(NLDO) - Agribank is the first state-owned commercial bank to increase interest rates this month.

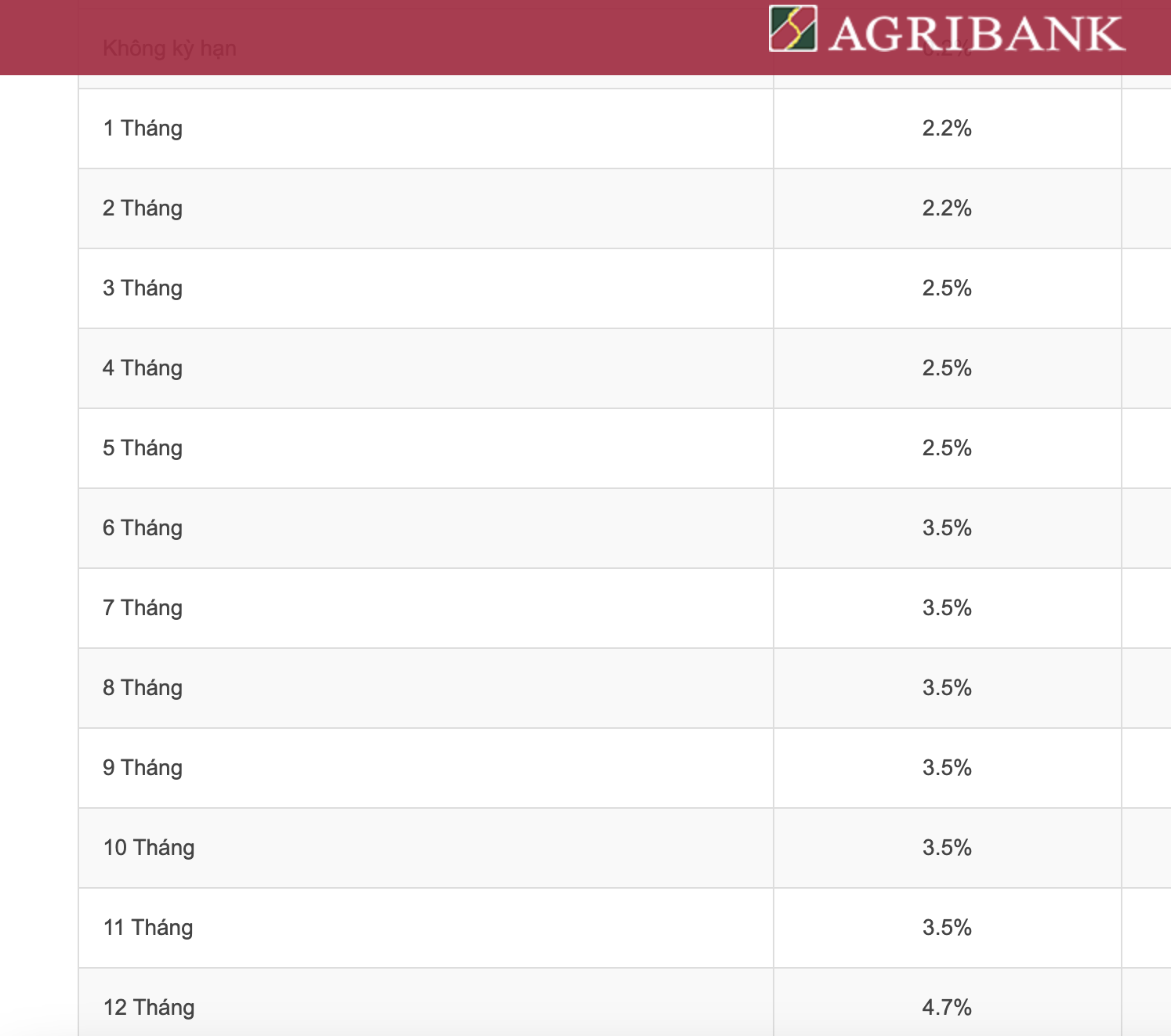

Agribank has just adjusted the interest rate table to increase by 0.5% for many terms. Accordingly, the interest rate for 1-2 month savings deposits increased to 2.2%/year; for 3-5 month deposits increased to 2.5%/year; the interest rate for long-term deposits from 12 months is 4.7%/year...

Agribank is currently mobilizing the highest interest rate of 4.8/year when customers deposit savings for 24 months. Thus, Agribank has adjusted many short-term terms with a strong increase in recent months.

With this interest rate increase, Agribank is also the bank with the highest interest rate for short terms among the "big guys" of state-owned commercial banks.

Interest rates continue to increase

Currently, customers depositing for a short term of less than 6 months at Vietcombank, BIDV and VietinBank, the highest interest rate is 2%/year. With a term of 9 months, VietinBank and BIDV mobilize interest at 3%/year while Vietcombank mobilizes at 2.9%/year.

With a long term of 24 months, VietinBank and Agribank mobilize the highest interest rate of 4.8%/year; Vietcombank and BIDV mobilize at a lower rate of 4.7%/year.

