Ms. Nguyen Thi Nhu Loan, CEO of Quoc Cuong Gia Lai, was accused of violating the law in the transfer of the 39-39B Ben Van Don project.

The consolidated financial report for the first quarter of 2024 of Quoc Cuong Gia Lai Joint Stock Company (QCG) shows that as of the end of March, the payable debt amounted to VND 5,161 billion, mostly short-term debt of more than VND 4,903 billion.

Borrow money from many other individuals and businesses

Unlike many businesses, in QCG's debt structure for many years, money borrowed from related individuals and organizations accounts for a large proportion.

The financial statement notes at the end of March 2024 show that the total amount payable to the parties after borrowing is about 670 billion VND.

Ms. Nguyen Thi Nhu Loan – General Director – lent the company more than 78.1 billion VND. Mr. Lai The Ha – Chairman of the Board of Directors, lent the company more than 18.2 billion VND.

QCG also borrowed money from Ms. Lai Thi Hoang Yen – the chairman’s daughter – for more than 9 billion VND. Ms. Nguyen Ngoc Huyen My – the daughter of Ms. Nhu Loan (major shareholder) also lent the company 700 million VND.

Some businesses are also on the list of businesses lending money to QCG, such as Hiep Phuc Real Estate JSC with 272 billion VND.

Pham Gia Construction and Housing Trading Company Limited and Mat Troi Hydropower Joint Stock Company lent Quoc Cuong Gia Lai 152.8 billion VND and 62 billion VND respectively.

In addition to loans from leaders and related parties, Quoc Cuong Gia Lai's financial statements record loans from banks.

At the end of the first quarter of this year, QCG was borrowing nearly 107 billion VND in short-term loans from the Vietnam-Russia Joint Venture Bank (Da Nang branch) with an interest rate of 8.5%/year, due on January 1, 2025.

The collateral for the above loan is the land use rights and assets attached to the land lots located in Lien Chieu district, Da Nang.

In addition, QCG also has two long-term loans from Gia Lai Foreign Trade Joint Stock Commercial Bank to invest in two hydropower plants.

There is a loan of 101 billion VND to finance the Iagrai 2 hydropower project with an interest rate of 8%/year, due in April 2029. The remaining loan of nearly 198 billion VND with an interest rate of 8.4% was poured by QCG into the Ayun Trung hydropower project, due in June 2029. The collateral for these two debts is the land use rights at these projects.

At the end of May, the board of directors of Quoc Cuong Gia Lai also issued a resolution approving the transfer of both hydropower plant projects mentioned above.

Of which, the Ia Grai 2 Hydropower Plant project has an estimated price of about 235 billion VND, while the Ayun Trung Hydropower Plant has an estimated selling price of 380 billion VND.

