Bitcoin has increased by more than 60% since the beginning of the year, but its price rarely fluctuates strongly in double digits, making many investors "less interested" in this currency.

In the summer of 2021, when the world's largest cryptocurrency dropped to 31,500 USD, Dang Khoa (HCMC) poured more than 20 million VND to "try it out". After a week, Bitcoin increased by nearly 13%, Khoa sold it for a profit of more than 2 million VND and from then on became interested in this new asset. He decided to spend time learning, gradually learning trading techniques and carefully studying RSI indicators to detect overbought or oversold conditions, SMA indicators to determine price trends or Bollinger Bands indicators to measure market fluctuations...

By the end of July 2021, this currency fell below 30,000 USD. This was also the time when Khoa re-joined with a more proactive mindset with a capital of over 100 million VND. At that time, in one day, Bitcoin could go up and down by more than 10%. Although not every trade was favorable, he still had many sessions of profiting tens of millions of VND in just one day.

“I called it the ‘get rich overnight’ phase and was captivated by Bitcoin’s volatility,” Khoa recalled.

The young investor then withdrew all his cryptocurrency to limit debt when buying an apartment in early September 2021. Staying out of the market throughout the crypto "winter", Khoa returned in 2023 but gradually became discouraged because, according to him, the "charm" of Bitcoin (i.e. high volatility) was no longer there.

He realized that this currency is "more mature". Although it tends to increase in price, "getting rich overnight" is almost rare. Even the consecutive "waves" that have lasted since the beginning of the year, helping Bitcoin increase by more than 60%, have not excited Khoa and the investors he knows.

They are saving capital to access other cryptocurrencies. Khoa, in particular, has mainly traded Cosmos and Optimism since the beginning of the year. This investor gave a recent example with Optimism, after just one night, he made a profit of more than 4-5 million VND when he invested 40 million on the evening of March 2, then quickly sold it the next morning when the price increased to nearly 4.3 USD per unit. In addition, expecting similar ETFs for Ether to be approved, Khoa also invested about 30% of his capital to hold the world's second largest cryptocurrency for a longer term.

Not only Dang Khoa, many other investors are tending to shift cash flow from Bitcoin to other asset channels . The FxEmpire data platform analyzed capital flows in the derivatives market in the last 10 trading days of February, showing that cash flows are tending to flow out of the world's largest cryptocurrency and move to alternative coins (altcoins), notably Ether.

“Investors are exiting the Bitcoin market to reinvest their profits into Ether,” the platform noted.

A recent report by market analysis firm Glassnode, which looked at a variety of liquidity, flow, and metrics data, found that the recent uptrend has created a shift in capital flows towards altcoins. The firm’s altcoin indicator shows better growth and more signs of sustainability than before, with a focus on high-cap assets.

Bitcoin is famous for its high volatility and frequent swings. For years, investors viewed this as a feature rather than a bug, as it could yield significant and immediate returns. But recently, according to Business Insider , the cryptocurrency's volatility has become more like that of a regular, "boring" asset.

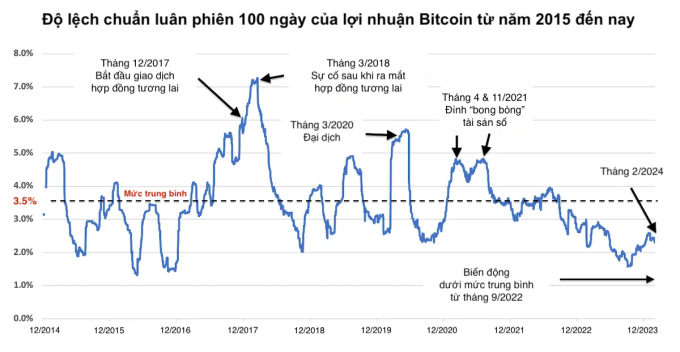

Bitcoin's long-term volatility was three times higher than that of the S&P 500, which typically swings about 1% daily in either direction, according to data from market analytics platform DataTrek Research. Bitcoin's volatility has been below average since September 2022. Even the recent launch of spot ETFs has failed to lead to a significant spike in its price.

The chart below shows the 100-day rolling standard deviation of Bitcoin returns from 2015 to present. The rolling standard deviation shows how dispersed the market price is from the average. A higher standard deviation indicates a more volatile Bitcoin price and vice versa.

Bitcoin is moving at a lower amplitude than its average since late 2022. Source: DataTrek Research

It’s worth noting that Bitcoin has historically peaked and bottomed during periods of above-average volatility. For example, from December 2017 to March 2019, the asset hit a record high of $19,000 and then fell to $8,000. Several other events over the past few years have produced similar patterns. Meanwhile, stocks tend to bottom during periods of above-average volatility, but make new highs during periods of low volatility.

DataTrek Research data shows that Bitcoin has been more stable than usual over the past 18 months, although it is still more than twice as volatile as large-cap US stocks. "Greater institutional interest could reduce Bitcoin's daily price volatility. Simply put, the cryptocurrency may finally be coming of age," the DataTrek Research team said.

Bitcoin's stability is also reflected in the recent uptrend that reached a record of 69,200 USD. The market price has been considered "hot" since the beginning of February, but the fluctuation range per session is only around 1,000-2,000 USD. In many sessions, the price chart is almost flat, the difference between the highest and lowest prices of the day is only a few hundred USD.

The market experienced the most volatility from the evening of March 5 to the early morning of March 6, when Bitcoin’s price dropped more than 14% in just a few hours. On social media sites discussing cryptocurrencies, many investors complained that the currency increased slowly but decreased too quickly.

Meanwhile, during the uptrend at the end of 2021, Bitcoin often fluctuated between $3,000 and $4,000 a day throughout October and November 2021. There was a session where the difference between the highest and lowest prices of the day reached nearly $6,000. After peaking at nearly $68,800, Bitcoin also slipped shortly after, but only lost 5.5%.

Mr. Ho Quoc Tuan - Senior Lecturer at Bristol University (UK), said that Bitcoin's fluctuations in the past two weeks have made many people think that this digital currency is increasing rapidly. But according to him, Bitcoin has actually become much more stable.

"It is increasingly difficult for investors to get rich and expect the price to increase from $3,000 - the time when some Bitcoin funds such as Grayscale were opened - to $60,000 as before," said Mr. Tuan.

On the other hand, the new characteristics of Bitcoin attract capital flows from investors who prefer stability. As a result, this asset becomes even less volatile, the price movement will be sequential.

"Sooner or later, hot money will move to another channel, but no one knows for sure what it is," said this expert.

Little Gu

Source link

![[Photo] Vietnamese rescue team shares the loss with people in Myanmar earthquake area](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/ae4b9ffa12e14861b77db38293ba1c1d)

![[Photo] Solemn Hung King's Death Anniversary in France](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/786a6458bc274de5abe24c2ea3587979)

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in March](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/8393ea0517b54f6791237802fe46343b)

Comment (0)