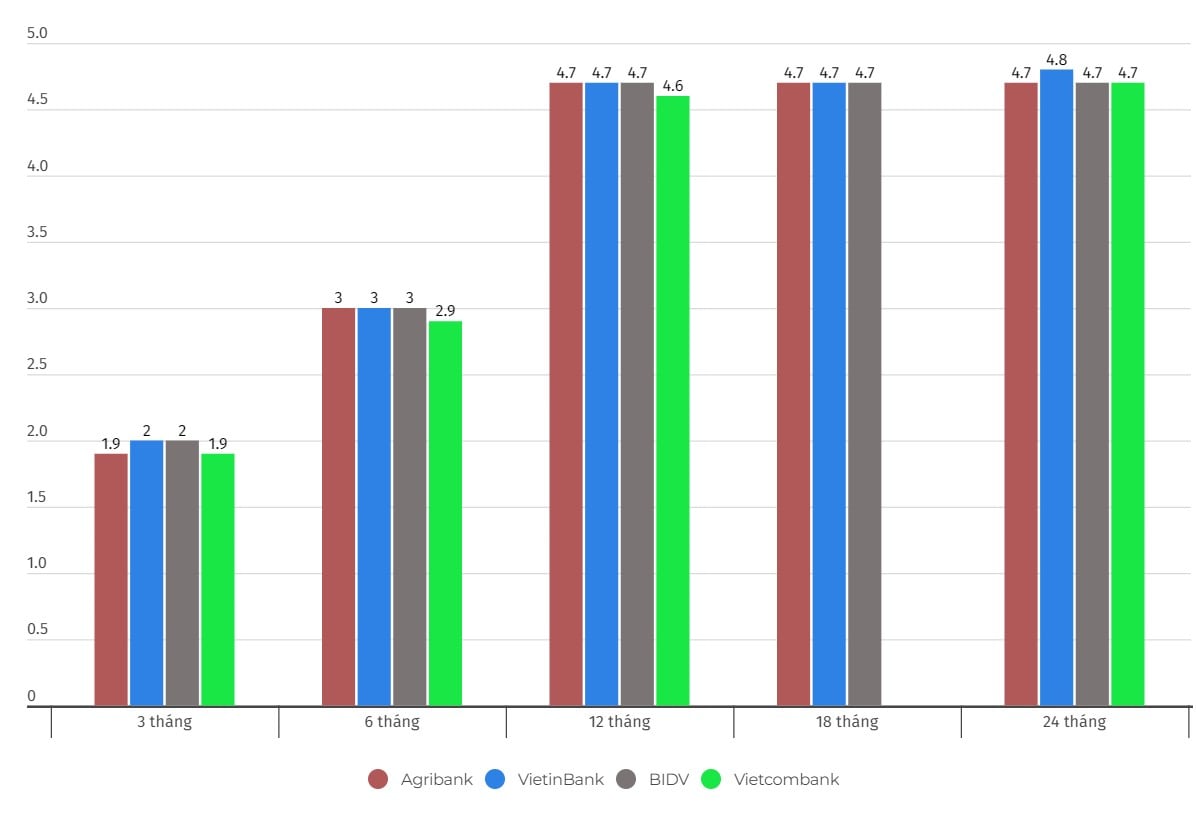

Latest interest rates of Agribank, VietinBank, Vietcombank and BIDV

According to Lao Dong reporter's records with 4 banks Vietcombank, Agribank, VietinBank and BIDV on July 19, 2024, the mobilization interest rate table is being listed around the threshold of 1.6-4.8%/year.

