Some banks still periodically charge fees for accounts that have been inactive for many years, causing many people to panic because they suddenly owe millions of dong in fees.

After a customer owed 8.8 billion VND on his credit card, many people proactively called the bank's switchboard to check accounts and bank cards opened many years ago but not used, only to discover that there was a debt of up to millions of VND.

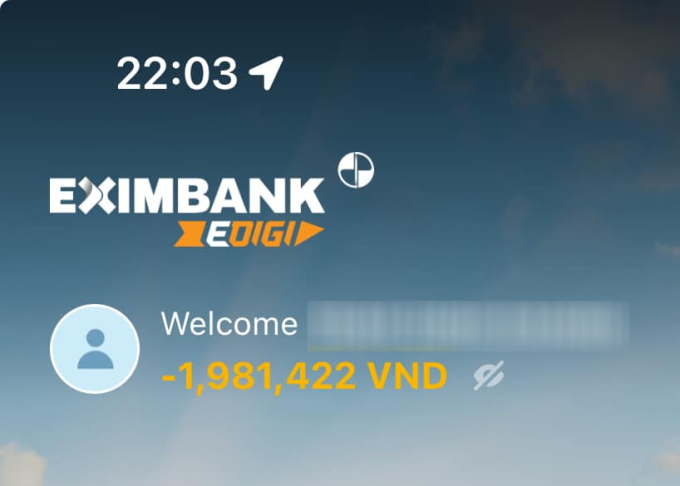

Recently, Ms. Thao (HCMC) called the Export-Import Bank (Eximbank) to check her long-unused payment account, and was surprised to be informed by the staff that she owed more than a million VND in fees.

This fee debt includes a balance change notification fee of VND49,000 per quarter and an account management fee of VND11,000 per month, due to the account not maintaining sufficient balance from 2018 to present.

Ms. Thao said that this was a company account that was required to be opened a decade ago to receive monthly salaries. After that, the company asked her to open another bank account to receive her salary, but did not recommend closing the old bank account to avoid fees.

"Meanwhile, for many years, I have not made any transactions using this account and have not received any messages from the bank informing me of monthly fees," said Ms. Thao.

In a social networking group with thousands of members, many of whom are former employees of Ms. Thao’s workplace, a similar situation was reported. Depending on the account package, service, and number of years of non-use, some people owe fees ranging from several hundred thousand to millions of dong.

A customer's account is nearly 2 million VND negative due to bank fees. Photo: Provided by the character

Another case is Mr. Huong (HCMC), after calling all the banks where he used to have accounts, he discovered that he owed fees at both banks, DongA Bank (DongABank) several hundred thousand VND and Eximbank more than 1 million VND.

"The bank staff said that if I want to close my account, I have to pay this fee. If I don't pay, I'm worried that one day I will owe tens of millions of dong if I keep being charged this annual fee," said Mr. Huong.

In fact, customers who owe service fees are not considered bank loans, so they do not affect their credit history or are classified as bad debt. At the same time, banks usually do not charge interest on these periodic fees.

It is very common for a person to have multiple unused accounts. Bank accounts opened to "support" acquaintances who are running targets, or opened to receive salary at a former agency but not used, are situations that many people who use bank accounts encounter.

Currently, each bank has different policies for accounts that have been inactive for a long time. However, most banks in the market such as Vietcombank, Agribank, MB, MSB, HDBank, Techcombank... have policies to temporarily lock or close accounts if the account holder does not make transactions and maintains a balance from 6 months to 3 years.

When a bank temporarily locks or closes an inactive personal payment account, it not only helps the bank avoid incurring management costs, but also helps the account owner avoid additional fees in case of non-use or neglect.

Quynh Trang

Source link

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)