Reporter (PV): Could you share about the number of young customers who are accessing MB's home loan package and the current outstanding balance?

Mr. Vu Hong Phu: After more than a year of implementation, we are now providing home loans to about 2,000 customers with a loan balance of more than VND 3,000 billion. Most customers are very excited and have responded positively to the preferential program for young people to borrow money to buy houses. Most of the houses that customers bought in the recent period have now increased in value on the market. Currently, MB is also a pioneer in providing capital for investors to build social housing and customers to buy and own social housing.

|

Mr. Vu Hong Phu - Member of MB Executive Board. |

To realize the dream of buying a house, MB always proactively advises customers based on their income level. For example, how much house should be owned that is suitable for the ability to pay the debt without affecting daily life. Based on that, we have a series of investors, or social housing project owners to introduce to customers to approach buying a house.

PV: For young people who have just started working and have low income, paying off bank loans every month is not a simple matter. So what has MB done to increase access to credit capital for these people?

Mr. Vu Hong Phu: MB Dream Home product is designed to "unlock the dream home" for young people. Therefore, for those who have just started working and have low income, they only need an income of 10 to 15 million VND/month to be able to own a dream home. In addition, in terms of loan term, we design home loans for customers with a loan term of up to 35 years, the longest on the market today. Meanwhile, home loans on the market usually only have a term of 25-30 years. In terms of loan amount, MB will finance customers up to 80% of the value of the collateral and is valued at the time the customer buys the house.

Another outstanding incentive in the market is that in the first 5 years of borrowing, young customers who borrow to buy a house from MB do not have to pay the principal but only pay periodic interest (in the first year, MB's loan interest rate fluctuates from 6-8%, while the average loan interest rate on the market is more than 10%). In the next 5 years, customers only have to pay 15% of the principal and periodic interest. Thus, in the first 10 years, customers only have to pay 15% of the principal and periodic interest, which helps reduce financial pressure for young customers. Even more special is that MB Dream Home is aimed at young people, so customers will basically experience the whole thing on our application platform.

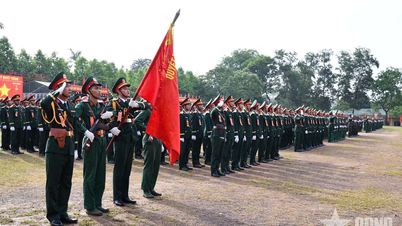

|

Military Commercial Joint Stock Bank (MB) creates the best conditions for young customers to borrow to buy houses. |

Specifically, customers can access the MBBank application to register for a loan, provide the required information and they will receive loans directly on the bank's application if they provide complete information. In case the customer provides insufficient information, the artificial intelligence (AI) of the MBBank application will contact the customer to clarify. In the near future, we will continue to upgrade this experience to shorten the time to automatically decide on loans on the MBBank application for young people to borrow to buy a house.

PV: In addition to providing credit for young people to buy houses, does MB provide any other support for customers, sir?

Mr. Vu Hong Phu: Definitely yes. Not only aiming to meet credit needs for customers, we also aim to provide financial solutions for customers. The specific financial solution here is based on the customer's income, we will provide solutions such as automatic investment or investment channels to help customers accumulate more financial resources. The second story is to optimize a loan with the minimum cost, customers will be structured with accompanying products. For example, MB has member companies related to the life and non-life insurance sector to support customers. When customers start a loan, our member companies will always protect that loan for customers. In case the customer encounters an unfortunate event, the house will still be kept for the customer.

PV: For young customers with unstable jobs, during the time of borrowing from the bank, if their income fluctuates, affecting their ability to repay the loan, does MB provide any support?

Mr. Vu Hong Phu: For young people, MB always sees that the future and opportunities for young people are very good. Therefore, when the bank offers preferential home loan solutions, it also provides additional motivation for customers. However, there are still certain risks such as health-related risks, risks due to customers being affected by their jobs and having no income for a certain period of time. Therefore, the insurance package for customers that member companies in the MB ecosystem are providing is the biggest way to minimize risks for customers. We structure so that customers can have a principal grace period (ie not having to pay the principal during that period); even when customers encounter limitations in paying periodic interest, MB will try to restructure the loan interest rate to help customers overcome that difficult time .

PV: Thank you very much !

ROYAL - ANH VIET (performed)

Source: https://www.qdnd.vn/kinh-te/cac-van-de/giai-phap-thu-huong-toi-uu-cho-nguoi-tre-mua-nha-thu-nhap-thap-821324

![[Photo] Prime Minister Pham Minh Chinh chairs the fourth meeting of the Steering Committee for Eliminating Temporary and Dilapidated Houses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/e64c18fd03984747ba213053c9bf5c5a)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

![[Photo] The moment Harry Kane lifted the Bundesliga trophy for the first time](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/68e4a433c079457b9e84dd4b9fa694fe)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

Comment (0)