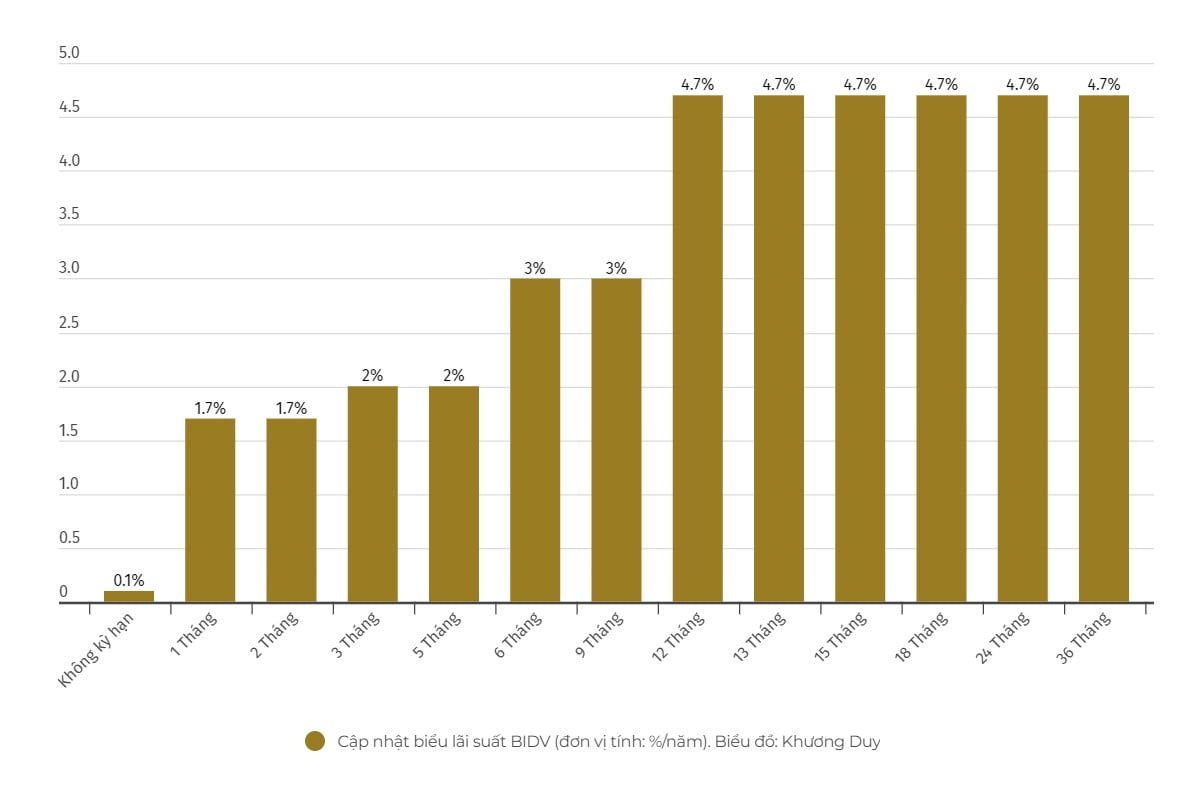

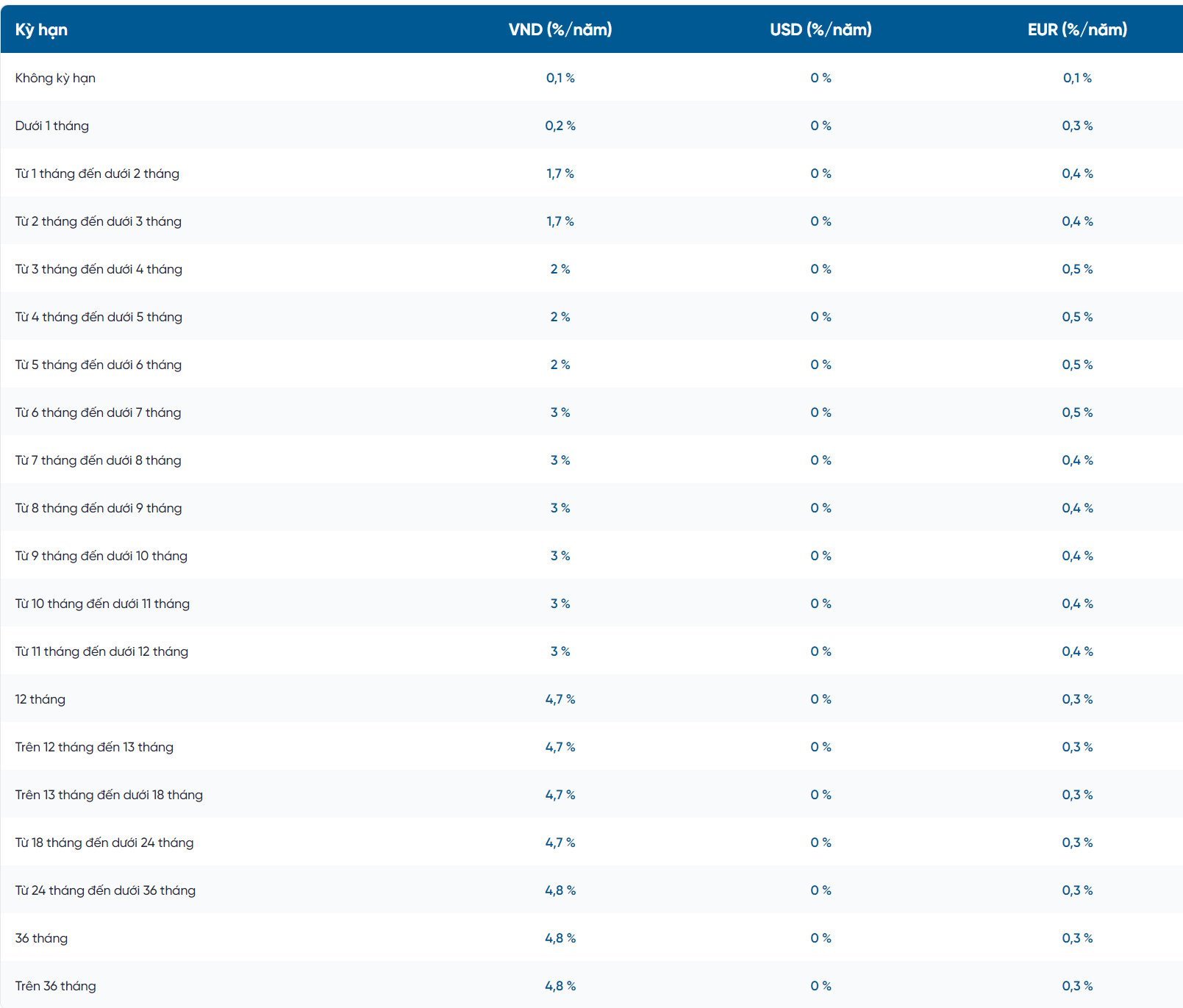

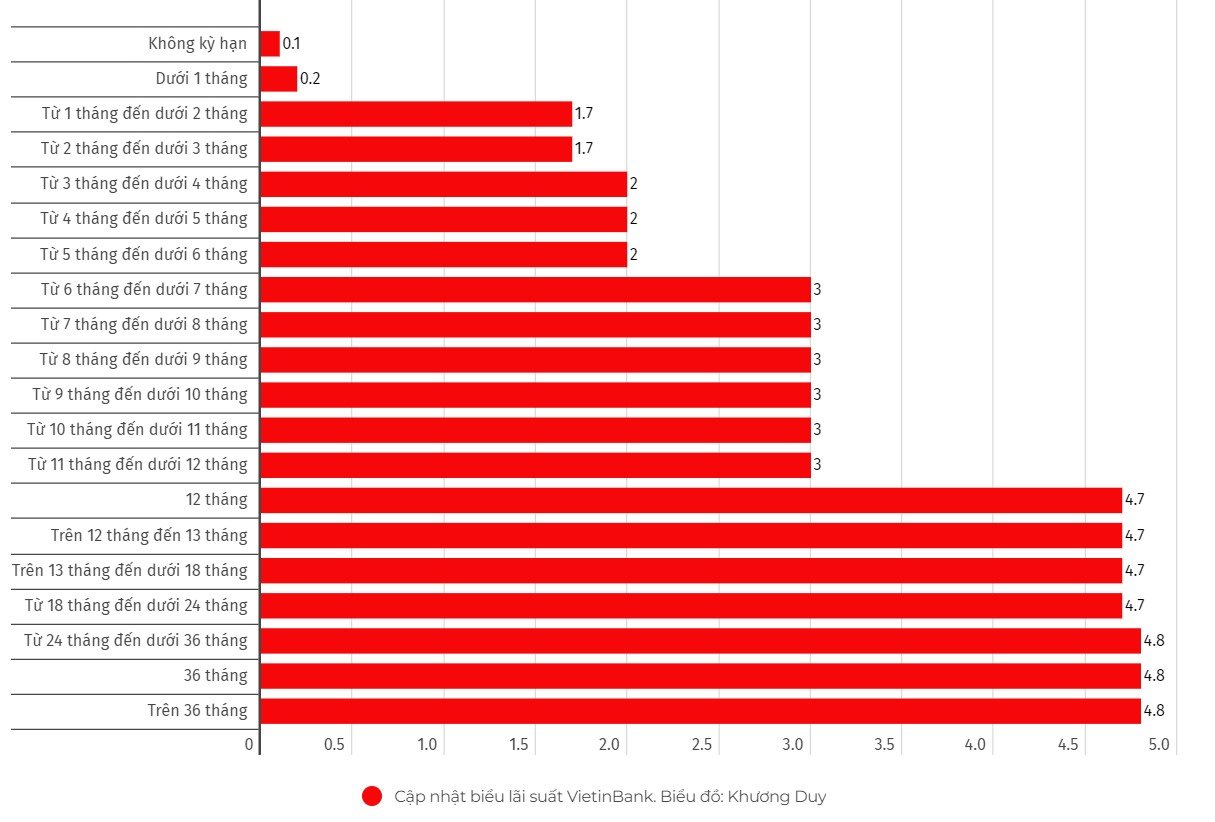

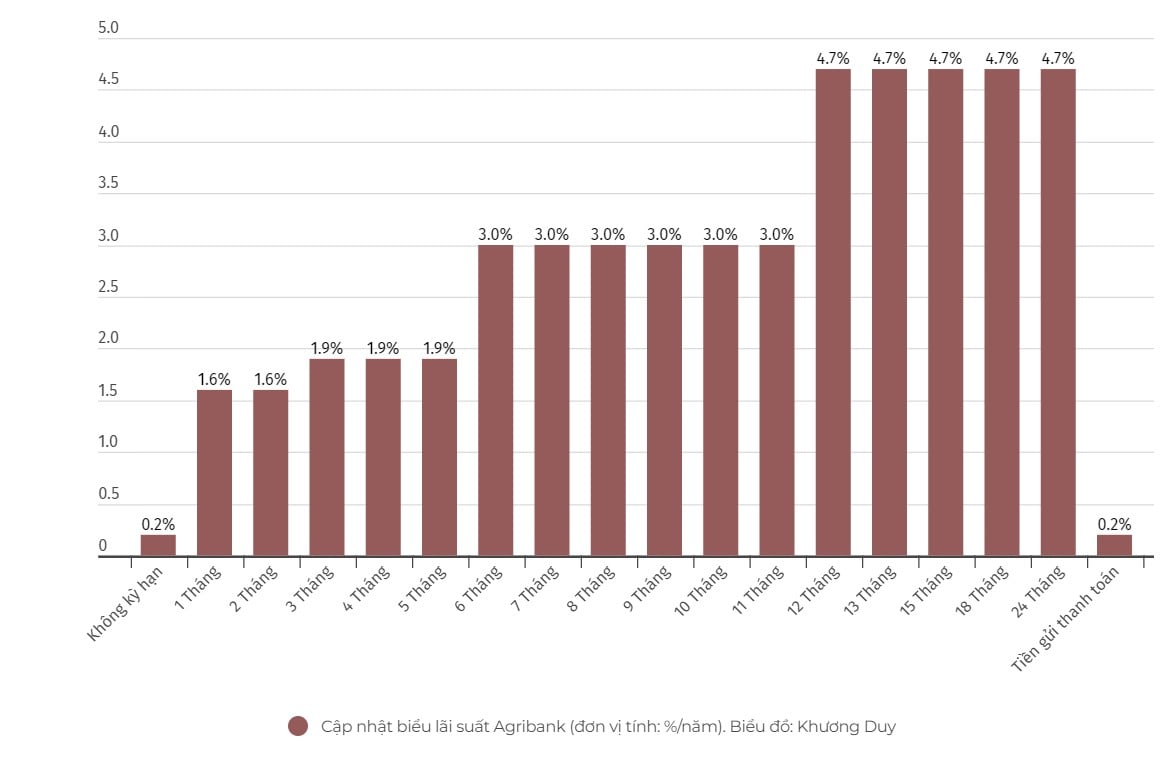

Of which, VietinBank has the highest interest rate (4.8% for terms over 24 months). BIDV's interest rate currently fluctuates between 1.7-4.7%/year, Vietcombank's interest rate currently fluctuates between 1.6-4.7%/year, Agribank's interest rate fluctuates between 1.6-4.7%/year.

