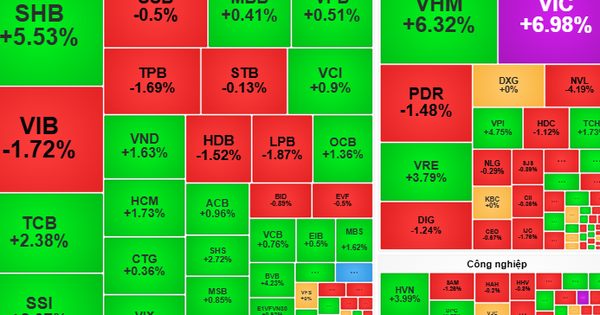

The VN-Index is still in a tug-of-war state with selling pressure dominating, making it impossible for the market to establish a clear recovery trend.

Liquidity continues to decline sharply, showing that demand is still cautious, with no clear buying action.

In the absence of supportive information, the market is in need of a slight recovery to relieve the active selling sentiment in the market; the market is likely to move sideways but with an upward trend as the main trend.

Entering September, looking to the remaining months of 2024, experts from Mirae Asset Securities Company believe that the market will continue to receive mixed news surrounding the general growth prospects of major economies in the region or for Vietnam in particular.

Here, the market will continue to look for new stories to lead the growth momentum as the story of Vietnam's market upgrade may once again be delayed in the FTSE's assessment report in September 2024.

To date, the final drafts on amending laws related to securities trading and brokerage to meet the remaining criteria for the upgrade process have only just been approved and are still pending before the upcoming National Assembly session in October.

On the other hand, the lack of clear growth drivers as well as the not-so-optimistic developments in many pillar stocks are likely to cause the market to record unexpected volatile trading sessions with more frequent frequency as in the last 6 months.

The main trend is still sideways fluctuations within a large range extending from 1,200 points to 1,280 points of VN-Index, Mirae Asset analysis group commented.

In the medium and long term, Mirae Asset analysis team believes that the market still does not have enough data to assess that the market will soon enter a trend reversal phase, and the VN-Index is likely to continue moving towards the psychological milestone of 1,300 points in the context that the P/E valuation of the VN-Index remains at a relatively attractive level (trading below the average of the last 10 years).

However, fluctuations may appear due to increased profit-taking sentiment when VN-Index surpasses the psychological resistance zone. This trend may last until VN-Index successfully conquers the 1,330 point mark.

However, Mirae Asset believes that short-term risks still exist as the VN-Index will tend to return to the balance zone after recording an increase lasting 3 weeks before and heading towards the support zone lasting from 1,240 - 1,250 points.

Source: https://laodong.vn/kinh-doanh/chung-khoan-no-luc-phuc-hoi-trong-ngan-han-1393605.ldo

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

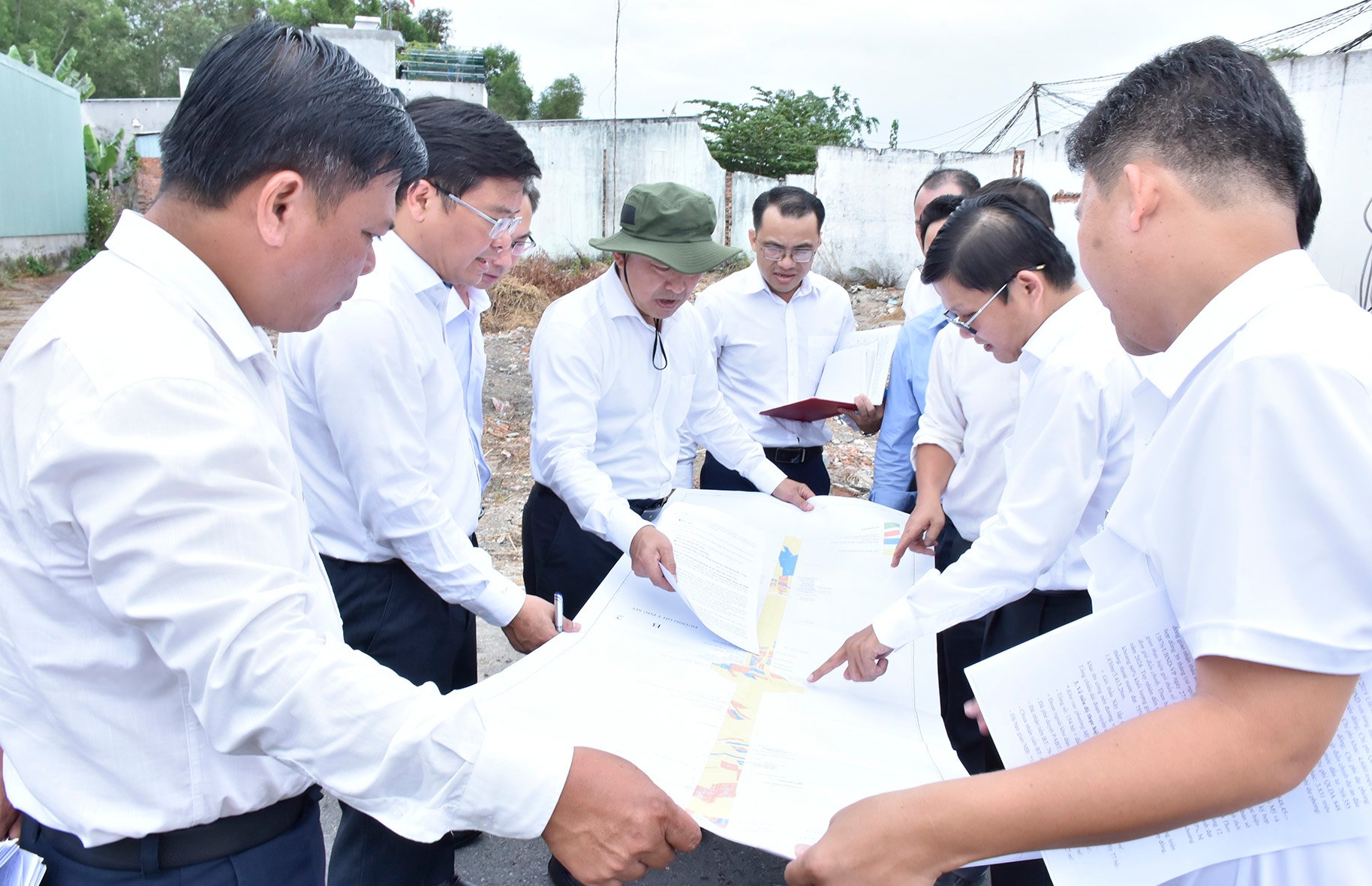

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)