(NLDO) - Some banks "go against the flow" to reduce short-term deposit interest rates right after Lunar New Year 2025.

On February 10, the latest interest rate tables of some banks have some noteworthy information. The trend of interest rate reduction is taking place at some banks.

At BacABank, right after Tet, customers who deposit 1-month term savings decreased to 3.6%/year instead of 3.75%/year before. Compared to January 2025, the 1-month term interest rate decreased by 0.4 percentage points.

For the same 1-month deposit term, MSB and Kienlongbank have also just reduced interest rates. Of which, Kienlongbank reduced by 0.7 percentage points to 2.8%/year.

For customers who deposit savings for 3 months, some banks such as Techcombank, TPBank, Kienlongbank, BacABank have just reduced interest rates, applied from February 10.

Like Techcombank, customers depositing for 3 months have their interest rate reduced from 3.75% to 3.5%/year; TPBank has reduced it from 4% to 3.8%/year; a decrease of about 0.2 percentage points compared to the previous interest rate schedule.

For the 6-month term alone, MSB adjusted down quite strongly by 0.4 percentage points to 4.3%/year. Banks mainly adjusted down the short term.

The decrease in interest rates of some banks after Tet is quite surprising, in the trend of increasing input interest rates over the past time.

On the contrary, some other banks maintained stable deposit interest rates compared to before Tet.

For state-owned commercial banks including Vietcombank, Agribank, BIDV and VietinBank, the deposit interest rate level remains unchanged compared to the end of 2024. The short-term savings interest rate of less than 6 months of these banks is the highest from 2.9% - 3.5%/year.

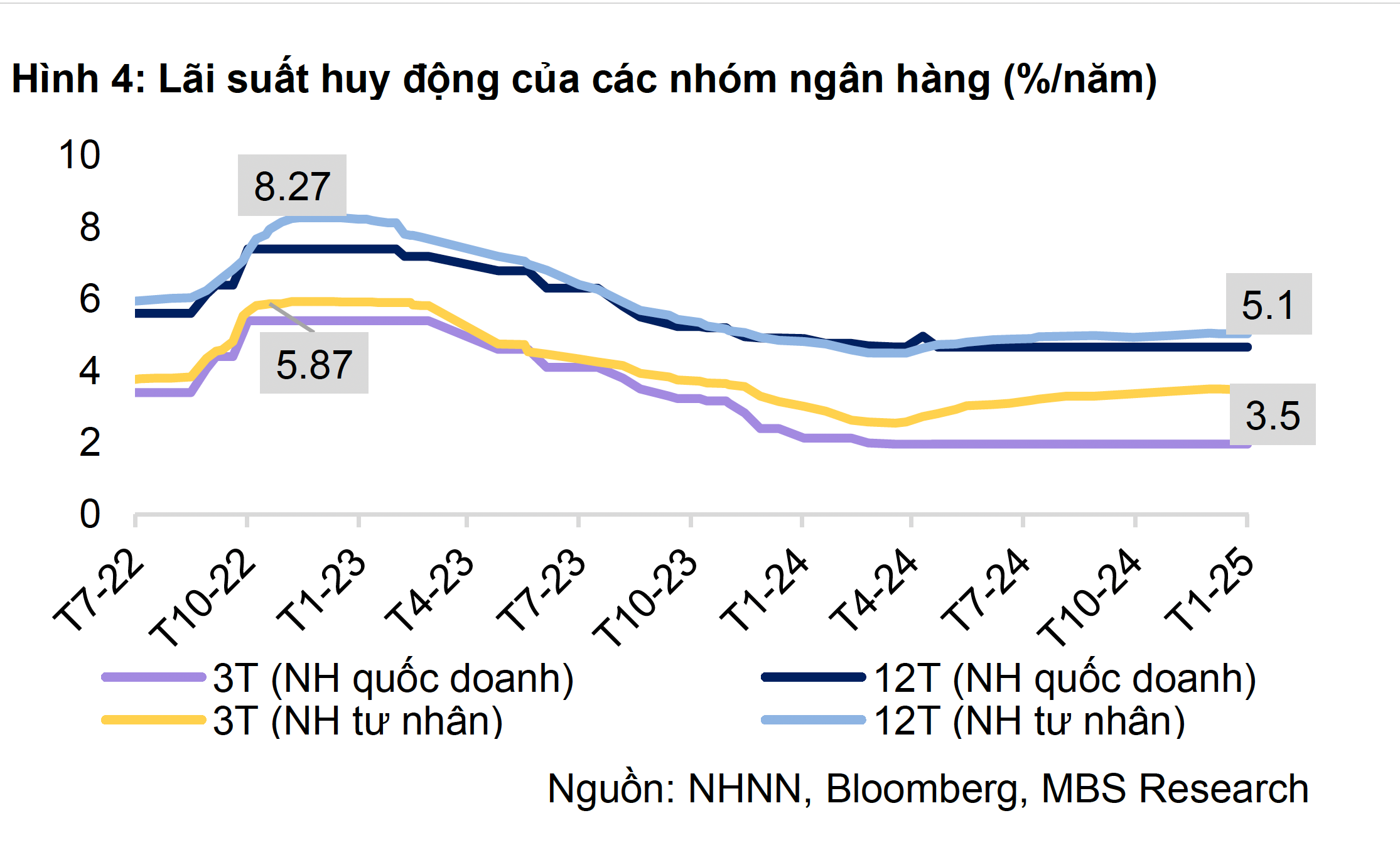

In the latest currency market update report, experts from MBS Securities Company said that in January 2025, the market had 12 banks increasing deposit interest rates with an increase of 0.1 - 0.9 percentage points.

The trend of increasing deposit interest rates is mainly happening at small-scale commercial banks as they prepare large capital sources to serve the credit plan this year when the State Bank sets a credit growth target of about 16% to achieve an economic growth rate of 8%.

"Banks need to focus on promoting credit growth as well as capital mobilization from the beginning of the year to achieve the set targets.

In addition, in January, 7 banks also reduced input interest rates with a significant reduction of 0.1 - 0.75 percentage points.

The State Bank has issued instructions on stabilizing deposit interest rates and continuing to strive to reduce lending interest rates. It is forecasted that 12-month deposit interest rates of major banks will fluctuate around 5% - 5.2% this year," said an expert from MBS.

Source: https://nld.com.vn/sau-tet-xuat-hien-nhieu-ngan-hang-giam-lai-suat-gui-tiet-kiem-196250210133921466.htm

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)