Exchange rate still faces upward pressure

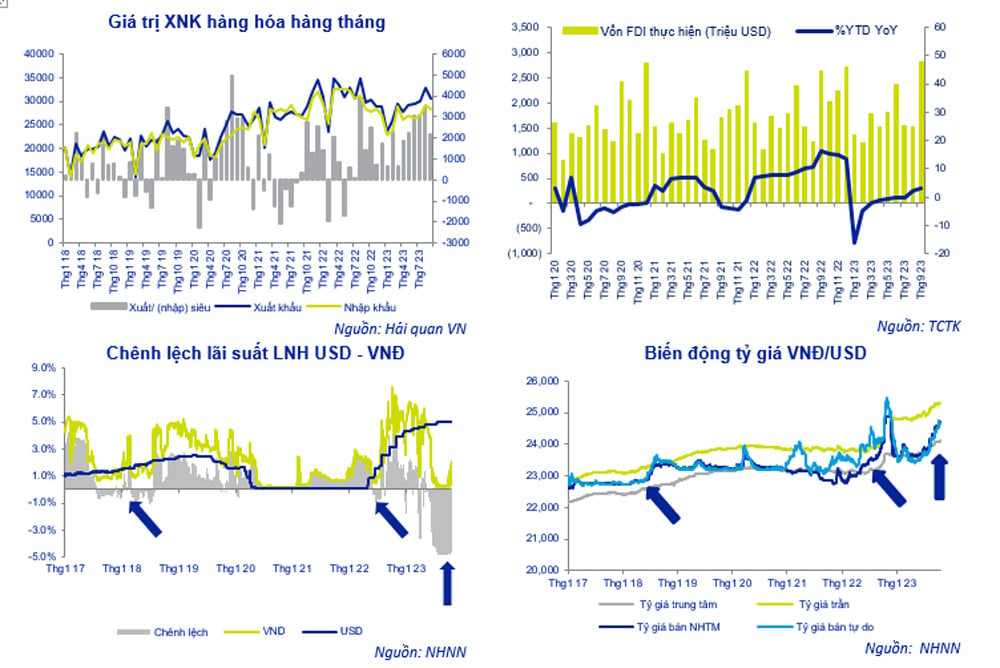

In recent trading sessions, the USD/VND exchange rate is still under increasing pressure even though fluctuations are no longer much.

After reaching a historic peak of VND24,110/USD on October 20, the central exchange rate was adjusted down by the State Bank of Vietnam (SBV) to VND24,087/USD in the trading session on October 25. With a +/- 5% margin currently applied, the ceiling exchange rate that banks are allowed to trade at is VND25,291/USD.

Most banks are selling USD at 24,730-24,760 VND/USD, lower than the ceiling and lower than the historical peak of 24,888 VND/USD recorded on October 25, 2022. However, this is still the highest level since the beginning of the year. VND is still under pressure to decrease due to the strong USD in the international market when the world is unstable.

On October 25, Vietcombank listed the rate at 24,300 - 24,730 VND/USD (buy - sell). Last week, the USD price at the bank increased by 85 VND in both buying and selling.

Compared to the end of September, the USD/VND exchange rate at Vietcombank has increased by 1.1%, thereby putting pressure on monetary policy as well as the State Bank's efforts to fight inflation and the Government's solutions to stimulate rapid economic growth again.

