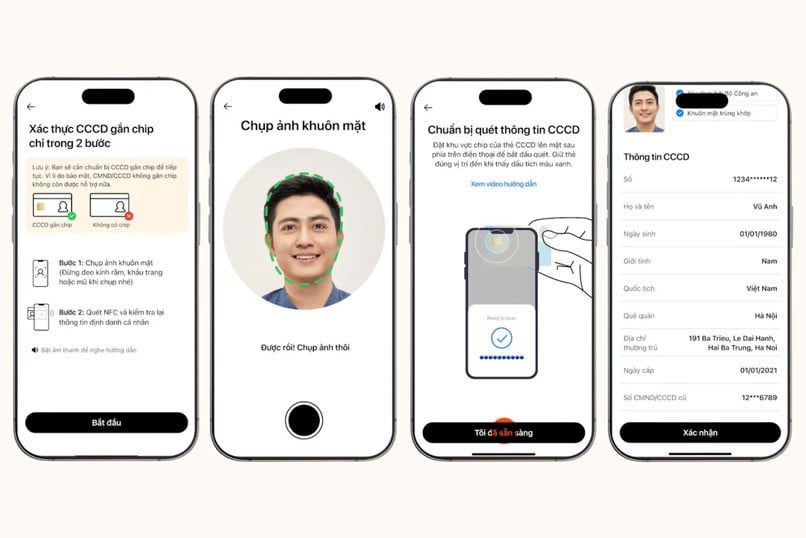

With the help of technology, especially after the biometric authentication regulation came into effect, opening a payment account (bank account) online has become easier without having to go to the counter.

Steps to open a bank account at home

To open an electronic payment account, customers need to prepare their ID card/citizen identification card or passport, residence permit or proof of entry visa validity (for foreigners).

Download the bank application (app) where you opened your account via CH Play or AppStore, select New Customer => select Bank Account => select Open Account Now.

Enter your phone number and get the OTP verification code sent to your phone, then enter the OTP verification code.

Verify identity with the chip-embedded CCCD by pressing “Confirm”, then take a photo of your face according to the application's instructions, turn on the NFC connection on the phone, touch the chip on the CCCD to the back of the device, then press “Confirm” to complete.

Fill in your permanent address, email address, occupation, job position.

Some banks now allow account holders to choose an account number according to their personal preferences and needs, or use their personal phone number as the account number.

For regular accounts, click “Regular account number”. The account number will be randomly provided by the bank.

For a nice account number, click “Nice account number”, then enter the desired number series and select “Agree”.

Confirm card receipt and select card type: Click “Receive card now” or “Later” if you don’t need the card yet, then select the card type and select the card version you want to use.

For the non-physical card version: Click Select under the Non-physical version banner => Select Continue => Verify face to complete.

For physical and non-physical card versions: Click Select under the Both non-physical and physical banner => Select Continue => Fill in the card receiving address => Check the information again and Verify to complete.

After successful registration, the screen displays the login name as the customer's phone number. The customer needs to set a new password, this is the final step in the process of opening a bank account.

Customers can also choose to log in with their fingerprint or face instead of a password.

After successful login, customers will be taken to the home page of the banking application and can start performing banking transactions, such as transferring funds, checking balances, paying bills and many more.

Regulations on opening payment accounts for banks

Circular 17/2024/TT-NHNN regulating the opening and use of payment accounts (bank accounts)

Article 16 of Circular 17 provides details on opening payment accounts by electronic means.

Accordingly, the bank collects documents, information, and data to verify customer identification information; biometric information of account holders (individual customers); biometric information of legal representatives (organizational customers).

The bank checks the legality and validity of documents, information, and data verifying customer identification information and must compare and match the biometric information of the account owner (for individual customers) and the legal representative (for corporate customers).

Biometric data stored in the encrypted information storage part of the authenticated identity card is issued by the police agency or through authentication of that person's electronic identification account created by the electronic identification and authentication system.

Banks must display warnings to customers about prohibited acts when opening and using payment accounts by electronic means and have technical solutions to confirm that customers have fully read the warning contents.

Provide customers with the content of the agreement to open and use a payment account and confirm the customer's acceptance of the agreement to open and use a payment account.

Notify customers of the payment account number, name, transaction limit through the account and the account's start date.

The bank shall decide on its own measures, forms, and technologies for opening payment accounts by electronic means, bear any arising risks (if any), and must meet at least the following requirements: Ensure standards on security, safety, and confidentiality according to regulations of the State Bank; confirm the customer's acceptance of the contents of the account opening agreement.

Banks must store and preserve fully and in detail documents, information, and data identifying customers during the process of opening and using accounts by electronic means, such as: customer identification information; biometric factors of the account holder; sounds, images, audio and video recordings; phone numbers registered for transactions on electronic software; mobile phones; unique identification information of transaction devices (MAC address); transaction logs; biometric information comparison results.

Information and data must be stored safely, securely, backed up, ensuring the completeness and integrity of the data to serve the work of checking, comparing, authenticating account holders during account use, resolving inquiries, complaints, disputes and providing information from competent authorities,...

Opening an account by electronic means does not apply to joint payment accounts, foreign currency payment accounts, or individual customers aged 15 to under 18.

Source: https://vietnamnet.vn/cac-buoc-mo-tai-khoan-ngan-hang-tai-nha-2374992.html

![[Video] The craft of making Dong Ho folk paintings has been inscribed by UNESCO on the List of Crafts in Need of Urgent Safeguarding.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765350246533_tranh-dong-ho-734-jpg.webp)

Comment (0)