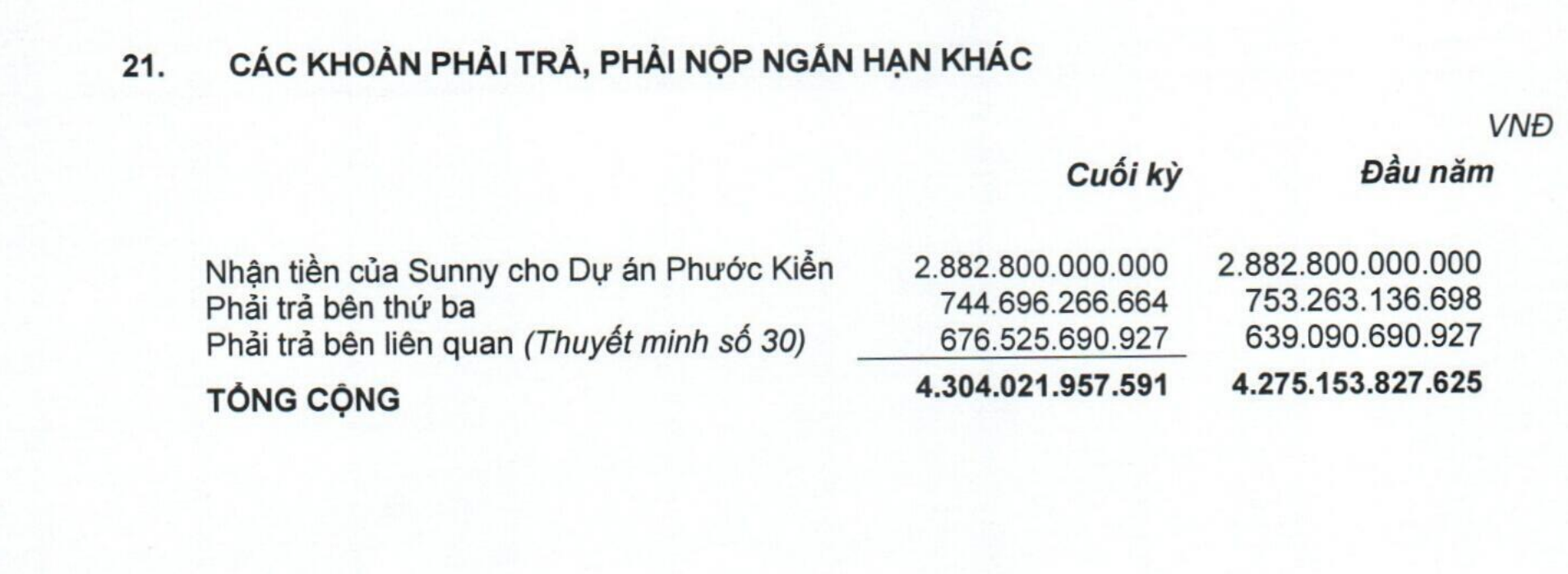

Must pay 2,882 billion VND for Phuoc Kien project

However, the heaviest burden, in the other short-term payables of Quoc Cuong Gia Lai, is the amount of 2,882 billion VND - money received from Sunny for the Phuoc Kien project.

According to the court's verdict in the case of Ms. Truong My Lan, Quoc Cuong Gia Lai will have to pay back this money.

QCG's financial report recorded a payable of VND 2,882 billion for the Phuoc Kien case - Screenshot

QCG then appealed part of the verdict, only agreeing to pay 1,441 billion VND to Ms. Truong My Lan. The company claimed that in this transaction, they were the bona fide party and did not know the origin of the money related to Ms. Lan.

Pressure to pay many short-term debts is large. Meanwhile, total assets are 9,515 billion VND but most of them are in inventory with 7,033 billion VND, cash is 30 billion VND.

According to the 2023 audited report, unfinished real estate inventories are mainly in Phuoc Kien residential area projects, Lavia project, Central Premium project, Marina Da Nang project, etc.

Explaining the decline in business results in the first quarter of 2024, Ms. Nhu Loan said that the procedures for implementing projects were not resolved, so the company's revenue and profit decreased.

In addition to the plan to sell the hydropower plant, at the end of February 2024, the Board of Directors of QCG Company approved the policy of transferring 31.39% of shares at Quoc Cuong Lien A Joint Stock Company for about 150 billion VND.

In the 2023 management report, QCG is a company with a charter capital of VND 2,751 billion.

Ms. Loan owns nearly 102 million QCG shares, equivalent to 37% of capital. Ms. Nguyen Ngoc Huyen My (Ms. Loan’s daughter) – holds more than 39.38 million shares.

Mr. Lau Duc Huy (Ms. Loan’s son-in-law) owns more than 10.53 million shares. Mr. Nguyen Quoc Cuong (Ms. Loan’s son) holds 537,500 shares…

Meanwhile, Mr. Lai The Ha - Chairman of the Board of Directors only holds 597,500 shares. Ms. Lai Thi Hoang Yen - Mr. Ha's daughter - owns 1.5 million shares at QCG.

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)