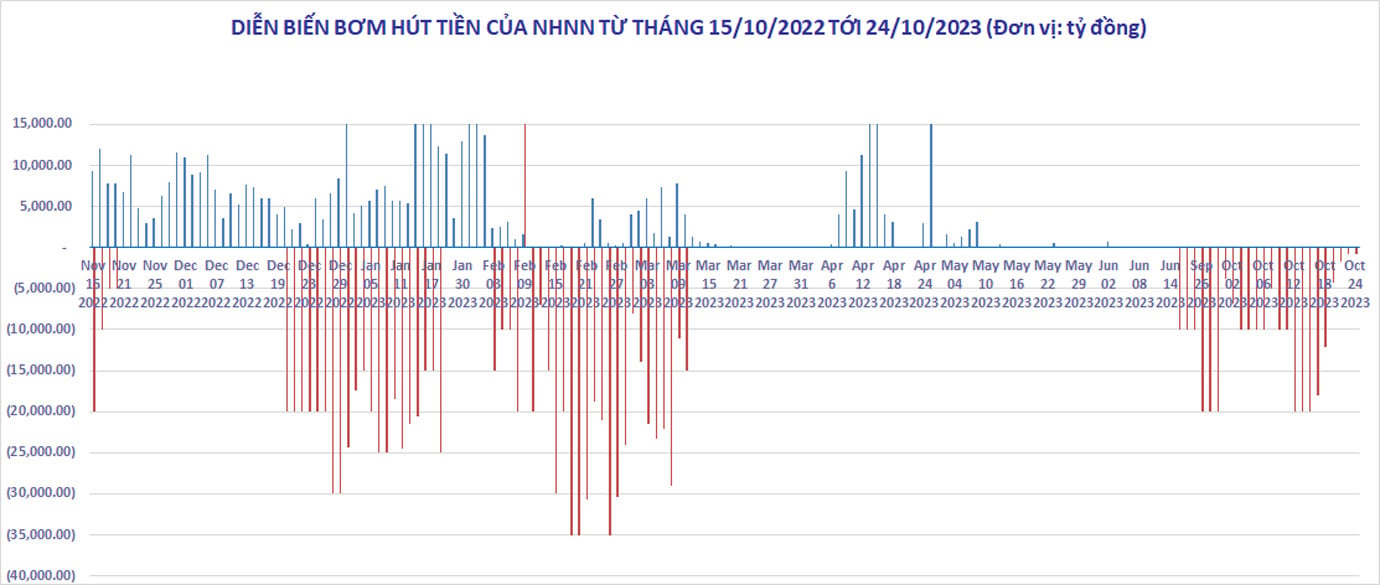

The USD/VND exchange rate continues to increase even though over the past month, the State Bank of Vietnam has intervened in the liquidity of the interbank market through the issuance of 28-day treasury bills.

In total, from September 21 to October 24, the State Bank of Vietnam has withdrawn more than VND263,000 billion, while nearly VND30,000 billion of treasury bills have matured. The total net withdrawal amount is VND233,000 billion.

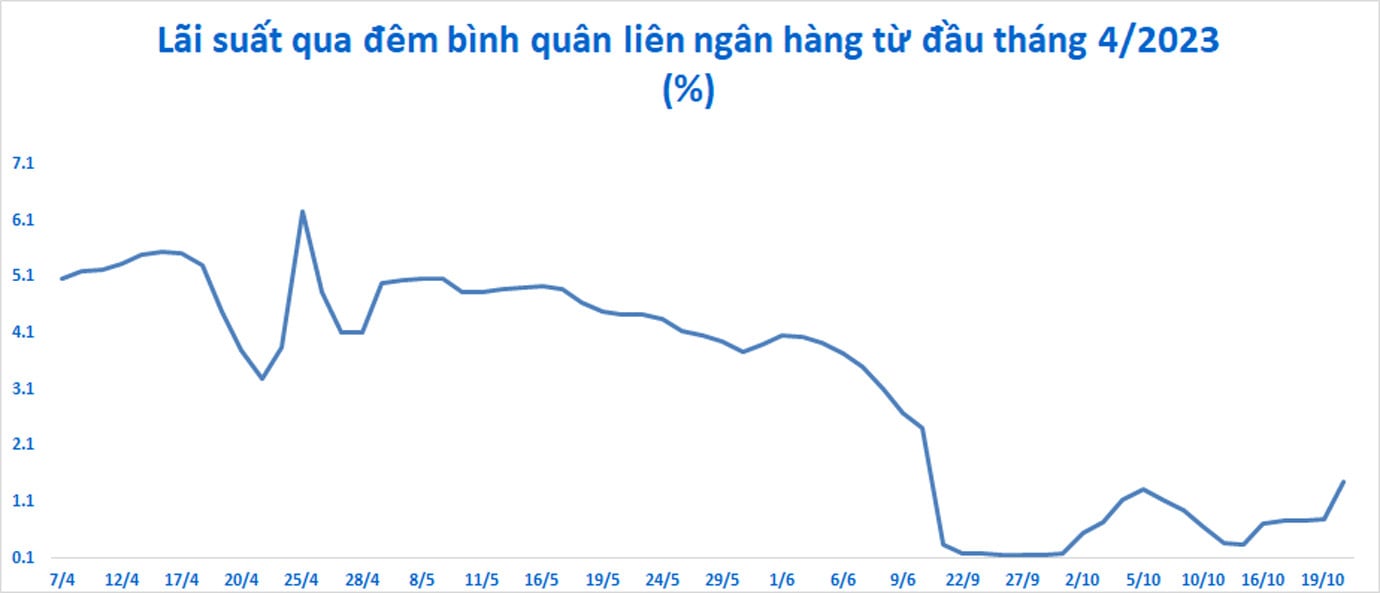

Although the USD/VND exchange rate in the banking system is still on an upward trend, the pressure on the VND has eased. Interest rates in the interbank market have increased again, from a record low of 0.35%/year on October 13 to 1.47%/year in the session on October 20.

