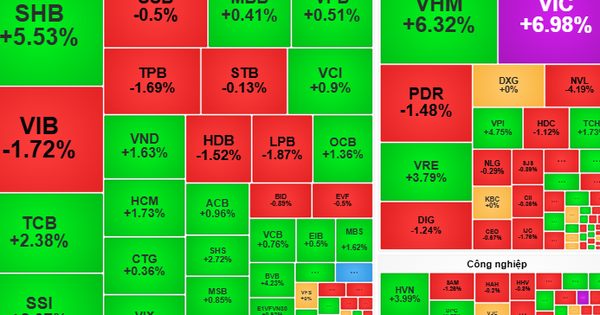

After a decline in early August, the VN-Index has recovered quite impressively, returning to the old short-term peak around 1,280 - 1,300 points, led by pillar stocks.

Entering the first days of September, contrary to optimistic forecasts, the market has continuously decreased, the trend of VN-Index has become less positive when it failed to maintain the support zone of the 20-session average price line. The index is under pressure to correct to the price zone of 1,250-1,255 points.

The current developments have not yet shown that demand and short-term cash flow will increase again. In the following sessions, experts also forecast that the index may continue to be under pressure to adjust to the 1,250 point area and recover to retest the current nearest resistance area around 1,265 points.

According to Dr. Nguyen Duy Phuong, Investment Director of DG Capital, this is the time of information depression, so the state of tug-of-war, narrow fluctuations with low liquidity will likely recur in the short term. This development may last in September and Dr. Phuong expressed the opinion that it is not excluded that the tug-of-war trend will gradually decrease because the difficulty in short-term surfing activities in the past time will weaken the short-term cash flow into the market.

In addition, the domestic market trend will also be affected by the general trend of the world stock market. In addition, differentiation will occur according to the forecast of the third quarter business results of each enterprise and industry group.

Experts from VCBS Securities Company also commented that the market has declined quite sharply in recent sessions mainly due to the lack of motivation from demand and cautious investor sentiment. VCBS recommends that investors stay calm, should not rush to sell but should wait for recovery periods to restructure the portfolio if necessary. The immediate priority will still be to hold stocks that maintain a positive trend with a ratio of about 50% of the portfolio and bring the leverage ratio to a safe level. With the current developments, the 1,250 point area will be the nearest support and there may soon be a recovery at this score area.

Experts also believe that in the current context, geopolitical risks and regional conflicts are always topics of interest to experts and investors around the world. This is one of the leading reasons that can affect investor sentiment. From price fluctuations of basic commodities such as freight rates, rubber, crude oil, sugar, gold prices can immediately affect asset price movements and short-term fluctuations in the stock market.

In addition, monetary policy developments in the third quarter and the end of 2024 will also affect the actions of investment funds and trading developments of individual and institutional investors. Tightening or loosening activities are always important factors related to the general market trend.

Finally, economic growth prospects, GDP growth, global PMI indicators, business results of listed enterprises, revenue/profit growth figures of companies also affect assumptions and valuation levels. These are factors that investors need to pay attention to for the end of 2024.

Source: https://laodong.vn/kinh-doanh/dong-tien-van-dung-ngoai-thi-truong-chung-khoan-1392550.ldo

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)