The National Assembly requires both focusing on removing immediate obstacles and closely following the goal of renewing the growth model and improving the endogenous capacity of the economy.

Overcoming fear of mistakes, fighting against "group interests"

On the morning of November 29, the National Assembly (NA) closed the 6th session of the 15th NA after more than 22 working days. In his closing speech, NA Chairman Vuong Dinh Hue said that at the session, the NA thoroughly discussed the situation and results of the implementation of the socio-economic development plan, state finance and budget, and public investment in 2023 and passed the Resolution on the socio-economic development plan, state budget estimates, and central budget allocation plan in 2024.

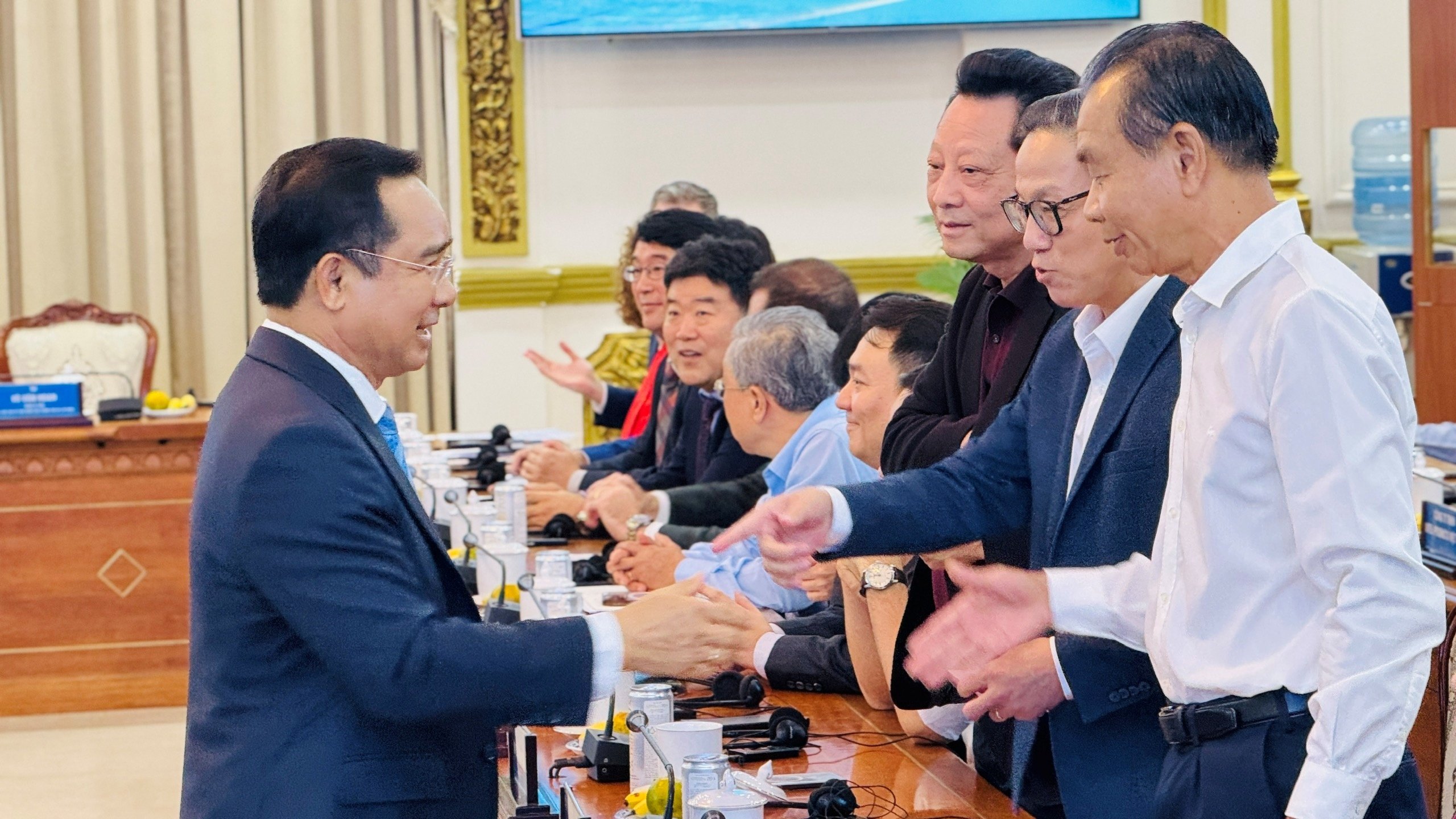

General Secretary Nguyen Phu Trong and leaders and former leaders of the Party and State attended the closing session of the 6th session of the 15th National Assembly.

GIA HAN

Postpone land law to next session

Regarding legislative work, the Chairman of the National Assembly said that at the session, the National Assembly passed 2 legal resolutions and 7 draft laws, including: the Law on Identity Cards ; the amended Law on Real Estate Business; the Law on Forces Participating in Protecting Security and Order at the Grassroots Level; the amended Law on Housing; the Law on Management and Protection of National Defense Works and Military Zones; the amended Law on Water Resources; and the amended Law on Telecommunications. The National Assembly also allowed the piloting of specific policies to speed up the progress of 21 regional and inter-provincial road projects.

