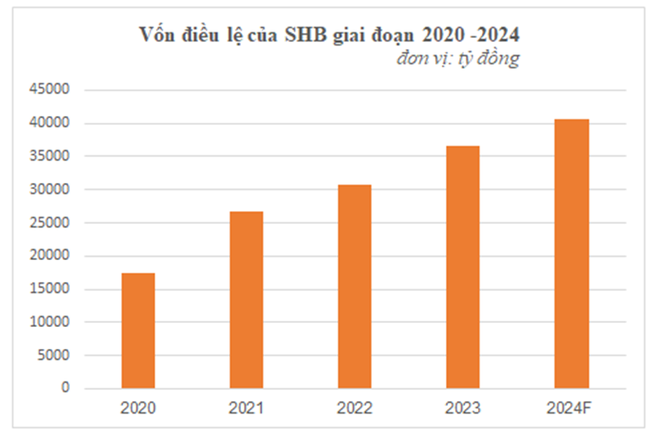

ANTD.VN - The State Bank of Vietnam (SBV) has just issued a document approving Saigon - Hanoi Bank (HoSE - SHB) to increase its charter capital to VND 40,658 billion through issuing shares to pay dividends.

Specifically, the State Bank approved SHB to issue nearly 403 million shares to pay dividends in 2023 at a rate of 11%, equivalent to shareholders owning 100 shares will receive 11 new shares.

The source of capital used to issue shares to pay dividends is the undistributed profit after tax after fully setting aside funds according to legal regulations and the remaining undistributed profit of the previous year according to the audited financial statements as of December 31, 2023.

|

SHB's charter capital increased to VND40,658 billion after completing the issuance of dividend shares. |

Upon completion, SHB's charter capital is expected to increase by nearly VND4,029 billion, from VND36,630 billion to VND40,658 billion, continuing to be in the TOP5 largest private banks in the system. The increase in charter capital is of great significance in improving the bank's financial capacity, increasing SHB's competitiveness in the process of international economic integration, and especially meeting the expected benefits of shareholders.

According to the Resolution of the 2024 Annual General Meeting of Shareholders (AGM), SHB will pay a total dividend of 16% in 2023, including 5% in cash and 11% in shares. In August 2024, the Bank paid the first 2023 dividend in cash at a rate of 5% to shareholders.

SHB always maintains increasing charter capital through issuing shares to pay dividends at a rate of 10 - 18%, continuously improving the capital base. Thereby, capital safety ratios and risk management always comply better than the regulations of the State Bank, managing liquidity risks according to Basel II and Basel III standards. The bank is steadfast in its orientation of sustainable, safe and effective development, continuously improving its management capacity according to international standards and modern models.

According to banking and finance expert - Associate Professor Dinh Trong Thinh, a strong financial foundation is a measure to affirm the Bank's reputation in the market, thereby being the basis for expanding capital attraction from residents, businesses or mobilizing from the bond market with appropriate interest rates and terms.

In addition, Associate Professor Dinh Trong Thinh stated that increasing charter capital not only ensures financial safety factors, but also helps the Bank have more resources to invest in digital transformation and green credit in many areas of the economy.

|

By December 31, 2024, SHB's total assets will be VND 740 trillion; outstanding credit balance will be nearly VND 523 trillion, up 18%. Safety, liquidity, and risk management indicators will comply with and be better than the regulations of the State Bank of Vietnam, with the capital adequacy ratio (CAR) at 12%.

In the strong and comprehensive transformation strategy 2024-2028, SHB continuously promotes innovation - creativity, technology application, applies new initiatives internally and brings customers convenient and modern products, services and solutions. This is one of the factors that helps the CIR index to be optimized at 24.68% - the lowest in the industry thanks to promoting digitalization, applying technology to operating processes, to optimize operating costs. The bank applies modern technology solutions such as: artificial intelligence (AI), big data (Big Data), machine learning (Machine learning), cloud computing, biometrics... The proportion of transactions via digital channels and online platforms of SHB continuously increases in the leading group in the industry. To date, more than 95% of SHB's operations and processes are digitized. More than 98% of transactions of individual and corporate customers are carried out entirely through digital channels Mobile banking, Internet banking.

In the period of 2024-2028, SHB is focusing resources to implement a strong and comprehensive Transformation Strategy based on 4 pillars: Reforming mechanisms, policies, regulations, and processes; People are the subject; Taking customers and markets as the center; Modernizing information technology and digital transformation and steadfastly following 6 core cultural values "Heart - Trust - Trust - Knowledge - Intelligence - Vision".

SHB sets a strategic goal of becoming the TOP 1 Bank in terms of efficiency; the most favorite Digital Bank; the best Retail Bank and at the same time the TOP Bank providing capital, financial products and services to strategic private and state corporate customers, with a supply chain, value chain, ecosystem, and green development.

Originating from the Heart, SHB always accompanies, creates and spreads good values to people, community and society, joining the country in entering a new era.

Source: https://www.anninhthudo.vn/shb-duoc-chap-thuan-tang-von-dieu-le-len-40658-ty-dong-post600193.antd

Comment (0)