Deploy multiple tasks

Electronic invoices (E-invoices) help buyers easily look up and compare; help businesses reduce costs compared to using paper invoices; help tax authorities build a database of invoices...

According to Mr. Nguyen Van Tiep - Director of Quang Nam Tax Department, recently the tax sector has organized propaganda and dissemination of legal policies on the use of electronic invoices to help people and businesses understand the benefits, responsibilities and effectiveness of using electronic invoices, raising taxpayers' awareness of compliance with tax laws.

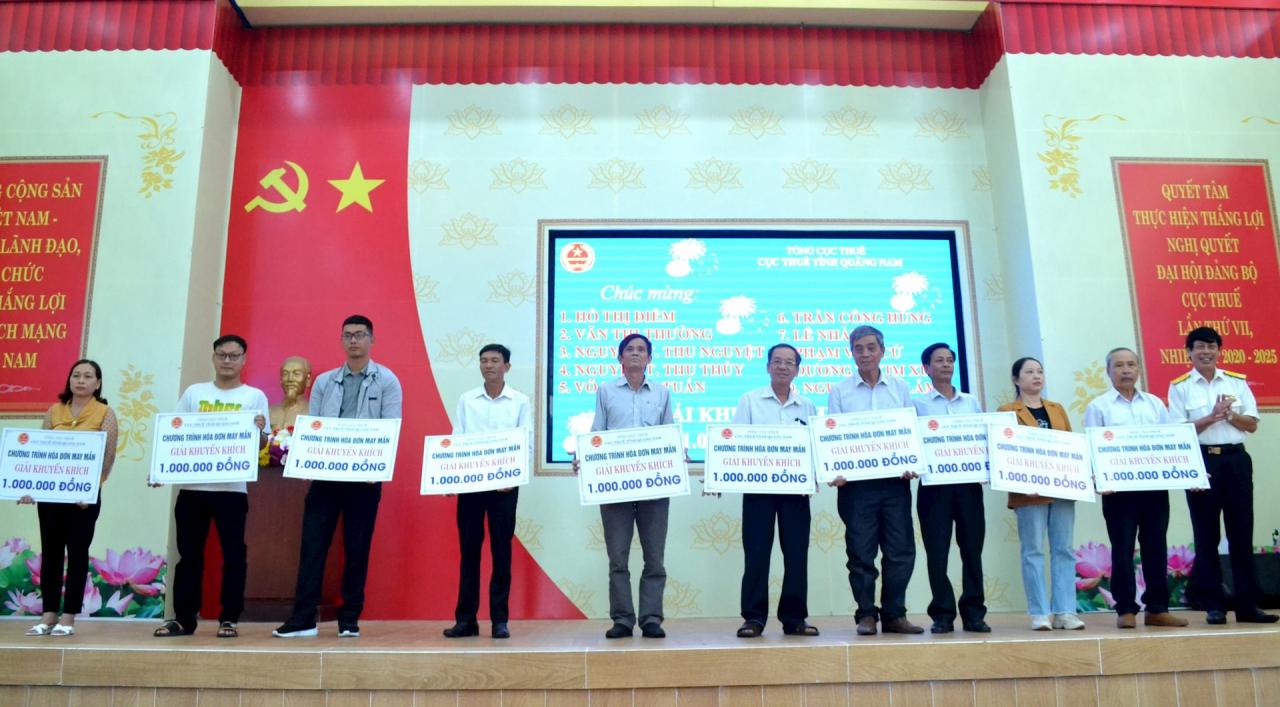

In the coming time, the tax sector will continue to coordinate with departments and branches in implementing electronic invoices. Accordingly, electronic invoices generated from cash registers are linked to the lucky invoice program to control the revenue of business organizations and individuals.

The tax sector, in coordination with relevant agencies, continues to focus resources on inspecting and supervising retail gasoline stores, especially those that still use POS machines with software installed to create electronic invoices for each sale and connect data with tax authorities.

Vice Chairman of the Provincial People's Committee Tran Nam Hung assigned the Department of Industry and Trade to deploy synchronous and effective solutions to support businesses and retail stores of petroleum to carry out digital transformation, applying automatic connection solutions when issuing electronic invoices for each sale. By March 2025 at the latest, the number of retail stores of petroleum applying automatic connection solutions will reach 100% of the total number of retail stores in the province.

The Provincial Police, the Provincial Market Management Department, and the State Bank of Vietnam, Quang Nam Branch regularly coordinate to provide information and data related to the use of electronic invoices and e-commerce business of organizations and individuals for the Quang Nam Tax Department to manage taxes according to regulations.

District People's Committees direct their affiliated departments to coordinate with Tax Departments to strengthen the management of the use of electronic invoices to improve the effectiveness of tax management for e-commerce business activities in the area.

Identify and overcome risks

According to the General Department of Taxation, the use of electronic invoices in recent times has shown many signs of fraud by organizations and individuals. The General Department of Taxation requires local Tax Departments to disseminate to all officials and civil servants the exploitation and full and effective use of the functions of the electronic invoice system, invoice risk management, combined with actual tax management work to build a list of high-risk taxpayers. From there, inspections are conducted to improve tax management efficiency, prevent and promptly handle violations in the use of electronic invoices.

Local tax authorities need to promptly notify and publicize the list of enterprises not operating at their registered business addresses, enterprises trading in illegal invoices that have been discovered by the investigation agency, and enterprises with high risks regarding invoices so that enterprises can review, promptly declare, adjust, and supplement, ensuring that they are consistent with the actual goods traded.

According to Mr. Luong Dinh Duong - Deputy Director of Quang Nam Tax Department, the implementation of electronic invoices from 2022 to present has created a profound reform in tax management, creating a healthy and equal business environment among tax-paying organizations and individuals.

However, the alarming reality is that a large number of taxpayers deliberately take advantage of the flexibility of the mechanism and policies, establishing enterprises not for the purpose of production and business but to carry out illegal acts of buying, selling and using electronic invoices.

Many enterprises have production and business activities but their awareness of tax law compliance is not high, they have participated in illegal electronic invoice trading activities to declare tax deductions, value added tax refunds, and falsely declare expenses to evade taxes, causing losses to the budget.

That reality poses the task of the Quang Nam tax sector to quickly and accurately detect the path of enterprises' electronic invoices, identify output and input invoices and shortcomings of enterprises to handle them in accordance with regulations.

Mr. Luong Dinh Duong said that Quang Nam Tax Department will maximize the application of electronic invoice management integrating data to strictly manage taxes. The tax sector will accelerate inspection and examination of electronic invoices, nurture revenue sources, and ensure budget revenue.

Quang Nam Tax Department said it is focusing on implementing the project "Preventing budget loss in Quang Nam"; strengthening revenue management, exploiting revenue sources and effectively preventing revenue loss in a number of fields and business activities in the province, contributing to increasing revenue for the state budget. The tax sector is implementing revenue loss prevention with a focus and key points, focusing on fields and business activities with high tax risks.

Source: https://baoquangnam.vn/nganh-thue-quang-nam-quan-ly-chat-hoa-don-dien-tu-3146866.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)