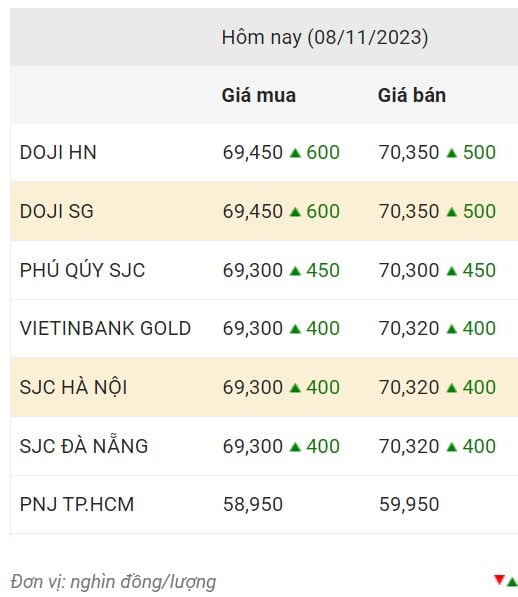

Domestic gold price

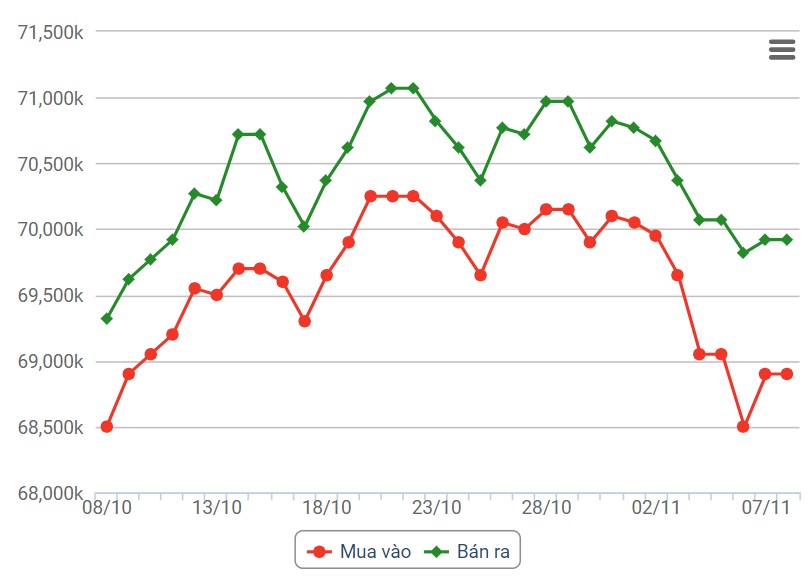

Domestic gold price developments

World gold price developments

World gold prices fell amid a stronger US dollar and reduced demand for safe havens.

Recorded at 6:00 a.m., the US Dollar Index measuring the greenback's fluctuations against six major currencies was at 105.607 points (up 0.23%).

Investors are waiting for comments from US Federal Reserve (FED) officials for more clarity on the direction of interest rates.

On November 7, a series of Fed officials maintained their views on the Fed's next decision, but noted that they would focus more on economic data and the impact of higher long-term bond yields.

Tastylive’s head of global macro, Ilya Spivak, said that geopolitical risks are gradually being resolved and as central banks “step back” from raising interest rates, that will push yields lower, so there are not many catalysts to boost gold prices this week.

Notably, oil prices in the Asian market today experienced a difficult trading session. In the previous session, oil prices even slid to their lowest level in more than three months due to concerns about weakening demand in the world's leading oil consuming countries, the US and China. Oil is a commodity closely related to and moves in the same direction as gold prices.

Central banks bought 800 tonnes of gold from January to September this year, a record nine-month high, according to the World Gold Council.

In its Gold Demand Trends Q3 2023 report, the World Gold Council said that central banks' net purchases of gold bullion in the first nine months of the year increased by 14% compared to the same period last year.

Global gold demand excluding OTC trading was 8% above the five-year average in the third quarter, but down 6% from last year's all-time high.

China has been the biggest buyer of gold this year in its 11-month buying streak, according to data from the World Gold Council. Other notable buyers include Poland, Singapore, Türkiye, Russia and India.

Source

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)