The Standing Committee of Duc Linh District Party Committee recently had a working session with the District Social Policy Bank (SPB) Transaction Office on the implementation of policy credit programs in the area.

According to the report of the District Social Policy Bank Transaction Office, the capital source for implementing the credit plan by the end of June 2023 reached 464.32 billion VND, an increase of 30.8 billion VND, a growth rate of 7.1% compared to the plan at the beginning of 2023. Of which, capital from mobilization reached 54.1 billion VND, an increase of 8.94 billion VND, a growth rate of 19.8%, including mobilization of deposits from the Savings and Loan Group (TK&VV) reaching 32.5 billion VND, an increase of 24.5% compared to the beginning of the year, reaching 100% of the annual plan; mobilization from organizations and individuals reached 18.5 billion VND, an increase of 2.89 billion VND. The total outstanding balance of lending programs reached 463.6 billion VND, an increase of 30.7 billion VND, a growth rate of 7.1% compared to the beginning of the year, reaching 100% of the annual plan. Total loan turnover in the year reached 69.46 billion VND/2,255 households borrowing capital...

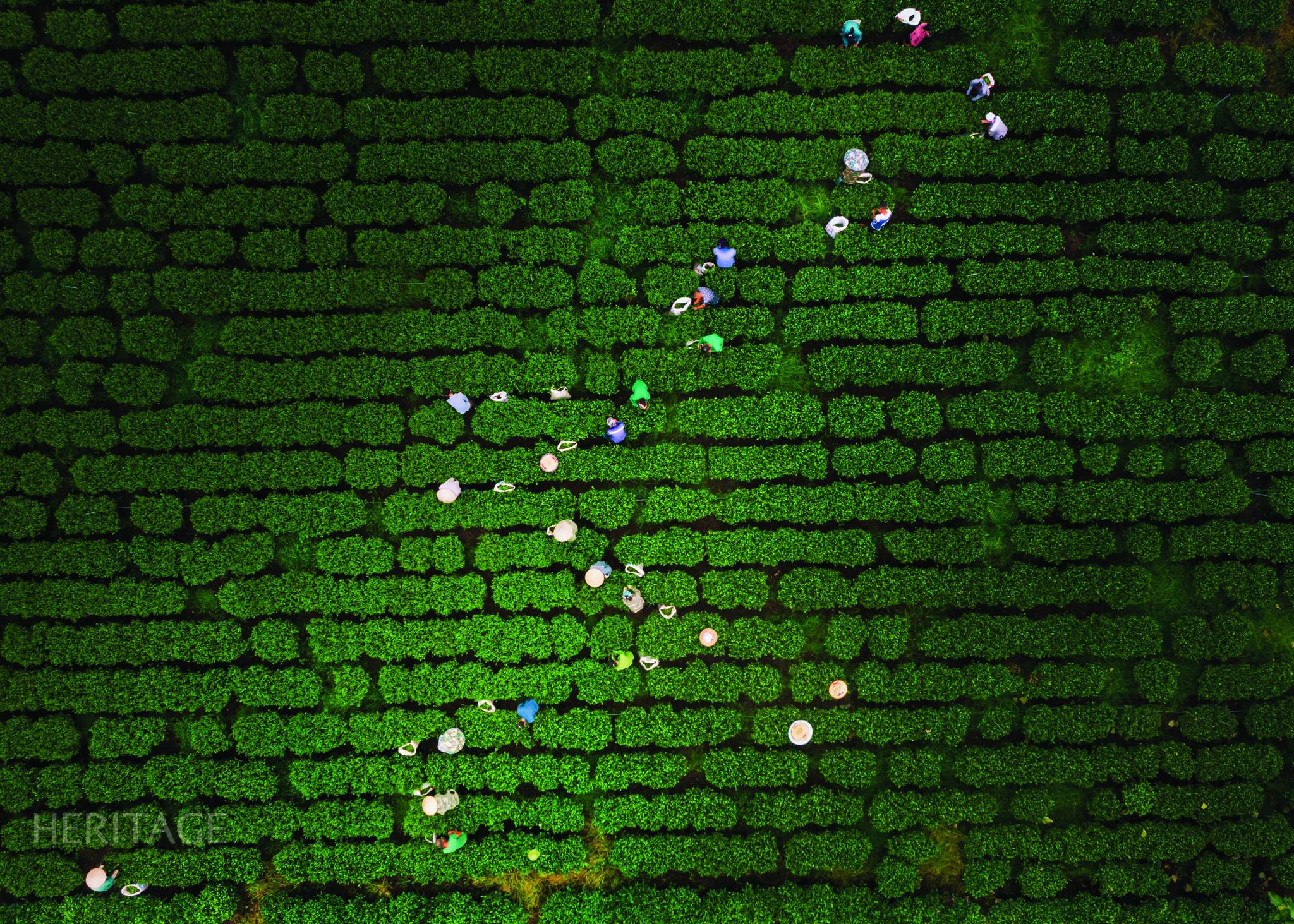

From policy capital to help poor households in Duc Linh rise up

In addition to the achieved results, the implementation of credit programs in the district still has some difficulties, namely: overdue debts increase, the number of loans requesting an extension of repayment period increases; borrowers tend to go to work far away after borrowing, leading to difficulties in debt monitoring. According to Mr. Le Van Nhi - Director of the Transaction Office of the People's Credit Fund of Duc Linh district, one of the causes is the difficult economic situation, workers who lose their jobs in industrial parks return to their localities and have a high demand for loans to create jobs. However, the capital source from the national fund for job creation for the unit to lend is still limited. Meanwhile, the income of workers has decreased compared to the same period last year, borrowers have difficulty in paying interest and principal periodically, leading to an increase in the number of loans requesting an extension of repayment period.

In the remaining months of 2023, the District Social Policy Bank Transaction Office will focus on disbursing 100% of the annual credit plan, striving for an increase of 10% according to the plan assigned by the Central Government at the beginning of the year. At the same time, keep the overdue debt ratio below 0.18%, reduce 25% of the number of inactive loans for 2 months (45 loans).

Standing Committee of Duc Linh District Party Committee works with the District Social Policy Bank Transaction Office.

Speaking at the meeting, Mr. Le Van Toan - Deputy Secretary of Duc Linh District Party Committee requested the District Social Policy Bank Transaction Office to proactively advise the Standing Committee of the District Party Committee to continue to strengthen the Party's leadership over policy credit activities according to Directive No. 40-CT/TW dated November 22, 2014 and Conclusion No. 06-KL/TW dated June 10, 2021 of the Secretariat. Focus on timely and effective implementation of preferential credit programs, improve credit quality, pay attention to ensuring that lending must be to the right beneficiaries. Strengthen coordination with entrusted units, remove difficulties in debt collection. At the same time, promote the application of information technology in banking operations to improve labor productivity, work efficiency...

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)