According to banks, customers who deposit money for a 1-month term will quickly recover both principal and interest. Customers can deposit money regularly on a monthly basis or withdraw capital when needed within 1 month without worrying about being charged interest at the non-term rate. The 1-month term is for customers who use working capital regularly, especially business customers, salaried employees, enterprises, etc.

When employee salaries are idle for a short period of time, this period is very suitable to create additional sources of income.

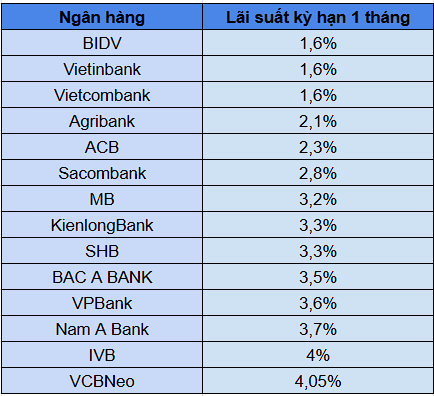

According to the survey, the current interest rate for 1-month term deposits at commercial banks is fluctuating from 1.6% - 4%/year. The highest interest rates belong to two banks VCBNeo and IVB, respectively 4.05%/year and 4%/year. Meanwhile, the lowest interest rate for this term is from the group of 3 state-owned commercial banks BIDV, Vietinbank, Vietcombank with only 1.6%/year.

|

| Interest rates for 1-month deposits (over-the-counter savings) at commercial banks |

Also related to this 1-month term, according to the latest update, a bank has made a move to reduce interest rates. Nam A Bank has announced a reduction in deposit interest rates for terms under 6 months, with a uniform reduction of 0.2%/year. Currently, the 1-month deposit interest rate at Nam A Bank is only 3.7%/year from 3.9%/year.

Nam A Bank keeps deposit interest rates unchanged for terms from 6-36 months. The interest rate at the counter for interest payment at the end of the term for 6-month terms is 4.7%/year; for 7-8 month terms is 4.9%/year.

Interest rates for 12-13 month savings remain at 5.3%/year, while interest rates for 14-17 month terms are 5.4%/year.

The highest interest rate at Nam A Bank is still for deposits with terms of 24-36 months, currently maintained at 5.6%/year.

Source: https://thoibaonganhang.vn/lai-suat-gui-tien-1-thang-tai-cac-ngan-hang-hien-ra-sao-162656.html

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

Comment (0)