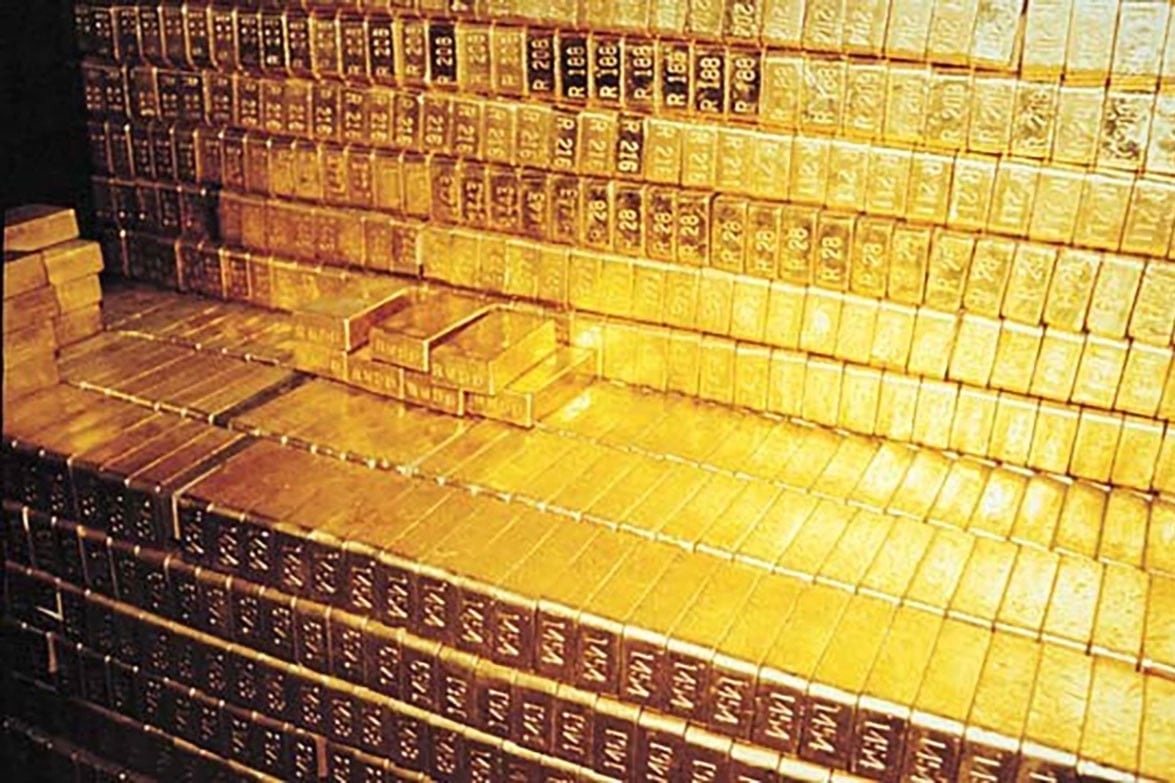

Many mysterious gold vaults around the world have attracted attention after US President Donald Trump questioned the quantity and quality of the largest US gold vault, Fort Knox, while Elon Musk demanded to livestream an inspection.

The world's largest and most mysterious gold reserves

Located in Kentucky, USA, Fort Knox is the world's most famous gold depository with about 4,580 tons of gold reserves, worth about 420 billion USD. This is considered a symbol of America's financial strength, protecting the national treasure under 1.2m thick reinforced concrete walls, 20-ton doors and a strict security system.

However, there are many rumors surrounding this gold deposit. Notably, the hypothesis of fake gold or a shortage of reserves compared to the announced amount. US President Donald Trump and the person considered to be the leader of the US Department of Government Efficiency (DOGE) Elon Musk took this opportunity to ask the question: "Does Fort Knox still have the amount of gold as announced or is it just a cover?"

In contrast to Fort Knox, the gold vault at the New York Federal Reserve (New York Fed) is not entirely the property of the US Government but is mainly gold deposited by governments, central banks and international organizations from more than 60 countries. This gold vault contains about 6,330 tons of gold. This is the largest gold vault in the world.

The vault can withstand the weight because it is located on the bedrock of Manhattan Island, 24m underground, 15m below sea level, protected by thick steel walls and a tight security system. However, there is also much debate about whether the US actually has control over this gold, and whether the countries that deposit the gold can withdraw it if they want?

The Bank of England (BoE) gold vault in London is also one of the most important gold reserves in the world, with about 5,130 tons of gold. It is the largest gold trading center in Europe, where central banks around the world deposit gold to ensure liquidity in the London gold market, allowing them to lend, sell or buy gold. The UK Treasury only holds about 6%.

Unlike Fort Knox, where gold is barely moved, the London vault functions as a true financial center. Audits at the BoE are regular, but there has never been a livestreamed inspection of the vault as Trump and Musk have proposed for Fort Knox. In January, for the first time, there was a significant movement of gold from the BoE to the US, due to the large swings in futures prices.