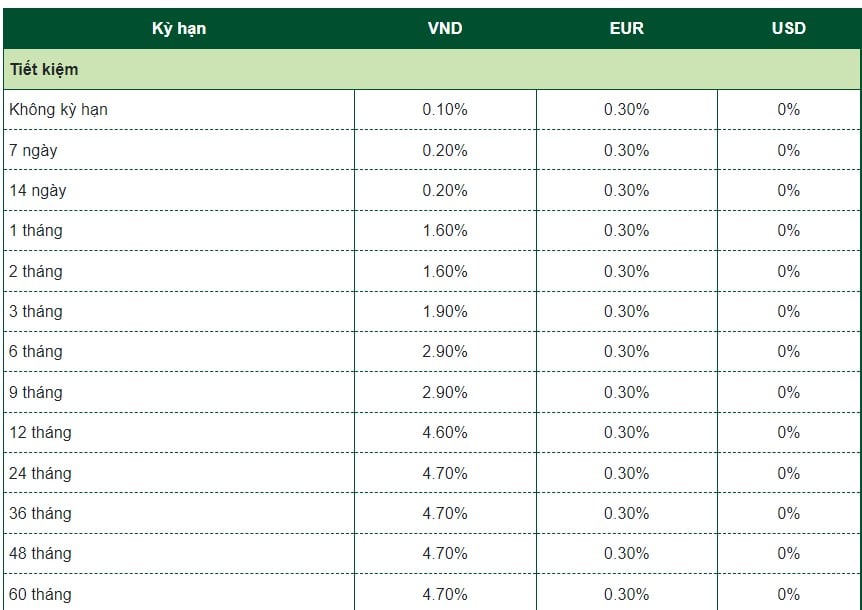

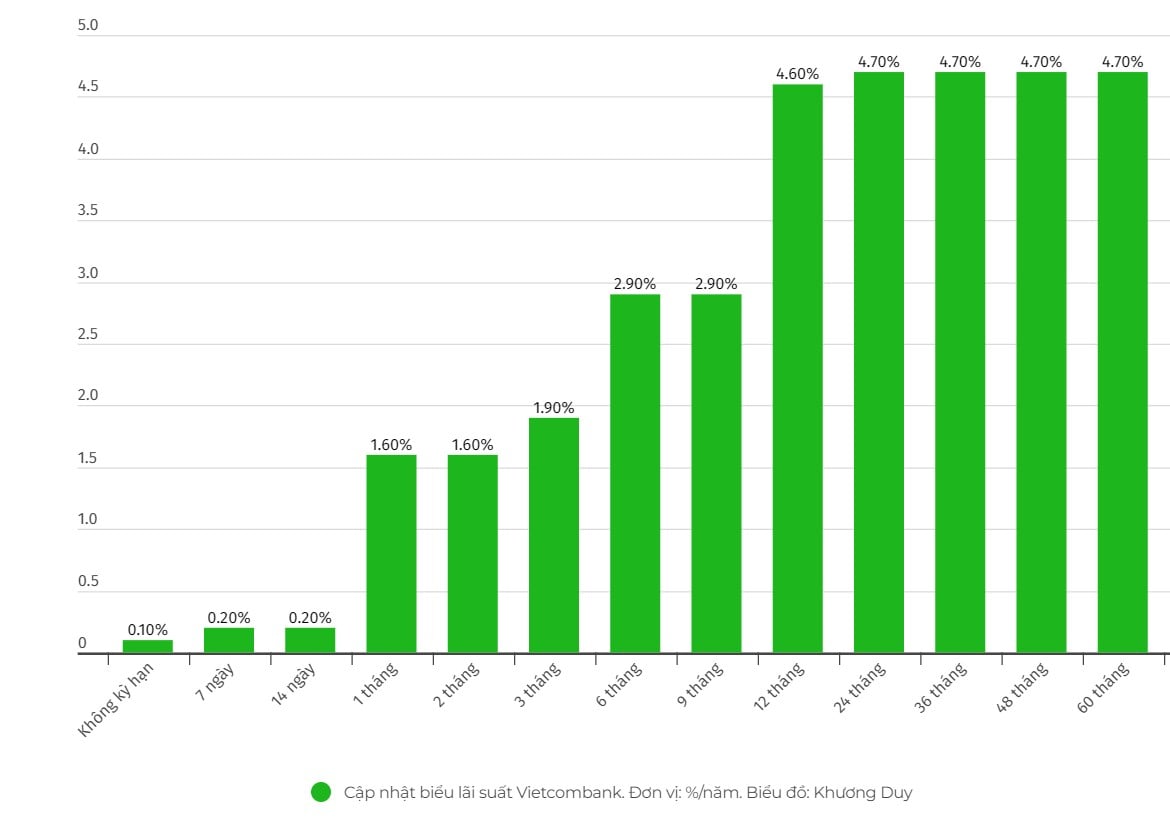

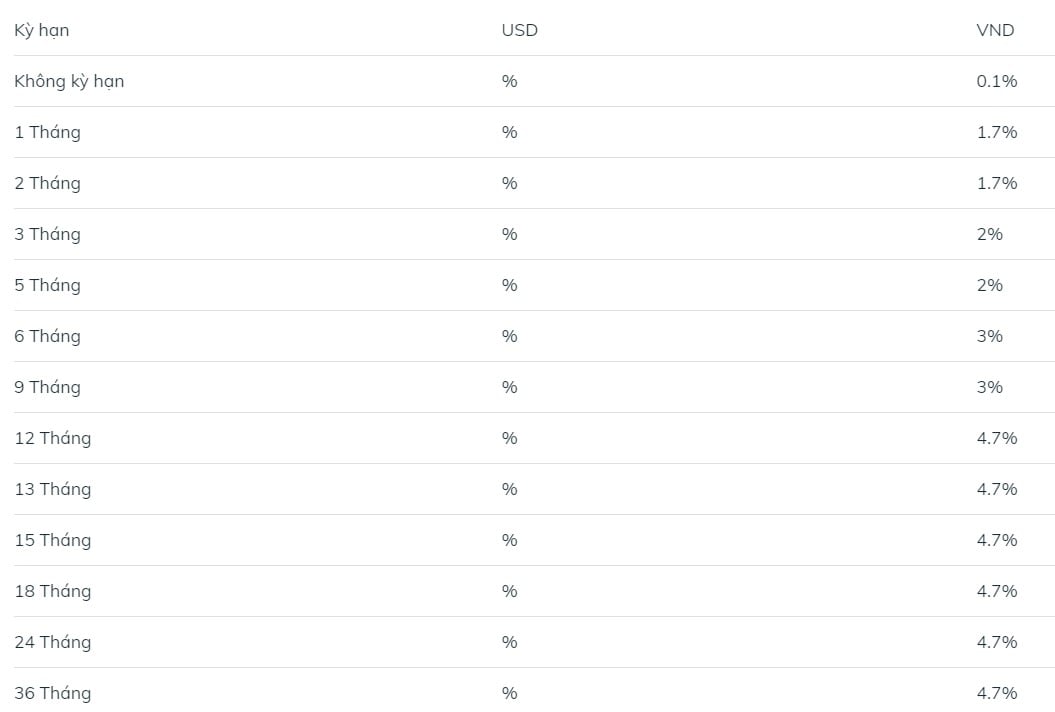

Below are the latest Big 4 interest rate details:

Below is a detailed update of interest rates of banks in the Big 4 group:

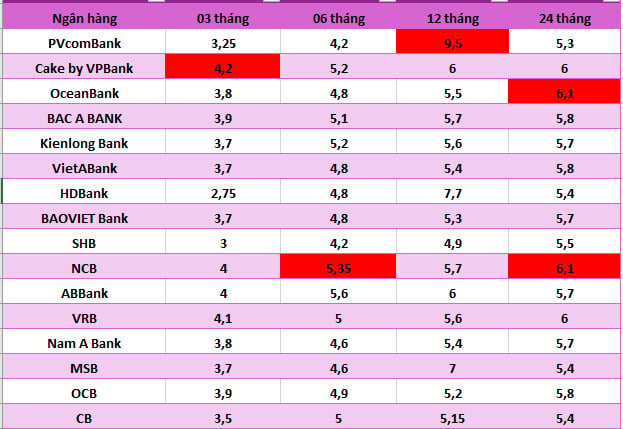

In addition, readers can refer to interest rates of some other banks through the following table:

Currently, ABBank lists the highest interest rate, up to 9.65%, applied to cases of opening new/renewing 13-month term savings deposits with a deposit amount of less than 1,500 billion VND.

PVcomBank ranked second, with a 12-month term interest rate listed at 9.5%/year with a minimum deposit of VND2,000 billion.

