Pilot implementation of commercial housing project

On November 30, 2024, the National Assembly issued Resolution No. 171/2024/QH15 on piloting the implementation of commercial housing projects through agreements on receiving land use rights or having land use rights. This Resolution takes effect from April 1, 2025.

Accordingly, Clause 3, Article 3 of Resolution 171/2024/QH15 clearly states that real estate business organizations that are allowed to receive land use rights transfer or change land use purpose for agricultural land to implement pilot projects must be approved by the Provincial People's Council.

Pilot projects must meet conditions such as the scope of the land and land plots implementing the project being consistent with the district-level land use planning or construction planning, urban planning; the scope of the land and land plots implementing the project being consistent with the approved local housing development program and plan.

Real estate business organizations must satisfy the conditions prescribed by law on land, housing, real estate business, investment and other relevant legal provisions.

In particular, in the case of using planned defense land and security land areas removed from defense land and security land to implement pilot projects, the above conditions must be met and there must be written approval from the Ministry of National Defense for defense land and the Ministry of Public Security for security land.

|

| A section of Bien Hoa - Vung Tau expressway through Dong Nai province. Illustrative photo |

Regulations on principles, criteria and norms for allocating public investment capital from the state budget for 2026 - 2030

Resolution No. 70/2025/UBTVQH15 of the National Assembly Standing Committee stipulates principles, criteria and norms for allocating public investment capital from the state budget for the period 2026 - 2030. This Resolution takes effect from April 1, 2025.

According to the Resolution, capital allocation must be focused, effective, not spread out, and meet national socio-economic development goals. Allocation principles include: Complying with the Law on Public Investment and the Law on State Budget; increasing mobilization of non-budgetary capital, reducing administrative procedures; prioritizing important national projects, transport infrastructure works, regional connectivity, digital transformation, energy, water security; ensuring publicity and transparency in allocation.

The order of capital allocation is determined as follows: Urgent public investment projects. National target programs, important national projects. Refund of advanced capital, payment of construction debt. Completed projects but not yet fully allocated capital. Programs using ODA capital, international preferential loans. PPP projects according to regulations on public-private partnership investment.

The Resolution also stipulates criteria and norms for allocating central budget capital, local capital, domestic capital and foreign capital for the period 2026 - 2030. Accordingly, mountainous, border and island localities will be given priority in capital allocation to narrow the development gap.

Regarding the capital allocation norms for the 2026 - 2030 period, a maximum of 30% of the central budget will be allocated for targeted supplement to localities and allocated by sector and field (excluding capital for projects under the National Target Program and ODA capital, preferential loans from foreign donors).

The remaining central budget capital is allocated to ministries and central agencies according to sectors and fields. Ministries and central agencies are responsible for specific allocation to programs and projects in accordance with legal provisions and the principles and order of priority stipulated in this Resolution.

New regulations on fees for maintaining digital signature certificate verification system

The Ministry of Finance has just issued Circular No. 13/2025/TT-BTC regulating the collection rates, collection, payment, management and use of service fees for maintaining the digital signature certificate status checking system. The Circular takes effect from April 10, 2025.

Accordingly, the fee payers are organizations with a license to provide trusted services. For public digital signature certification licenses that are still valid under the Law on Electronic Transactions 51/2005/QH11, licensed organizations must still fulfill their fee payment obligations.

The fee for public digital signature certification service is 3,000 VND/month/digital signature certificate issued to organizations and enterprises; the service for issuing timestamps and certifying data messages is 4,200,000 VND/month/digital signature certificate issued to trusted service providers.

The billing period is from the month the certificate is valid until the month before it expires, is suspended or revoked.

Regarding fee management and usage, the fee-collecting organization retains 85% to cover operating costs and pays 15% to the state budget. If the fee-collecting organization is a state agency that is not allocated, all collected fees will be paid to the budget.

Funding management supports sustainable business operations

Circular No. 09/2025/TT-BTC of the Ministry of Finance on guiding the mechanism for management and use of state budget funds to implement the "Program to support private sector enterprises in sustainable business for the period 2022 - 2025" takes effect from April 20, 2025.

Circular 09/2025/TT-BTC stipulates the expenditure contents to develop an ecosystem to support sustainable business, including: Developing documents on sustainable business; connecting businesses with credit institutions and investors; sharing practical experiences on sustainable business; raising awareness; building a network of consultants to support small and medium-sized enterprises in sustainable development.

The state budget will support small and medium-sized enterprises to conduct sustainable business under Program 167 and regulations in Decree No. 80/2021/ND-CP detailing and guiding the implementation of a number of articles of the Law on Support for Small and Medium Enterprises. Relevant agencies and organizations are responsible for determining the content and objects of support in accordance with regulations. The determination of costs, support funds and support mechanisms shall be implemented in accordance with Circular No. 52/2023/TT-BTC. The level of budget support for each content shall be applied according to the highest level prescribed in Decree No. 80/2021/ND-CP.

(According to VNA)

Source: https://baolamdong.vn/kinh-te/202503/nhung-chinh-sach-noi-bat-ve-kinh-te-co-hieu-luc-tu-thang-42025-1b6229f/

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

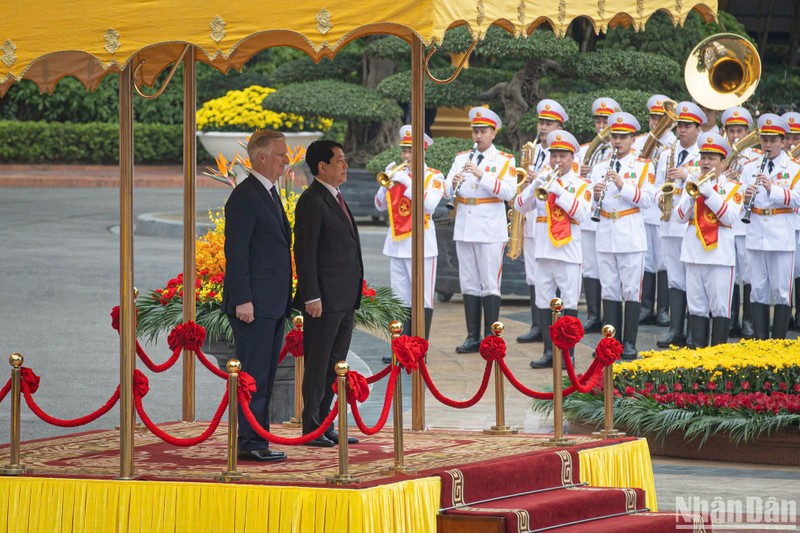

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

Comment (0)