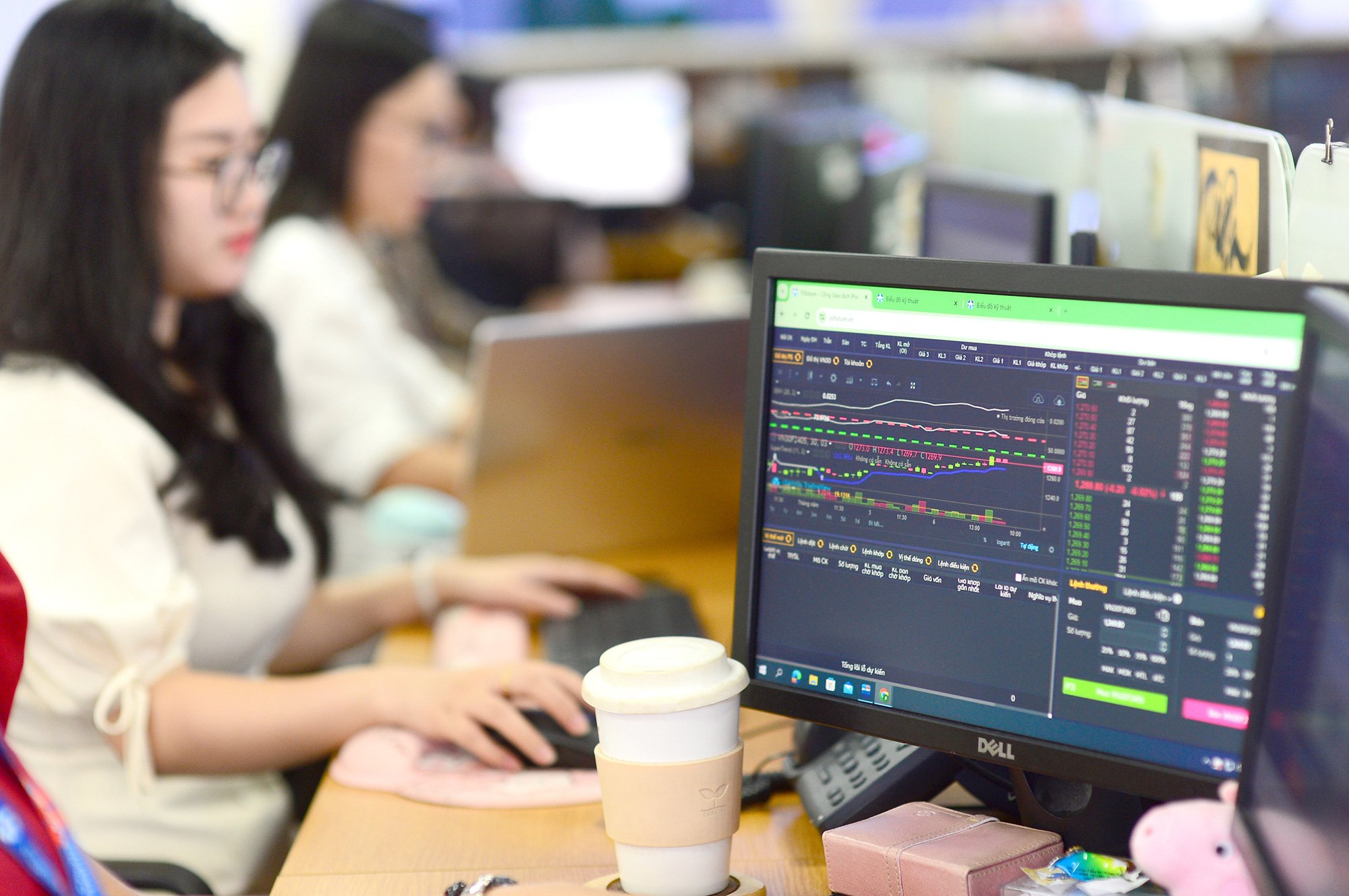

Many experts believe that Vietnam's stock market is lacking institutional investors, especially foreign ones - Photo: QUANG DINH

In 2023, Vietnam raised only over 7 million USD through IPO, a fraction of Indonesia's IPO value, due to the absence of listed businesses, lack of quality goods, and failure to attract large institutional investors.