National Assembly Chairman Vuong Dinh Hue speaks at the closing session

Promote results, overcome limitations

Regarding the supervision activities, the Chairman of the National Assembly emphasized that the National Assembly has conducted supreme supervision of the implementation of the National Assembly's resolutions on three national target programs on new rural construction, sustainable poverty reduction and socio-economic development in ethnic minority and mountainous areas. After the supervision, the National Assembly passed a supervision resolution with many important contents, many recommendations and solutions to speed up the progress, improve the efficiency and quality of national target programs in the coming time. The National Assembly spent two and a half days questioning the Prime Minister, Deputy Prime Ministers and ministers and heads of sectors on the implementation of thematic supervision resolutions and questioning of the 14th National Assembly and from the beginning of the 15th National Assembly's term to the end of the 4th session, with 21 fields in 4 groups of contents: general economy; sectoral economy; internal affairs, justice; culture and society. The National Assembly passed a resolution on questioning, which clearly defined the address, time scope and specific and clear responsibilities. The NA Chairman requested the Government, the Prime Minister, ministers and heads of sectors to resolutely and effectively implement the issues committed to the NA and voters nationwide, promptly and effectively overcoming limitations and weaknesses, and creating substantial, fundamental and long-term changes in each field being questioned. In addition, the NA conducted a vote of confidence for 44 people holding positions elected or approved by the NA. The results of the vote of confidence were made public and received high appreciation from voters and people nationwide. "The NA requests those who are voted for to continue promoting the achieved results, overcoming limitations to successfully fulfill the important responsibilities assigned by the Party, State and people," NA Chairman Vuong Dinh Hue emphasized. "With the results achieved, it can be affirmed that the 6th session of the 15th National Assembly has been a great success, increasingly meeting practical requirements," the NA Chairman affirmed and requested that NA deputies and NA agencies promptly implement the laws and resolutions passed by the NA.The National Assembly is scheduled to hold an extraordinary meeting in January 2024, deciding on the Land Law.

At the press conference announcing the results of the 6th session of the 15th National Assembly right after the closing session on the morning of November 29, Secretary General of the National Assembly Bui Van Cuong said that the fact that the National Assembly has not yet passed the revised Land Law and the revised Credit Institutions Law shows the caution and responsibility of the National Assembly because during the discussion process, there were still many different opinions, and it is necessary to have time to carefully consider them. Mr. Cuong also informed that the National Assembly Party Delegation is reporting to the competent authority to organize an extraordinary session in early January 2024 to review and pass the draft revised Land Law, the revised Credit Institutions Law and other contents submitted by the Government. For more information, Standing Member of the Economic Committee (the agency examining the draft revised Land Law and the revised Credit Institutions Law) Pham Thi Hong Yen said that up to now, there are still some major contents that need to be further studied to perfect policies to have optimal solutions. Specifically: the issue of implementing commercial housing projects, mixed-use commercial housing projects; the relationship between land recovery cases and land use rights agreements to implement socio-economic development projects without using state budget capital; the issue of land management and exploitation; cases of applying land valuation methods; the issue of using national defense and security land combined with economic land; cases of foreign-invested economic organizations receiving real estate project transfers. Regarding the Law on Credit Institutions, there are currently 3 extremely important issues with different opinions, including: early intervention measures; special control; special lending to credit institutions.Continuing to reduce 2% VAT, Vietnam applies global minimum tax from 2024

In the Resolution of the 6th session of the 15th National Assembly, approved by the National Assembly at the closing session on the morning of November 29, the National Assembly agreed to reduce the VAT rate by 2%, from 10% to 8% for groups of goods and services that are currently receiving tax reductions in Resolution 43 of 2022 of the National Assembly on fiscal and monetary policies to support the Socio-Economic Recovery and Development Program. The VAT reduction period is from January 1, 2024 to June 30, 2024. This tax reduction does not apply to a number of goods and services, which have been stipulated in Resolution 43, including: telecommunications, information technology, financial activities, banking, securities, insurance, real estate business, metals, prefabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products, goods and services subject to special consumption tax. Regarding the land acquisition, compensation, support and resettlement project of Long Thanh airport, the National Assembly agreed to extend the implementation period until December 31, 2024. At the same time, it added VND 966,749 billion from the general reserve of the central budget of the medium-term public investment plan for the period 2021 - 2025 for this project. "The Government is responsible for the accuracy and completeness of information and data reported to the National Assembly; direct relevant ministries, branches and the People's Committee of Dong Nai province to coordinate, implement and complete the project according to the schedule and regulations of the State Budget Law, the Public Investment Law and relevant laws," the resolution stated. On the same morning, the National Assembly passed a Resolution on applying additional corporate income tax according to the regulations on preventing global tax base erosion (global minimum tax). According to this resolution, Vietnam will apply global minimum tax from January 1, 2024. The tax rate will be 15% for multinational enterprises with a total consolidated revenue of 750 million euros (about 800 million USD) or more in 2 of the 4 most recent years. Investors subject to tax will be required to pay global minimum tax in Vietnam. According to the review by the General Department of Taxation, Ministry of Finance, there are about 122 foreign corporations investing in Vietnam affected by the global minimum tax. The additional tax difference compared to the current level is about 14,600 billion VND per year.Thanhnien.vn

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)