues, there is a chance that we can deal with Israel and Iran in a way that ends the conflict for a period of time. That ends the conflict, in other words, stops the attacks back and forth," Reuters news agency quoted Mr. Biden.

This news helped significantly reduce "war premiums" and cool oil prices.

Global picture

The easing of tensions in the Middle East coincides with a worrying assessment of global oil demand. A series of reports from major organizations such as the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC) have lowered their forecasts for global oil demand in 2024 and 2025, adding to the gloomy outlook.

OPEC cut its global demand growth forecast for 2024 to 1.93 million barrels per day in mid-month, marking its third straight downward revision. The IEA, meanwhile, was even more pessimistic, predicting demand growth of just 900,000 barrels per day next year.

Countries around the world are grappling with economic challenges that are affecting energy consumption patterns. China’s economy, the world’s top oil importer, is growing at its slowest pace since early 2023. This is in addition to a significant shift in the country’s transportation sector, with electric vehicle sales up a record 42% in August 2024.

China's crude oil imports fell 3% in the first nine months of the year, according to Reuters. "China's data shows tentative signs of improvement, but recent press conferences on additional economic stimulus have left market participants unimpressed," Rishi Rajanala, a strategist at Aegis Hedging, told Reuters.

While demand is down, supply is expected to be abundant in the coming period. US crude oil production reached a record high of 13.5 million barrels/day, and increased production in some countries such as Brazil and Canada, further reassuring the market.

“Supply continues to flow for now, and barring major disruptions, the market will face a significant surplus in the new year,” the Guardian quoted the IEA as saying. This would also act as a shock absorber in the event of an escalation of conflict in the Middle East.

Impact of oil prices on the economy

The trajectory of oil prices will likely depend on the interplay between economic and geopolitical tensions, analysts say. China’s economic outlook remains uncertain, and any negative developments could exacerbate the decline in oil prices. Conversely, any escalation in geopolitical tensions would also send oil prices into a tailspin.

“As global markets continue to adjust, decision makers will need to closely monitor these moves and prepare for further unpredictability in the oil market,” said Andrea Zanon, founder of Confidente.

In the worst-case scenario, when the conflict spreads and Iran closes the Strait of Hormuz, a vital oil shipping route, oil prices could hit $100 a barrel. Not only would oil prices rise, but other commodities such as gold and the US dollar could also suffer a shock, with a strong impact on the global economy.

Commenting on The New Arab , analyst Zeeshan Shah of FINRA said that the biggest beneficiaries from rising oil prices will be Saudi Arabia, the Gulf countries and especially Russia.

Conversely, the biggest losers would be oil-consuming countries like Pakistan and Bangladesh – where a sudden spike in oil prices could severely impact their fragile economies.

Crude oil prices fell sharply

Crude oil prices fell sharplySource: https://tuoitre.vn/vi-sao-trung-dong-nong-bung-bung-ma-gia-dau-lai-giam-20241022101746196.htm

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)