The Banque de France gold vault, located in Paris, is one of the most important gold vaults in Europe, holding about 2,437 tons of gold, accounting for the majority of France's foreign exchange reserves. Built in the 19th century, the vault is located 27 meters underground, with thick concrete walls and a state-of-the-art security system. It is the main gold storage center in France.

Although not as well-known as Fort Knox or the New York Fed, the Banque de France plays an important role in ensuring the financial stability of France and the Eurozone. In recent years, France has advocated maintaining gold reserves as a “shield” against global economic instability. The existence of this gold vault is a testament to Paris’s financial strength and long-term strategy in the world economy.

In addition to Fort Knox and Banque de France, the world has many other important gold vaults, each with its own unique character. The Swiss National Bank gold vaults are scattered in many secret locations, reflecting the country's policy of neutrality and safekeeping of assets. The total reserves are about more than a thousand tons, ensuring liquidity for the Swiss franc (CHF).

Meanwhile, the Deutsche Bundesbank (Germany) gold vault holds about 3.3 thousand tons of gold, which was dispersed during the Cold War and only recently repatriated from New York and Paris.

Gold race between superpowers, who is the "king"?

The Russian Central Bank's (RCB) gold reserves have recently grown the fastest in the world, following Western sanctions, now standing at nearly 2.3 thousand tonnes, helping Moscow increase its financial independence.

China’s gold vaults are highly secure, reflecting the country’s ambition to diversify its foreign exchange reserves. India’s vaults are concentrated in Mumbai, which is important because of its people’s tradition of hoarding gold. The Dutch Central Bank’s gold vaults were partially relocated, reflecting the country’s flexible approach to asset management.

It can be seen that the world's large gold reserves play an important role in protecting national financial reserves, supporting the economy and ensuring liquidity for the global financial system. These gold reserves are not only symbols of power but also have an influence on global monetary and economic policy.

The United States is still the country with the largest gold reserves with about 8,133 tons, followed by Germany (about 3,350 tons), Italy (2,452 tons) and France (2,437 tons). Russia and China are also increasing their gold accumulation, with Russia owning 2,299 tons and China about 2,273 tons.

Despite having the largest gold reserves, the US rarely buys more gold. Washington mainly uses gold as a basis to ensure the strength of the US dollar.

Meanwhile, European countries still consider gold an important reserve asset, helping to ensure regional financial stability and used in payments in financial centers such as London...

Russia and China have continuously increased their gold reserves in recent years to reduce their dependence on the US dollar and cope with economic sanctions.

It can be seen that gold has existed for thousands of years as a store of value, which is difficult to replace. However, in recent years, the emergence of many new types of assets such as Bitcoin and cryptocurrencies is raising questions about the future of this precious metal. In recent years, Bitcoin has been considered as “digital gold”, attracting the attention of many investors.

However, financial experts still believe that gold has advantages over many other assets, including cryptocurrencies. First of all, it is stability. Gold does not fluctuate as much as cryptocurrencies. Besides, it is widely accepted on a global scale. Gold is recognized and held in reserve by central banks.

Gold is also not dependent on technology because it is a physical, tangible asset. Meanwhile, Bitcoin can be affected by system errors or government regulations.

On the other hand, some billionaires like Elon Musk believe that Bitcoin has the potential to surpass gold if blockchain technology continues to develop. In recent days, Pi Network has shocked the financial market with an impressive debut, reaching a price of up to 3 USD, even though this coin has been mined for free for more than 5 years on mobile phones.

With the recent sharp increase in gold prices, continuously setting new records along with Donald Trump and Elon Musk's announcement to inspect the Fort Knox gold vault, this precious metal continues to attract the attention of international investors.

If Elon Musk livestreams an inspection of the Fort Knox gold vault, it will be the first time in American history that the world's most mysterious gold vault has been made public.

Is Fort Knox really as full of gold as it claims? Does the United States still hold the most gold in the world? And will gold continue to hold its ground against other new assets, including Bitcoin?

These questions remain unanswered, but one thing is certain: gold has been the most sought-after asset throughout thousands of years of history. In the future, the competition for position between gold and other assets, including cryptocurrencies, as well as major asset centers in the world will be fierce.

Source: https://vietnamnet.vn/nhung-kho-vang-bi-an-va-loi-don-ve-vang-gia-khien-ong-trump-musk-lo-lang-2375797.html

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Capital's youth enthusiastically practice firefighting and water rescue skills](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3f8481675271488abc7b9422a9357ada)

![[Photo] Prime Minister Pham Minh Chinh chairs the first meeting of the Steering Committee on Regional and International Financial Centers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/47dc687989d4479d95a1dce4466edd32)

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Ho Chi Minh City speeds up sidewalk repair work before April 30 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/17f78833a36f4ba5a9bae215703da710)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

Comment (0)