The 3-month interest rate also increased to 3.5%/year, gradually approaching the market mobilization interest rate 1. Since then, the difference in VND and USD deposit interest rates has narrowed significantly.

According to ACB Securities, in recent times, the increase in USD exchange rate has mainly come from the difference in USD and VND interest rates that has lasted since May 2023 and the increase in the price of the DXY index - measuring the fluctuations of the USD compared to a basket of 6 major currencies in the world.

In the context of slow credit growth, abundant liquidity in the interbank market, the interest rates of VND terms in this market are at a record low. The interest rate gap between USD deposits and VND deposits in the interbank market has been maintained at 3.0-3.5% for a long time, in a direction favorable to USD. As a result, the entire banking system has the motivation to maintain a net buying position for USD. This contributes to the increase in the USD/VND exchange rate.

Meanwhile, the DXY index has also increased sharply, from 99 points in mid-July to the current level of 106.35 points.

The yield on the 10-year US Treasury note surged to a 16-year high of over 5% on October 23, reflecting market expectations that the Federal Reserve will maintain high interest rates and the government will continue to sell bonds to finance its growing deficit.

Establish a new equilibrium

It can be seen that after the State Bank's proactive move to withdraw money, the foreign exchange market has become relatively stable again. Although the USD/VND exchange rate continues to increase, the pressure on the domestic currency is no longer great.

After more than 1 month of issuing 28-day bills to absorb excess VND in the interbank market, VND interest rates have begun to approach 1-3 month savings interest rates in the market 1.

But if this interest rate increases further and remains for a while, it may prompt banks to increase their savings interest rates again, thereby creating a domino effect on the system. Meanwhile, the exchange rate has increased sharply in recent times (+1.12%) and is only a short distance from the peak of 24,888 in 2022.

According to ACB Securities (ACBS), any increase in interest rates or exchange rates in the coming days could lead to the SBV applying new policies to achieve the goal of stability and balance.

However, this securities company believes that the State Bank still has enough tools to maintain the stability of exchange rates and interest rates. That is the relatively abundant supply of foreign currency from import-export activities, foreign direct investment (FDI), foreign indirect investment (FII) and remittances. Meanwhile, the pressure to repay foreign debt has not increased dramatically.

Specifically, according to the report of the General Statistics Office, in the first 9 months of 2023, import and export activities of goods had a surplus of 21.6 billion USD; services had a deficit of 6.7 billion USD; FDI disbursement was 15.9 billion USD; remittances were 9-10 billion USD.

According to ACBS, the market is at a new equilibrium, although it is still quite fragile.

Agriseco Securities believes that the exchange rate will face increasing pressure in the coming time when the Fed forecasts to raise interest rates in November while Vietnam maintains low interest rates.

VCBS Securities predicts that the strength of the USD will remain high until at least November and pressure on the exchange rate will remain constant.

According to Agriseco, the State Bank may have to use additional measures to regulate exchange rates.

In the short term, ACBS believes that the State Bank may propose two solutions. That is to let the balance of maturing bills and cash flow return to the interbank market. From there, liquidity and interest rates in the interbank market cool down. But the ultimate goal is to keep interbank interest rates high, close to the interest rates of the 1-3 month market, and not create a race to increase interest rates in the 1 market.

In case the liquidity regulation tool through treasury bills is not effective, the exchange rate continues to increase rapidly, and interest rates remain high, the State Bank of Vietnam may consider using the option of selling USD for a term of 3-6 months and allowing banks to cancel it.

The above solutions can be flexibly coordinated and will depend largely on the credit growth rate of the system as well as the supply and demand of USD in the fourth quarter. In case credit growth can break out in the last quarter of the year, ACBS believes that the SBV can even consider adding liquidity through the open market channel.

Source

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)