SMC staff want to withdraw from Nam Kim Steel after selling all shares

Having just divested all 13.1 million shares, people of SMC Investment and Trading Joint Stock Company (code SMC - HoSE floor) want to withdraw from Nam Kim Steel Joint Stock Company (code NKG - HoSE floor).

On April 2, Ms. Nguyen Ngoc Y Nhi submitted her resignation from the position of member of the Board of Directors for the 2020-2025 term at Nam Kim Steel according to her personal wishes.

Ms. Nguyen Ngoc Y Nhi was elected to the Board of Directors of Nam Kim Steel from June 18, 2020 to present.

According to research, Ms. Nguyen Ngoc Y Nhi is introduced to have more than 17 years of experience in the field of consulting, investing and financial management for investment funds and steel companies. Notably, Ms. Nhi is currently Vice Chairwoman of the Board of Directors and Deputy General Director of Finance and Accounting at SMC Investment and Trade.

Before Ms. Nhi withdrew from the Board of Directors at Nam Kim Steel, from February 5 to March 4, SMC Investment and Trade sold all 13.1 million NKG shares, reducing ownership from 4.98% to 0% of charter capital and officially no longer owning NKG shares.

It is known that from February 5 to March 4, NKG shares traded on the market from 23,500 to 24,500 VND/share.

Thus, it is estimated that SMC Investment and Trade has sold all 13.1 million NKG shares, earning about VND 307.85 billion to VND 320.95 billion.

Thus, Ms. Nhi's withdrawal from the Board of Directors at Nam Kim Steel follows the divestment of all capital from SMC Investment and Trade.

SMC is restructuring due to business difficulties.

Also related to asset sales, at the end of 2023, SMC Commercial Investment approved the transfer of land use rights, equipment, and architecture on land at SMC Binh Duong - Dong An Industrial Park, Thuan An District, Binh Duong Province with an area of 6,197 m2, with an expected sale value of 49 billion VND.

Previously, SMC Investment and Trade has just passed a Resolution to maintain the Company's operations. Accordingly, the Company's Board of Directors unanimously approved the policy of reducing production and business activities, personnel in the entire system, and reducing all arising costs.

In which, the General Director is assigned the responsibility to direct relevant departments and member companies to implement the plan to reduce production and business activities and cut personnel.

It can be seen that selling assets can be considered a specific action after the policy of narrowing down production and business activities and reducing costs.

SMC Trade Investment records additional loss of VND 879.3 billion in 2023

In terms of business activities, in the fourth quarter of 2023, SMC Investment and Trade recorded revenue of VND 3,212.26 billion, down 23.6% over the same period, and profit after tax of parent company shareholders recorded a loss of VND 329.87 billion (same period, loss of VND 514.99 billion).

During the period, the Company no longer operated below cost price when gross profit was recorded at positive VND 48.8 billion compared to negative VND 367.9 billion in the same period, an increase of VND 416.7 billion. In addition, financial revenue increased by 26.1%, equivalent to an increase of VND 6.23 billion, to VND 30.1 billion; financial expenses decreased by 22.8%, equivalent to a decrease of VND 23.17 billion, to VND 78.6 billion; sales and business management expenses increased by 290.8%, equivalent to an increase of VND 264.83 billion, to VND 355.9 billion; other profits increased by 11.03 times, equivalent to an increase of VND 27.13 billion, to VND 29.59 billion; and other activities fluctuated insignificantly.

In terms of core business activities (gross profit - financial expenses - sales & administrative expenses), in the fourth quarter of 2023, the Company continued to record a loss of VND 385.7 billion compared to the same period last year with a loss of VND 560.7 billion.

Thus, in the last quarter of 2023, although gross profit returned to positive, because the gross profit generated was not enough to cover financial costs, sales and business management costs, SMC Trade Investment continued to record a loss during the period.

Explaining the business losses, SMC Investment and Trade said that the freezing of the real estate market caused real estate businesses in general and construction and installation businesses to face prolonged difficulties, a sharp decline in revenue and cash flow, thereby leading to the Company's slow-moving debt to large customers. By the end of 2023, the Company had to increase provisions for receivables, making profits ineffective.

Accumulated in 2023, SMC Investment and Trade recorded revenue of VND 13,786.3 billion, down 40.5% over the same period, the parent company's after-tax profit recorded a loss of VND 879.3 billion compared to the same period of VND 578.99 billion, an increase of more than VND 300 billion in loss.

It is known that in 2023, SMC Investment and Trade plans to do business with revenue of VND 20,350 billion, down 12.2% over the same period and expected after-tax profit of VND 150 billion compared to the same period of loss of VND 651.8 billion. Thus, at the end of 2023, SMC Investment and Trade recorded a much larger loss than the plan to make a profit in the fiscal year.

Source

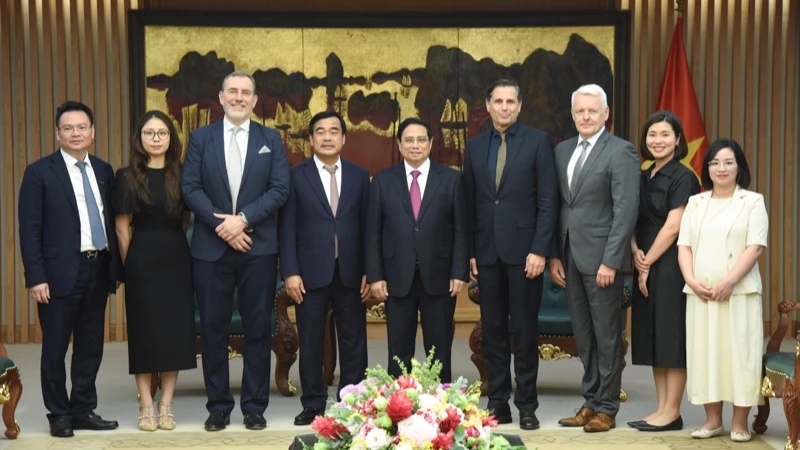

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

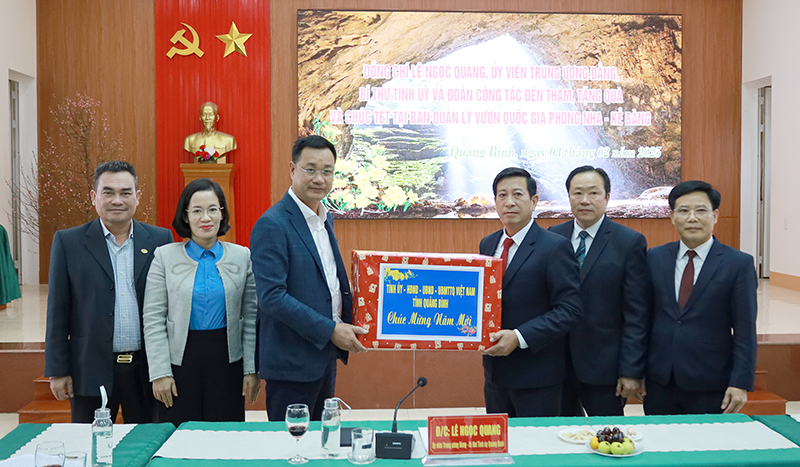

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

Comment (0)