According to records, in the trading session on October 24, the VN-Index increased slightly by 12.37 points, returning to the 1,105-point mark. However, this is still not a clear signal of recovery because market liquidity also dropped to its lowest level in the past 6 months.

On the HoSE, the matched order value was only recorded at VND9,000 billion, down about 10% compared to the previous session. This liquidity has also returned to its lowest level in the past six months since May 2023.

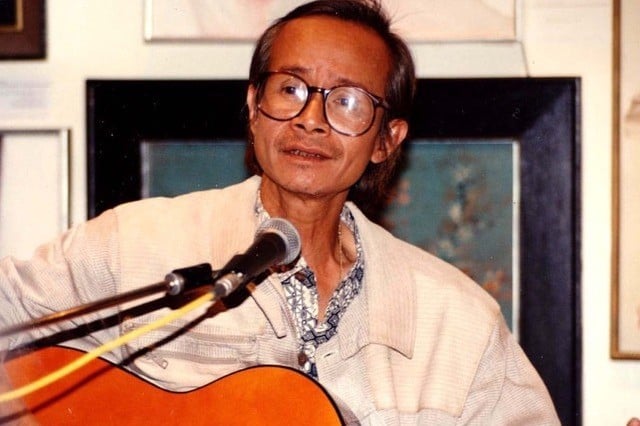

VN-Index slightly recovered to 1,105 points but market liquidity returned to the bottom in the past 6 months (Photo TL)

The average matched value of trading sessions since the beginning of October has been recorded at just under VND13,000 billion, much lower than the previous average of VND20,000 billion.

According to some experts, the decline in stock market liquidity is relatively understandable when the market has had deep corrections in the past month. This will easily create anxiety for investors. In addition, many investors will also observe more carefully to wait for the clearest signs of recovery of the market.

Another notable reason is that news about negative developments in the world economy is slowing down. The fear of a major crisis has subsided, and the supply of stocks in the stock market has decreased, affecting market liquidity.

Currently, the P/E valuation of the Vietnamese stock market has decreased from 14.1 times in mid-September to only 12.24 times, lower than the average of the past 5 years. Many predictions about the profit growth trend of companies in the third quarter will push the P/E index to continue to decline.

Based on economic data, foreign fund Pyn Elite Fund believes that the Vietnamese stock market will continue its growth trend in the coming time, with the potential to return to the valuation zone with P/S (market price to revenue ratio) at over 2 times.

Source

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

Comment (0)