Eximbank is entering the digital race with the goal of providing diverse and quality financial products with the goal of continuously improving the experience and developing the customer base.

Digital banking in Vietnam grows strongly

According to a study by Deloitte, customers today not only want a superior service experience, but also an experience that is tailored to their needs. Therefore, digital technologies such as artificial intelligence (AI), chatbots, and process automation are helping banks create new and fast experiences.

In Vietnam, many commercial banks are also racing to digitally transform to provide convenient, fast and secure financial services. By switching to digital platforms, banks have shown clear effectiveness in improving customer experience. This helps meet customer needs while promoting the development of the banking industry in Vietnam.

Forecasting the Vietnamese digital banking market, Accesstrade believes that digital banking will continue to witness strong growth. With net interest income expected to reach 68.11 million USD in 2024 and forecast to reach 82.39 million USD in 2028, the digital banking industry in Vietnam is becoming a potential market.

The State Bank of Vietnam also issued Decision 810/QD-NHNN approving the Digital Transformation Plan for the banking sector to 2025, with a vision to 2030, to develop digital banking, comprehensive and sustainable finance.

However, besides positive results, the digital transformation process in the banking industry still faces many challenges such as: perfecting the legal framework, ensuring information security and safety, and developing high-quality human resources; investment costs in technology infrastructure, human resource training; the problem of balancing innovation and risk management (cyber security, data security)...

Digital transformation is a core operational strategy

Eximbank's leadership representative said that digital transformation is identified as the focus of its operational strategy, an opportunity to accelerate and create breakthroughs and affirm its position. The bank is currently entering the digital race with the goal of providing diverse, high-quality financial products. Eximbank's goal is to continuously improve customer experience and develop its customer base.

“We have made preparations for the new phase to expand business opportunities in strategic segments. Eximbank identifies technology as the driving force for innovation and development of the organization in both depth and breadth. We are constantly investing heavily in the technology system with the goal of being modern - green - safe - secure,” an Eximbank representative affirmed.

Facing the wave of strong transformation, Eximbank identifies a proactive mindset, ready to face challenges and take advantage of opportunities from the technological revolution. By investing in technology, focusing on customers and building a flexible management platform, Eximbank not only ensures development but also contributes to the development of the banking industry in general.

Integrating technology into products

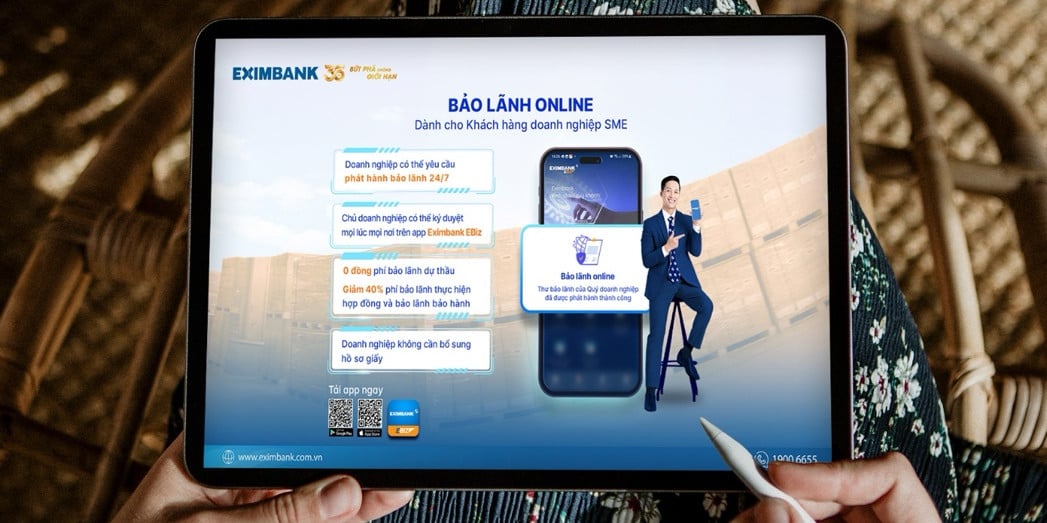

A clear demonstration of Eximbank's transformation journey is its products. Recently, the bank has launched Eximbank EBiz - a digital guarantee platform for businesses in the 4.0 era. This is an online guarantee solution, based on advanced automation technology, optimal security, helping businesses save time, costs, and improve business efficiency.

Previously, the launch of Eximbank EBiz helped Eximbank customers - business operators - easily approve transactions and manage finances anytime, anywhere on mobile phones, tablets, etc. This platform was carefully invested by the bank from interface to features, ensuring safety and security for customers.

Eximbank representative said that Eximbank EBiz is in the Top digital technology applications most trusted by customers and has been honored to receive many prestigious awards.

In addition, this bank has also successfully implemented digitalization projects across the bank, notably the application of Robot technology to automate business processes to help shorten transaction processing time and improve service quality; deploy business support technologies to improve product and service quality for customers...

