World gold prices continued to fluctuate with a large amplitude this week. Entering the new trading week, spot gold lost more than 2% due to pressure from the recovery of the USD. However, this precious metal quickly regained momentum and gained 3% on April 9, recording its best day in many years thanks to support from safe-haven money flows amid escalating US-China trade tensions after US President Donald Trump's decision to increase tariffs on Chinese goods. Escalating tensions and the weakening of the USD continued to help gold increase by 3% on Thursday and surpass the threshold of 3,200 USD/ounce for the first time on Friday.

At the end of the week, gold price was anchored at 3,238 USD/ounce, up 199.2 USD compared to the closing price of the previous week.

|

Spot gold prices are anchored above $3,200/ounce. Photo: Kitco |

The US Dollar Index fell sharply during the week, ending the week near 100 points. According to Jonas Goltermann, deputy director of market economics at Capital Economics, this is a big move for the USD as the world economy continues to react to US President Donald Trump's global tariffs.

It is clearly too early to assess the long-term effects of tariffs, but Goltermann said the dollar’s role as a safe haven is weakening, which is good for gold.

Given the current environment, it is no surprise that gold is trading at a new record high and has the potential to move higher, said Jerry Prior, CEO of Mount Lucas Management.

Earlier this week, US President Donald Trump announced a 90-day pause on reciprocal tariffs on several partners. However, analysts and economists note that the US administration’s decision to maintain a 10% global tariff on imported goods and continue its trade war with China is having a negative impact on the economy.

While he’s not looking at a recession, Sameer Samana, head of global equities and real assets at Wells Fargo, sees the risk of tariffs rising. “At some point, someone is going to have to pay 10% more for goods. Prices are going to go up, and that means consumers are going to buy less, and that’s going to drag on economic activity,” he said.

Market analysts at TD Securities predict that the US dollar will continue to weaken and gold prices will continue to rise this year.

According to FXMT market analyst Lukman Otunuga, the decision to impose tariffs on Chinese goods will increase trade tensions between the two countries. The negative ripple effect could affect the global economy, forcing central banks to cut interest rates to stimulate growth. Therefore, a weaker US dollar, concerns about global growth and expectations of lower US interest rates could push gold prices higher. Looking at the technical picture, gold is on a strong run on the daily chart, with prices up more than 6% this week. This brings the year-to-date gain to 23% with buyers in control.

Alex Kuptsikevich, market analyst at FxPro, sees more potential for gold. This week’s developments have proven the strength of gold. Gold closed the week at an all-time high, triggering an extended bull pattern that could potentially push it above $3,500 an ounce. Another encouraging sign for gold is that exchange-traded funds have also seen their highest inflows in years, further confirming the strength of the current rally.

Despite the prevailing optimism, some analysts warn that gold prices may have peaked.

“We are probably close to the maximum level of optimism in gold at the moment,” said Sameer Samana, likening getting into gold now to “coming late to the party” and investors chasing returns may regret it later.

Naeem Aslam, chief investment officer at Zaye Capital Markets, also acknowledged that gold is overbought. However, he said the current environment will reverse that scenario. When fear is high, gold becomes the only “safe haven” in the storm, and that fear can easily push prices higher before the fear becomes a reality.

Next week, markets will continue to pay close attention to any announcements from the White House and information related to the global trade war and tariffs. Investors are also waiting for a speech by Fed Chairman Jerome Powell on the economic outlook in the middle of next week.

In line with developments in the world gold market, domestic gold prices continued to increase sharply in most trading sessions. In particular, on April 9, domestic gold prices increased "skyrocketingly", with gold bar prices increasing by VND2 million for buying and VND1.7 million for selling, respectively, to VND99.7 million/tael for buying and VND101.9 million/tael for selling. Gold ring prices increased the most by VND2 million, to around VND99 million/tael for buying and over VND102 million/tael for selling.

|

| Domestic gold prices increased sharply this week. Photo: vietnamnet.vn |

The price of this precious metal continued to maintain a steady increase in the following trading sessions. On April 11, the price of gold increased by up to 3 million VND/tael at one point. At the end of the day, the price of gold bars increased by 1.6 million VND in both directions to 102.2 million VND/tael for buying and 105.2 million VND/tael for selling. Gold rings also increased by over 100 million VND/tael for buying and 104 million VND/tael for selling.

At 1:30 p.m. on April 12, the listed price of SJC gold bars was VND106.5 million/tael for sale. Currently, if converted according to Vietcombank exchange rate (excluding taxes and fees), the difference between domestic and world gold prices is about VND5.3 million/tael.

TRAN HOAI

*Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/gia-vang-tuan-toi-gia-vang-co-kha-nang-tang-cao-hon-nua-249175.html

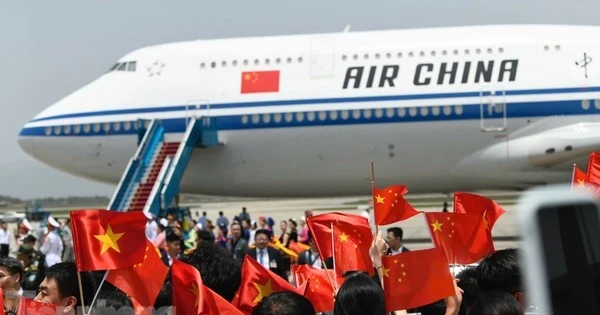

![[Photo] Hanoi people warmly welcome Chinese General Secretary and President Xi Jinping on his State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/d6ac6588b9324603b1c48a9df14d620c)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

Comment (0)