From February 18, 2025, imported goods with a value of less than 1 million VND when sent via express delivery service will be subject to import tax and value added tax.

Setting a level playing field

Previously, according to Decision 78/2010/QD-TTg, imported goods sent via express delivery services with a value of 1 million VND or less were exempt from import tax and value added tax. Imported goods sent via express delivery services with a value of over 1 million VND must pay import tax and value added tax according to the provisions of law.

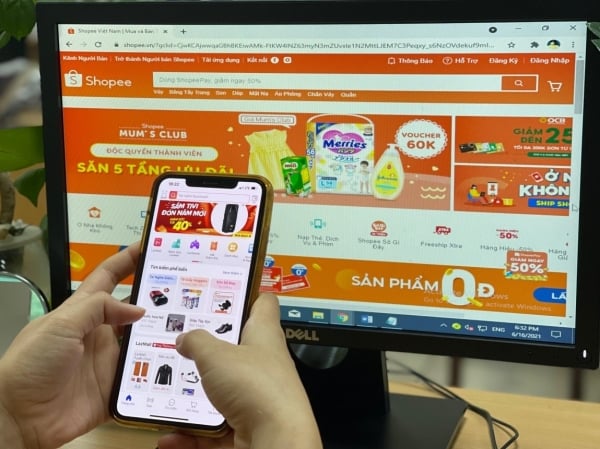

|

| Small-value imported goods will increasingly "flood" into the Vietnamese market. |

However, Decision No. 01/2025/QD-TTg completely abolishes Decision No. 78/2010/QD-TTg dated November 30, 2010 on the value of imported goods sent via express delivery services that are exempt from tax. Decision No. 01/2025/QD-TTg takes effect from February 18, 2025.

According to experts, abolishing tax exemption for low-value goods is an inevitable step, not only to increase budget revenue but also to protect domestic enterprises, contributing to building a fair and sustainable market.

Previously, many opinions said that, to ensure equality in business, it is necessary to tax imported goods of small value, especially through e-commerce channels. In the context of the development of the digital economy, which is creating favorable conditions for trading activities through e-commerce platforms, this field needs to be exploited and promoted effectively.

Responding to a reporter from Cong Thuong Newspaper about how Decision No. 01/2025/QD-TTg affects the Vietnamese e-commerce retail market, Mr. Hoang Ninh - Deputy Director of the Department of E-commerce and Digital Economy (Ministry of Industry and Trade) - said: " The decision has an important impact on the e-commerce retail market in Vietnam in terms of state management and business and consumer activities ".

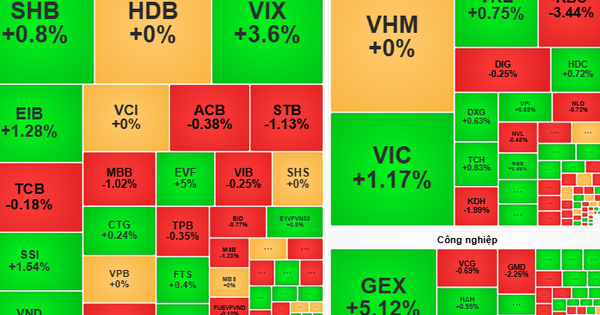

Mr. Hoang Ninh analyzed: Firstly , the imposition of import tax and value added tax on goods valued under 1 million VND sent via express delivery service is a step forward in ensuring fairness between imported goods and domestically produced and traded goods. The new regulation will contribute to establishing a more equal playing field, supporting domestic enterprises to develop sustainably.

Second , this regulation may make the prices of goods imported from outside Vietnam less attractive because the prices are too competitive. This will encourage consumers to consider more carefully when shopping for imported goods, thereby increasing demand for domestic goods, especially products of equivalent quality. This is an opportunity for domestic enterprises to improve their competitiveness and enhance product quality.

Third , from a management perspective, the new regulation will help authorities better control the flow of imported goods, especially in the context of cross-border e-commerce platforms operating strongly in Vietnam. Uniform tax collection will help increase state budget revenue, while limiting the abuse of tax exemption policies to import poor quality goods or trade fraud.

Guarantee the rights of buyers

Economic experts calculate that on average, each month, about 1.3 - 1.9 billion USD of small goods cross the border without paying tax, so on average, about 50 million USD enter and exit the Vietnamese market every day, but if we completely exempt them, that is a huge loss.

In addition, for the same type of goods, domestically produced goods still have to pay value added tax, so the exemption of value added tax for imported goods via express delivery services with small value has invisibly created a price difference, leading to unfair competition with domestically produced goods of the same type (due to having to pay value added tax), thereby affecting the production and consumption of domestic goods...

As a regular online shopper, Ms. Duong Hoang Mai (Hanoi) said, " Imposing taxes may increase product prices for domestic consumers, but that is only a small short-term loss; long-term benefits are more important ."

Discussing this issue, experts shared that imposing taxes on all imported goods will contribute to improving product quality and safety. The import inspection process will help limit cheap, poor quality foreign goods of unknown origin or unsafe. Consumers will have full information about the origin of the product, ensuring their purchasing rights.

Following the booming trend of e-commerce, not only the platforms that have been operating in Vietnam, but in the future, many more platforms may appear. From there, cheap goods will flood into Vietnam. Thus, removing tax exemption will contribute to supplementing resources for the state budget.

In addition, the statistics and calculations to collect taxes on imported orders under 1 million VND will no longer be too complicated when more and more technology platforms are applied. Currently, thanks to the increased application of information technology and the application of modern customs management methods, up to now, over 99% of customs procedures have been carried out electronically through the Automatic Customs Clearance System (VNACCS/VCIS).

The development and improvement of the above-mentioned electronic customs declaration system has helped to clear goods quickly and facilitate the management of large-scale daily goods declarations without disrupting commercial activities.

Customs declarants also do not need to go to customs offices to declare online, thereby reducing the number of declarants because the procedures are carried out through agents and shipping companies, so the management and collection of taxes on imported goods sent via express delivery services are carried out more centrally and quickly than before.

| In 2023, the total value of goods imported via express delivery services with a value of less than VND 1 million will be VND 27,700 billion. Correspondingly, the budget revenue from value added tax may increase by about VND 2,700 billion after the tax exemption is stopped. |

Source: https://congthuong.vn/thu-thue-hang-nhap-khau-duoi-1-trieu-kinh-doanh-binh-dang-368386.html

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)