Next is HDBank with a fairly high interest rate, 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB also applies quite high interest rates with interest rates at bank counters up to 8%/year for 13-month term and 7% for 12-month term. The applicable conditions are that new savings books or savings books opened from January 1, 2018 automatically renew with a term of 12 months, 13 months and a deposit amount of 500 billion VND or more.

Dong A Bank has a deposit interest rate, term of 13 months or more, end-of-term interest with deposits of 200 billion VND or more, applying an interest rate of 7.5%/year.

NCB, VRB and OceanBank apply an interest rate of 6.1% for a 24-month term; OCB applies an interest rate of 6% for a 36-month term; ABBank applies an interest rate of 6% for a 12-month term; BVBank and Cake by VPBank also apply an interest rate of 6% for a 24-month and 12-month term.

How much interest do you get if you save 200 million VND at Big 4?

To calculate interest on savings deposits at the bank, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months of deposit

For example, if you deposit 200 million VND for a 24-month term at Bank A with an interest rate of 4.7%/year, you can receive: 200 million VND x 4.7%/12 x 24 = 18.8 million VND.

With the same amount and term above, if you save at Bank B with an interest rate of 4.8%, the interest you receive will be: 200 million VND x 4.8%/12 x 24 = 19.2 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Source: https://laodong.vn/tien-te-dau-tu/nen-gui-tien-o-agribank-vietcombank-vietinbank-hay-bidv-1367979.ldo

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

Comment (0)