At the July dialogue with the theme "Upgrading, raising capital and developing institutional investors", organized by the Securities Journalists Club, experts all admitted that the Vietnamese stock market is like a "restaurant", lacking food, poor service... so investors will go elsewhere.

Too few institutional investors

Speaking at the dialogue, Mr. Nguyen Duc Chi - Deputy Minister of Finance - said that for a high-quality, sustainable stock market, institutional investors must account for a large proportion. Meanwhile, although the number of securities accounts has reached 8 million, the proportion of institutional investors in the Vietnamese stock market is very modest.

"There is no need for too many accounts. Even if there are only 6 million accounts, it would be reasonable if 50% of them are institutional investors," said Mr. Chi, adding that only when Vietnamese investors change their perception and invest through professional organizations instead of "self-managing assets and investing in stocks" can the number of institutional investors increase.

Ms. Vu Thi Chan Phuong, Chairwoman of the State Securities Commission, also said that in developed markets, the proportion of institutional investors is at 50-60%. Meanwhile, in Vietnam, individuals account for over 90%, and investment is still based on psychology. "Many times the market goes up and down without understanding why, in the end it is mainly due to psychological issues and instability," Ms. Phuong said.

According to Ms. Phuong, the Vietnamese market is like "a person wearing a tight shirt", needing to take a new step forward. "The State Securities Commission will soon announce the draft for final comments on the amendment of 4 circulars related to the stock market with many new points to remove difficulties for the market proposed by the management agency after consulting and receiving opinions from relevant parties", Ms. Phuong said.

"It is necessary to remove overly strict conditions and create more favorable conditions for institutional investors to participate in the stock market," said Mr. Chi, adding that the Ministry of Finance will facilitate and open up activities for investment funds. For example, the State Securities Commission has sought opinions on the issue of foreign investors not having to deposit 100% in order to upgrade the stock market.

The quality of goods has not improved.

The market must be upgraded to have a chance to welcome foreign capital. But after entering, what will investors buy if the market does not have good products? To attract more institutional investors, especially foreign institutional investors, experts all agree that the quality of products needs to be improved.

Mr. Nguyen Son - Chairman of Vietnam Securities Depository and Clearing Corporation (VSDC) - admitted that the stock market does not have many new things, especially commodities. "The public offering is limited, there is a lack of bright new businesses and corporations...", Mr. Son said.

While there is a lot of room for selling capital and equitizing state-owned enterprises, Mr. Le Thanh Tuan, Deputy General Director of the State Capital Investment Corporation (SCIC), said that it is not easy for domestic and foreign institutional investors to participate in buying and selling state shares.

"Many foreign institutional investors want to conduct transactions by negotiation method while divestment and equitization of state-owned enterprises must be carried out through auctions and information disclosure according to regulations...", Mr. Tuan said.

According to Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, the liquidity of Vietnam's stock market is the second highest in Southeast Asia. "However, like a restaurant, if the food is lacking or the service is not good, investors will go elsewhere," Mr. Hai said, adding that pre-funding must be removed soon and conditions created for foreign investors to have equal access to information.

Citing information that there were only about 3 Vietnamese stocks in the MCSI basket in 2017, financial expert Nguyen Duc Hung Linh said that Vietnamese stocks are lacking in goods. However, even after upgrading, they can still "fall down the rankings". "We are trying very hard to get in, but what is important is the assessment of foreign investors on the Vietnamese market," said Mr. Linh.

The market lacks new elements

Also at the dialogue, Mr. Dominic Scriven, Chairman of Dragon Capital, said that in the past 4 years, foreign investors have sold a net 4 billion USD in the Vietnamese stock market. Of this, about 2 billion USD was sold in the first half of this year alone.

Apart from objective factors such as the US interest rate hike, Mr. Dominic Scriven said that the Vietnamese market does not have many new and interesting factors to attract the attention of foreign investors.

The fact that Vietnam's market has not been upgraded also affects the decisions of many foreign investors, not to mention that in the past two years, a number of events have occurred that have affected their perception of risk.

Source: https://tuoitre.vn/them-hang-chat-luong-chung-khoan-moi-hap-dan-20240720084436306.htm

![[Photo] Ho Chi Minh City after 50 years of national reunification through buildings and symbols](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a224d0b8e489457f889bdb1eee7fa7b4)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

![[Photo] Air Force actively practices for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16fdec3e42734691954b853c00a7ce01)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

Comment (0)