In addition, Eximbank also focuses resources on implementing key target groups such as: expanding the development of the digital banking ecosystem, replacing the Core card system; deploying new payment services such as Apple Pay, Garmin Pay, Google Pay; open banking system; applying Chat GPT technology in operations management, combined AI technology (Block chain); Big Data in management, data analysis to develop new customer platforms and maintain the engagement of existing customers in many banking activities...

“In the long-term strategy, with the combination of advanced technology and customer service, Eximbank expects to contribute to shaping the digital financial market in Vietnam, thereby supporting Vietnamese businesses to develop and compete in the globalized environment,” an Eximbank representative affirmed.

Le Thanh

Source: https://vietnamnet.vn/eximbank-tang-toc-but-pha-bang-chien-luoc-chuyen-doi-so-2370464.html

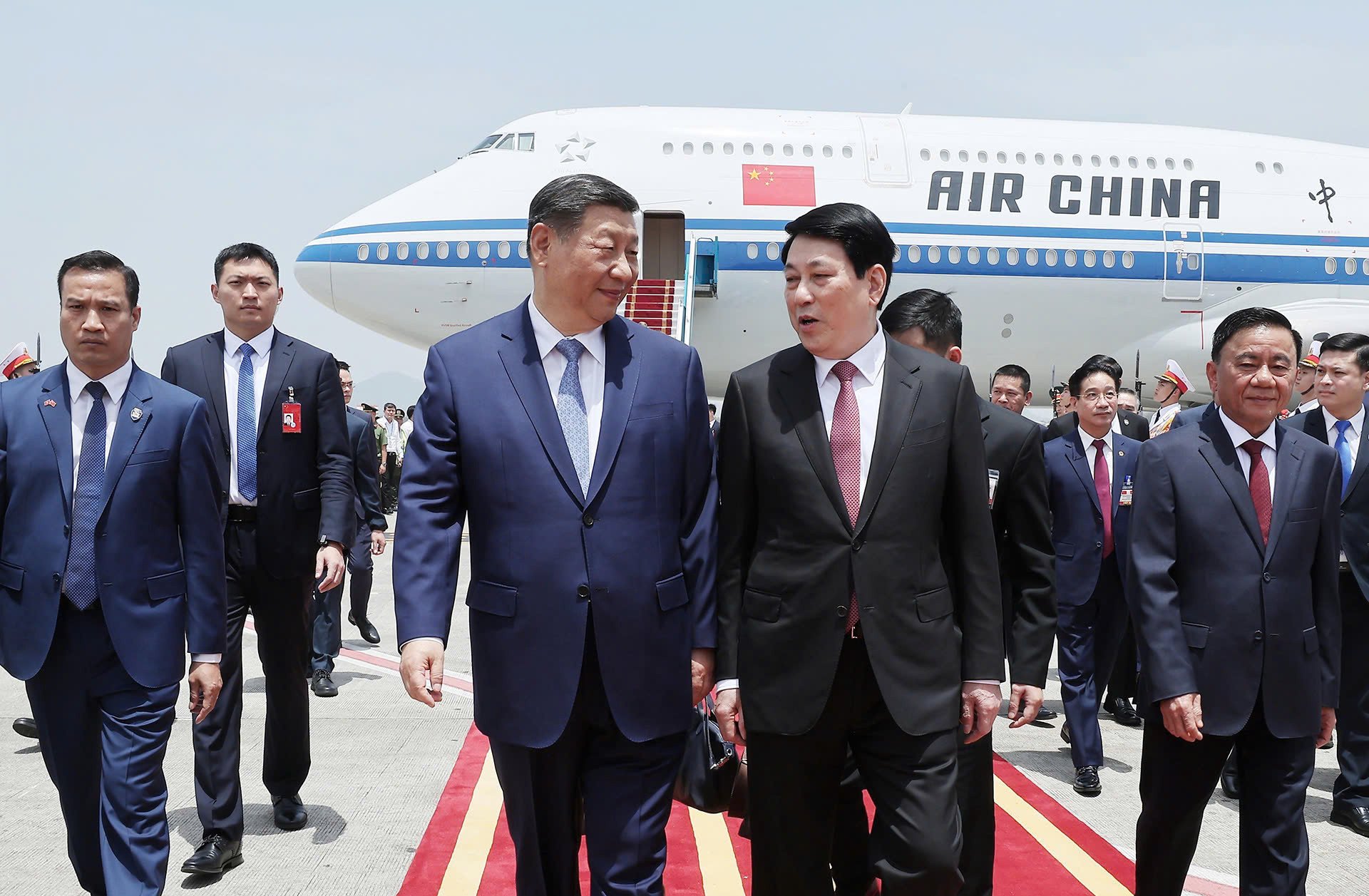

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] Hanoi people warmly welcome Chinese General Secretary and President Xi Jinping on his State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/d6ac6588b9324603b1c48a9df14d620c)

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

Comment (0)