As technology advances at breakneck speed, the banking industry is facing a major turning point to attract modern customers with increasing demands for seamless and multi-channel experiences.

MB launches more than 100 card sets for young people to choose from to suit their personality - Photo: DNCC

The latest banking industry report not only explores the changing consumer behavior of new customer groups but also reveals the Phygital trend - the combination of physical and digital.

Expectations of the new generation of consumersGenerations Z and Alpha - born and raised in the digital age - have become a key consumer force, shaping the development trends of many industries, including the financial industry.

The report "Banking industry and the new generation of consumers" recently released by MB with the accompaniment and consultation of prestigious experts in the fields of finance - banking and business administration pointed out that: Unlike previous generations, this group of customers requires a banking experience that does not stop at simple transactions, but must also be personalized and optimized through modern technology.

According to the report: "New generation customers are looking for a comprehensive banking experience that is not only fast and convenient, but also interesting and interactive. This places high demands on innovation, especially the ability to personalize and integrate digital technology into banking services."

These desires stem from the consumption habits of a generation accustomed to mobile apps and online experiences, leading them to prioritize the flexibility and convenience of digital services.

Unlike previous generations, Gen Z and Alpha are quick to adapt to cashless transactions, and they also appreciate convenience factors like online banking and mobile financial apps.

Pioneering in the digitalization of banking, in the recent episode of the Business Insights program "Protecting your wallet through technological breakthroughs", Mr. Vu Thanh Trung - Vice President of MB shared: "Some customers like it fast, some like it careful, and for Gen Z, using banking apps is also fun for them. We at MB have launched more than 100 card sets for young people to choose from to suit their personality."

This is a practical demonstration of how banks in Vietnam have made efforts to meet the expectations of this customer group.

Orientation to meet the needs of banksThe report emphasizes that comprehensive digital transformation is an urgent requirement for banks if they want to meet the increasing expectations of new generations of consumers.

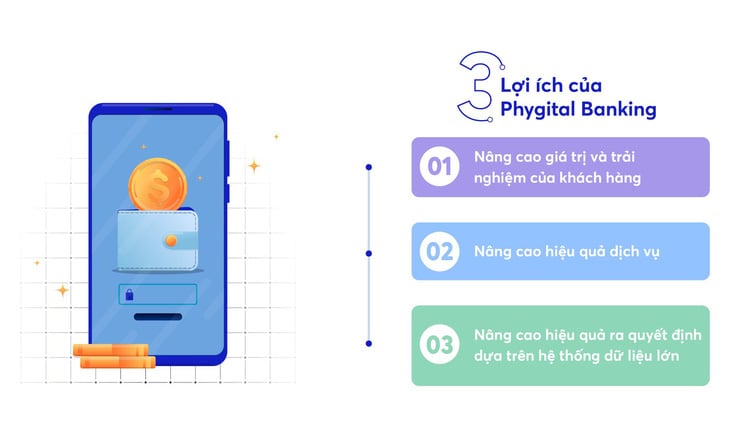

Accordingly, developing a Phygital system, harmoniously combining physical and digital channels, is considered a strategic solution to help banks provide multi-channel services, bringing seamlessness and consistency in customer experience.

“Phygital helps the banking industry optimize customer experience, reduce processing times, and ensure consistency across transaction channels,” the report said. In this direction, banks need to develop omnichannel systems, in which online services and physical transactions complement each other, creating a reliable and flexible experience journey.

Integrating VR and AR into banking services also brings a unique experience space, allowing customers to visualize financial products and easily understand the service packages they are using.

Phygital banking - Optimizing customer experience in the digital age. Source: Report "Banking industry and the new generation of consumers" - Photo: DNCC

Another important factor mentioned in the report is the application of Big Data analytics to better understand customer behavior and needs. Through Big Data, banks can provide highly personalized financial services, helping to optimize customer outreach strategies.

In addition, the report also mentions the potential for applying AI and machine learning technologies to automate processes and improve customer service performance.

With these tools, banks can easily detect unusual behaviors, thereby improving security for customers. "AI and machine learning not only help optimize processes but also provide the ability to detect and handle security issues effectively and quickly," the report noted.

The Phygital system also helps banks stay competitive in the market as young customers increasingly demand seamlessness and multi-channel in financial services.

Phygital not only helps optimize the customer experience, but also enables banks to be more flexible in providing services, from mobile applications, smart ATMs, to 24/7 consulting services.

The report emphasizes that: “An omnichannel system that tightly connects physical and digital channels is a decisive factor in retaining modern customers, ensuring satisfaction and loyalty.”

The report provides a comprehensive and detailed view of changes in consumer expectations and suggests new development directions for the banking industry to meet those needs.

With the Phygital system and advanced technology integration, banks not only have the opportunity to enhance customer experience but also strengthen their position in the increasingly competitive landscape.

Source: https://tuoitre.vn/phygital-banking-va-cong-nghe-dot-pha-2024112111163082.htm

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)