This is the second consecutive year MSB has been honored in this category.

Mr. Nguyen Quoc Khanh - Director of MSB Technology Division received the award for Outstanding Digital Transformation Bank

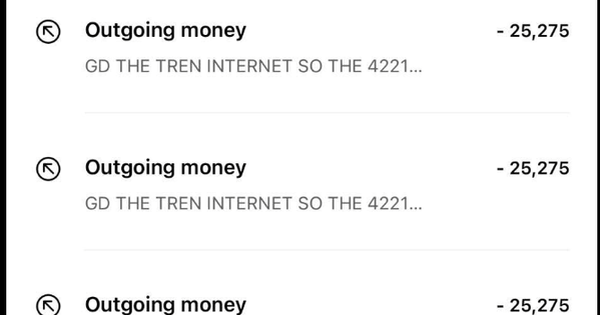

Previously, in 2021, MSB officially launched two key technology projects, Digital Factory and Core Banking Modernization, which are considered the "backbone" of the digital transformation journey. By 2022, these projects had achieved outstanding results. With the Core Banking change project, MSB is a pioneer in the market of converting the new core banking system to the most modern T24 Transact version in Vietnam today. The project has completed the set of business and technical requirements of the analysis phase. At the same time, customization, fine-tuning, and testing requirements are also being closely monitored by MSB, ensuring that the core system is ready for operation in the third quarter of 2023. With the "Digital Factory", by the end of 2022, MSB has successfully deployed 8 customer journeys, in which card journeys, unsecured lending journeys, and non-life insurance journeys are all 100% digitized. Replacing manual operations that require a lot of paperwork, customers coming to MSB have experienced a completely online process with high automation. All steps from registration, approval, appraisal to disbursement or issuance can be done directly on the digital platform via an electronic device connected to the internet. On the other hand, the successful digitization of processes and procedures also improves and shortens the time for customers to access and use products and services compared to traditional methods.

More specifically, when accessing the website vaytinchap.msb.com.vn, in just 5 minutes, individual customers can easily register for a loan with a limit of up to 100 million VND without having to prove their income. The product is considered one of the steps to help complete the ecosystem for personal financial transactions, creating a closed loop from opening an account to issuing and managing financial products such as payment cards, credit cards or loans. For businesses, customers can experience super-fast unsecured loans of up to 15 billion VND or comprehensive credit of up to 200 billion VND when accessing the website https://vaynhanhsme.msb.com.vn/, and submit an application online in 4 simple steps instead of going to the counter. With super-fast loan approval time - 3 working days, MSB is currently a pioneer in the market in completely digitizing the loan process. In particular, many financial transactions of corporate customers that previously required going to a transaction point can now be done online, including opening an account, tracking the status of loan application processing, disbursement, opening an account, international payments, buying and selling foreign currencies with incentives up to 60 points...

MSB aims to continue to increase the digital content in products and services.

Providing modern, effective financial solutions that accurately meet needs is the basis for MSB's breakthrough growth in the number of customers. By the end of 2022, MSB served more than 4 million individual customers and nearly 72,000 corporate customers. The number of individual customers on the e-banking channel increased by 57% over the same period in 2021, the number of new customers via eKYC for individuals and businesses increased by 85% and 259% respectively. The total number and value of transactions on the e-banking channel reached over 70 million transactions and VND 1,122 trillion.

To improve the quality of "purely digital" products and services, MSB is gradually completing the implementation of the STP (straight-through processing) program - automating the entire process from start to finish, allowing customers to process transactions completely online, thereby easily accessing banking products and flexibly using other services without complicated operations or assistance from staff.

During the period from 2023 to 2025, MSB will continue to invest nearly VND 2,000 billion in technology, realizing the goal of 70 to 80% of transactions being conducted on digital channels, while reducing product launch time to 4 weeks/product.

Digital transformation has been creating comprehensive changes in all areas of MSB's operations, which is an important foundation for the goal of becoming a bank with the best service quality based on a modern digital platform, while helping customers "reach new heights" in their journey of experiencing financial products and services as well as business activities. The award once again recognizes MSB's efforts in pioneering the creation of impressive solutions, joining hands to develop Vietnam's digital economy.

Source link

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)