According to VBMA data compiled from HNX and SSC, as of the information announcement date of March 28, 2025, there were 5 corporate bond issuances recorded in March 2025 with a total value of VND 10,699 billion.

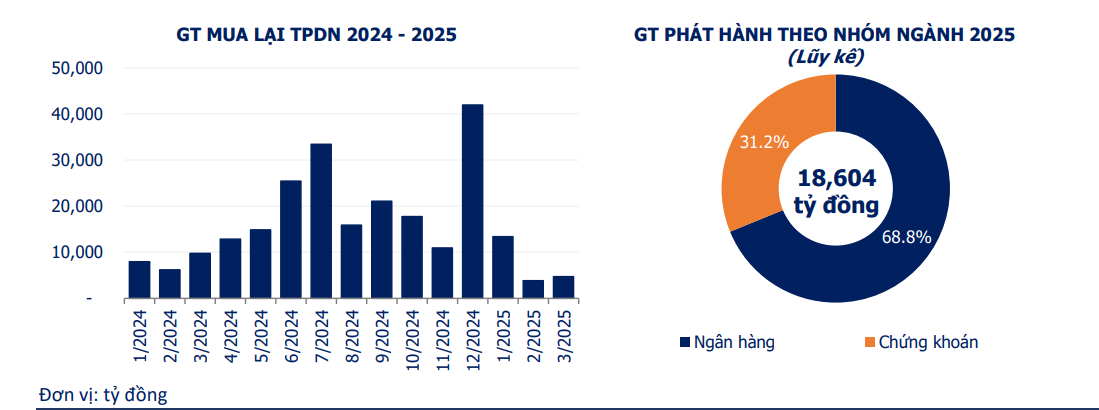

Accumulated from the beginning of the year, the total value of corporate bond issuance was recorded at VND 18,604 billion, with 9 public issuances worth VND 18,104 billion (accounting for 97.3% of the total issuance value) and 1 private issuance worth VND 500 billion (accounting for 2.7% of the total).

VBMA also added that, as of the date of information announcement on March 28, 2025, businesses had bought back VND 4,723 billion of bonds in March. Accumulated from the beginning of the year until now, the total value of bonds bought back before maturity reached VND 21,979 billion, down 1.5% compared to 2024. Real estate is the leading industry group, accounting for about 52.6% of the total value of early buybacks (equivalent to about VND 11,563 billion).

In the remainder of 2025, the total value of bonds due is VND 179,207 billion. 53.1% of the value of bonds due to mature belongs to the Real Estate group with VND 96,008 billion, followed by the Banking group with VND 41,166 billion (accounting for 22.6%).

Regarding the trading of privately issued bonds, during the reporting period, the average daily trading value of privately issued corporate bonds reached VND8,259 billion, down 0.2% compared to the previous week. The issuers with the most traded bonds were Tien Phong Commercial Joint Stock Bank (VND8,201 billion), Vietnam International Commercial Joint Stock Bank (VND5,244 billion) and Thai Son Construction Investment Joint Stock Company (VND3,982 billion). Since the beginning of the year, the total trading value of privately issued bonds has reached about VND270,316 billion.

Besides the positive signals about issuance in March, recently some businesses have also made new plans for issuing corporate bonds in 2025.

The Board of Directors of Thanh Thanh Cong - Bien Hoa Joint Stock Company recently approved a plan to issue bonds to the public in 2025 with a maximum total value of nearly VND 500 billion. These are convertible bonds, without warrants, without collateral and with a face value of VND 100,000/bond. The bonds have a term of 1 year and an interest rate of 9.5%/year.

The Board of Directors of Vietnam Joint Stock Commercial Bank for Industry and Trade has approved the plan to issue bonds to the public in the second phase in the first and second quarters of 2025 with a total maximum value of VND 4,000 billion. These are non-convertible bonds, without warrants, without collateral and with a face value of VND 100,000/bond. The bonds have a term of 8-10 years and a floating interest rate.

Asia Commercial Joint Stock Bank (ACB) The Board of Directors of Asia Commercial Joint Stock Bank has approved a plan to issue individual bonds divided into 10 tranches in 2025 with a maximum total value of VND 20,000 billion. These are non-convertible bonds, without warrants, without collateral and an expected face value of VND 100 million/bond. The bonds have a maximum term of 5 years, with a combined interest rate of fixed and floating.

Source: https://baodaknong.vn/tin-hieu-tich-cuc-tu-thi-truong-trai-phieu-doanh-nghiep-248200.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)