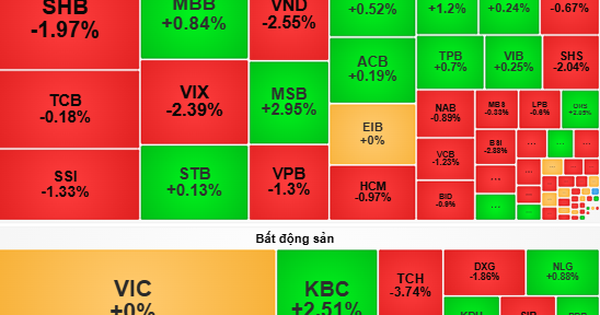

The stock market last week had a series of positive trading sessions when VN-Index set a new short-term peak and liquidity set a record.

At the end of the trading week, VN-Index increased by 18.02 points (+1.43%) to 1,281.8 points.

During the week, liquidity on HOSE reached VND151,877.51 billion, a sharp increase of 20.4% compared to the previous week. This was a trading week with record liquidity, averaging over VND30 trillion/session, with a trading volume of over 1.1 billion shares/session, demonstrating a fast and strong turnover in the market with many good short-term profit opportunities.

It can be seen that, besides the fact that investor sentiment has stabilized after concerns about economic policy reversal when the State Bank issued treasury bills to withdraw money, the market is also receiving a lot of information that is quite good at supporting sentiment.

The State Securities Commission has consulted its members on the regulation that foreign institutional investors can trade without depositing 100% of their money. If approved and implemented in the near future, this regulation will remove one of the two bottlenecks in the process of upgrading the market according to FTSE regulations: the requirement for pre-transaction deposit (prefunding) and the limit on foreign ownership ratio (room).

Along with the recent trial run of the KRX system by HOSE, it can be seen that the management agencies are very active in solving problems to upgrade the market in 2025 as the Government's target. This has helped the market have a good trading week, with the VN-Index climbing to the peak of 2023.

What many investors want to find the answer to most at this time is whether the VN-Index is still on the rise or not? Is it time to strongly disburse to buy stocks or not?

Dr. Nguyen Duy Phuong, Investment Director of DGCapital, believes that although the 1,280 point threshold has reached a new peak, it is still a sensitive area of the market. Therefore, caution and risk management are the key words for investors in the next trading week.

"The decision to disburse capital during this period by investors needs to be oriented towards the fact that stock prices that want to increase sustainably need to come from within, which is the positive business results of the enterprise.

The profits of listed companies recorded in the fourth quarter of 2023 have increased again and the outlook for 2024 is positive. This will support the upward momentum of the stock market," Dr. Phuong stated.

However, there are still many opinions that the current market is moving in a zone of more risk than opportunity after an increase of over 20% compared to the mid-term bottom zone of November 2023.

Since the beginning of 2024, with an increase of 12%, VN-Index is in the Top 3 stock indexes with the strongest growth in the world, after the stock indexes of Türkiye and Japan.

Therefore, VN-Index needs time to accumulate after a long increase to wait for more convincing evidence of the health of the economy and the recovery of corporate profits.

Source

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)