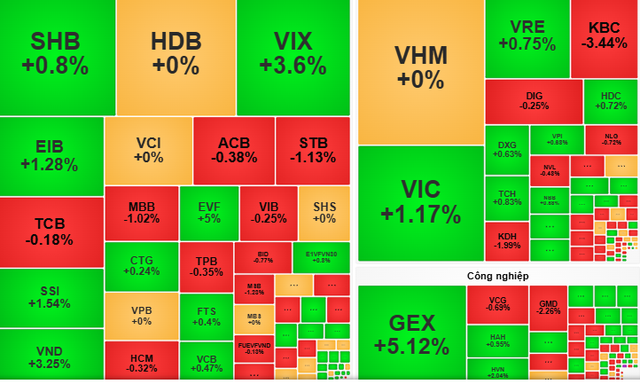

At the end of the trading session on April 2 , the VN-Index closed at 1,317 points, up 0.5 points, equivalent to 0.04%.

In the morning session of April 2, Vietnamese stocks continued to recover thanks to the group of steel, construction and real estate stocks attracting cash flow. The recovery of large-cap stocks such as VCB and GVR also contributed to helping the index maintain its green color.

Entering the afternoon session, a series of large stocks of all industry groups increased positively. VCB, VIC, VHM and FPT were the large-cap stocks leading the upward trend in the market.

However, the selling pressure of large-cap stocks was very strong in the last 15 minutes of the session, causing the index to gradually decrease. This shows that investors took advantage of the opportunity to take profits. In particular, foreign investors continued to net sell more than 700 billion VND of stocks, focusing on selling TPB and VNM codes.

At the end of the trading session on April 2 , the VN-Index closed at 1,317 points, up 0.5 points, equivalent to 0.04%.

VCBS Securities Company predicts that the market may fluctuate in the next session. Therefore, investors can take advantage of this development to increase the proportion of stocks that are still attracting cash flow, and should not chase stocks that have increased sharply in price recently.

Meanwhile, Rong Viet Securities Company recommends that investors keep their holdings at a reasonable level because risks are still hidden in some groups of stocks. However, stock "players" can still consider short-term purchases of some stocks that are showing positive developments.

Source: https://nld.com.vn/chung-khoan-ngay-mai-3-4-khong-nen-mua-duoi-co-phieu-19625040217535626.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)