Outstanding credit balance by the end of October is estimated to have grown by over 10%, higher than the same period last year.

This information was stated by State Bank Governor Nguyen Thi Hong in a report sent to National Assembly deputies. Accordingly, Ms. Hong said that credit growth as of October 31 reached 10.08% compared to the end of 2023. Compared to the same period last year, credit increased by 16.65%.

This year, the State Bank has set a credit growth target of about 15%. The current growth rate, according to the Governor, is in line with this target, meeting capital needs, supporting macroeconomic stability, and controlling inflation.

However, banking leaders admit that the credit absorption capacity of businesses and people is still low. Because after Covid-19, many businesses have reduced or stopped production due to lack of orders, dissolved, closed, and their financial health has declined. Meanwhile, people tend to tighten and reduce spending, leading to low credit demand.

In the context of low credit growth across the system, Governor Nguyen Thi Hong said the management agency proactively adjusted the target for each bank, without requiring them to submit additional requests.

In fact, in the early stages of this year, the credit growth of banks was uneven, with some units increasing low or even negative, while some credit institutions increased close to the assigned target. At the end of August, the management agency granted additional credit growth limits to banks to reach 80% of the credit target assigned at the beginning of the year.

In addition, the State Bank also requires banks to direct credit to priority sectors and economic growth drivers. This is to limit the increase and occurrence of bad debts, ensuring the safe operation of the system.

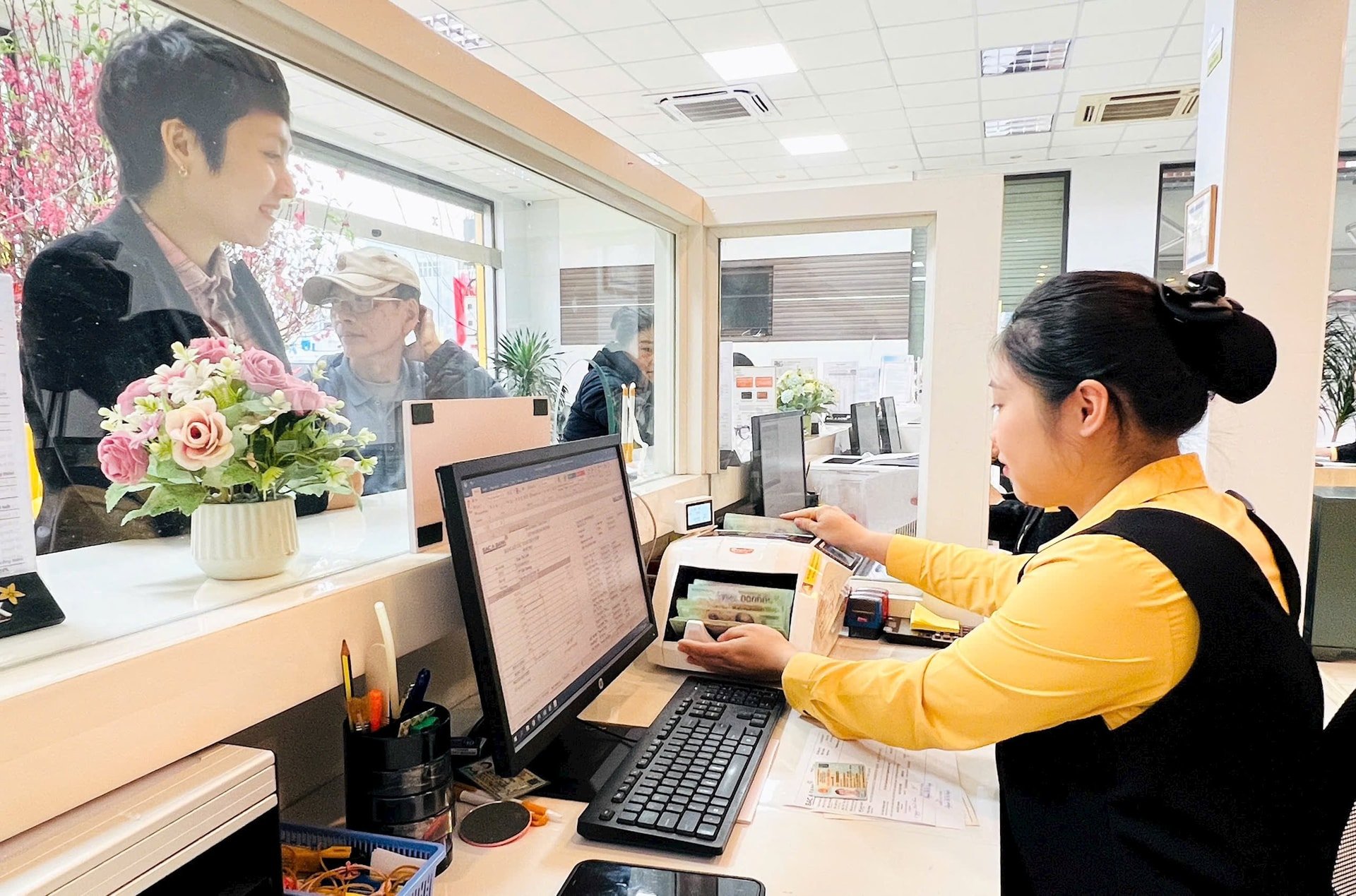

According to the State Bank's report, in the first 10 months of the year, the agency kept the operating interest rate unchanged. Authorities continue to require banks to reduce costs to lower lending rates. Banks must also publicize average lending interest rates and the difference between deposit and lending interest rates to help customers easily access capital.

As of October 20, the lending interest rate decreased by 0.76% compared to the end of 2023. However, according to this agency, reducing interest rates in the coming time is "very difficult". The reason is that lending interest rates have tended to decrease sharply in recent times. The continued increase in demand for credit capital will put pressure on the interest rate level. Meanwhile, reducing domestic VND interest rates will increase pressure on exchange rates and the foreign exchange market.

Not to mention, the State Bank believes that the pressure on capital supply of the system to the economy is still large in the context of difficulties in mobilizing from the corporate bond and securities markets. This poses a potential risk of maturity and large liquidity for the banking system due to having to mobilize short-term funds for medium and long-term loans.

Source

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

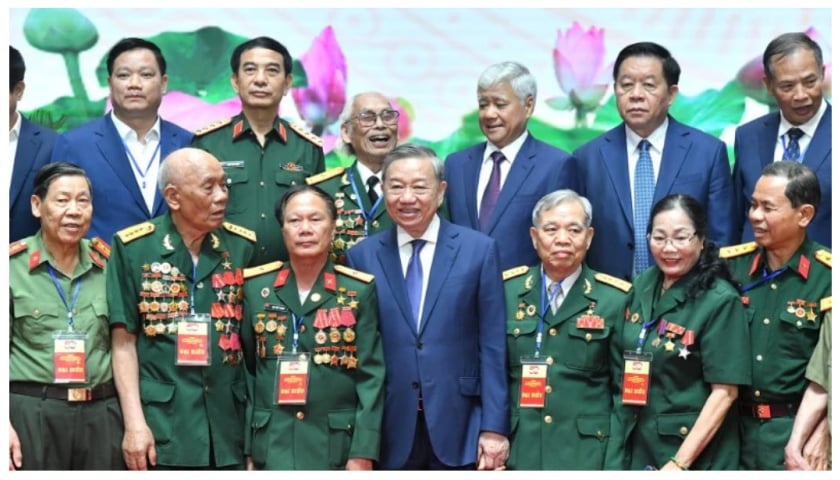

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)