Latest interest rate table at Agribank

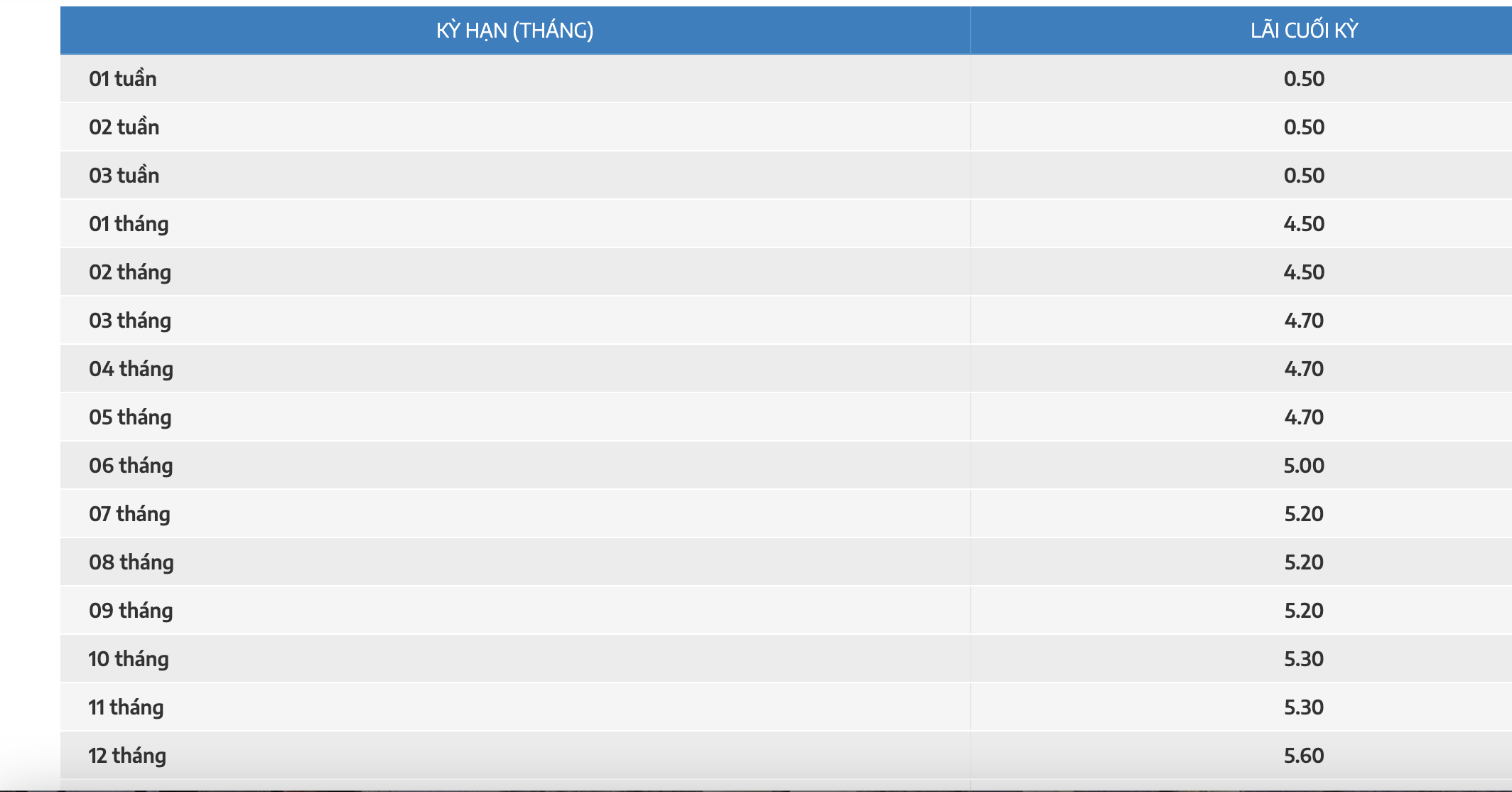

In the joint stock banking sector, Nam A Bank is the next bank to adjust online deposit interest rates for some terms. The highest increase is about 0.7 percentage points when customers deposit for short terms of 1-2 months, up to 4.5%/year.

The highest deposit interest rate at Nam A Bank is 5.9%/year for a term of 18 months or more.

Previously, VietABank also sharply increased savings interest rates, joining the increasing trend since the beginning of November at VIB, MB, Techcombank, VietBank...

Online deposit interest rate table at Nam A Bank

The rising interest rates have boosted the flow of idle money into banks. In Ho Chi Minh City, the State Bank of Vietnam - City Branch said that in recent months, mobilized capital has been on a positive growth trend, with an average growth rate of over 1.5%.

Statistics by the end of October 2024, in Ho Chi Minh City, deposits of economic organizations and individuals increased by 8.3% compared to the end of 2023, of which residential savings deposits reached over 1.4 million billion VND, accounting for about 36.8% - 38% of total deposits.

According to data from the State Bank as of the end of August 2024, the amount of savings deposits of residents flowing into the banking system was approximately 7 million billion VND, an increase of 6% compared to the end of last year.

Source: https://nld.com.vn/lai-suat-hom-nay-16-11-ong-lon-ngan-hang-tang-manh-lai-suat-tien-gui-196241116102719996.htm

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)