New students complete admission procedures at Van Lang University early morning of August 19 - Photo: VAN TUAN

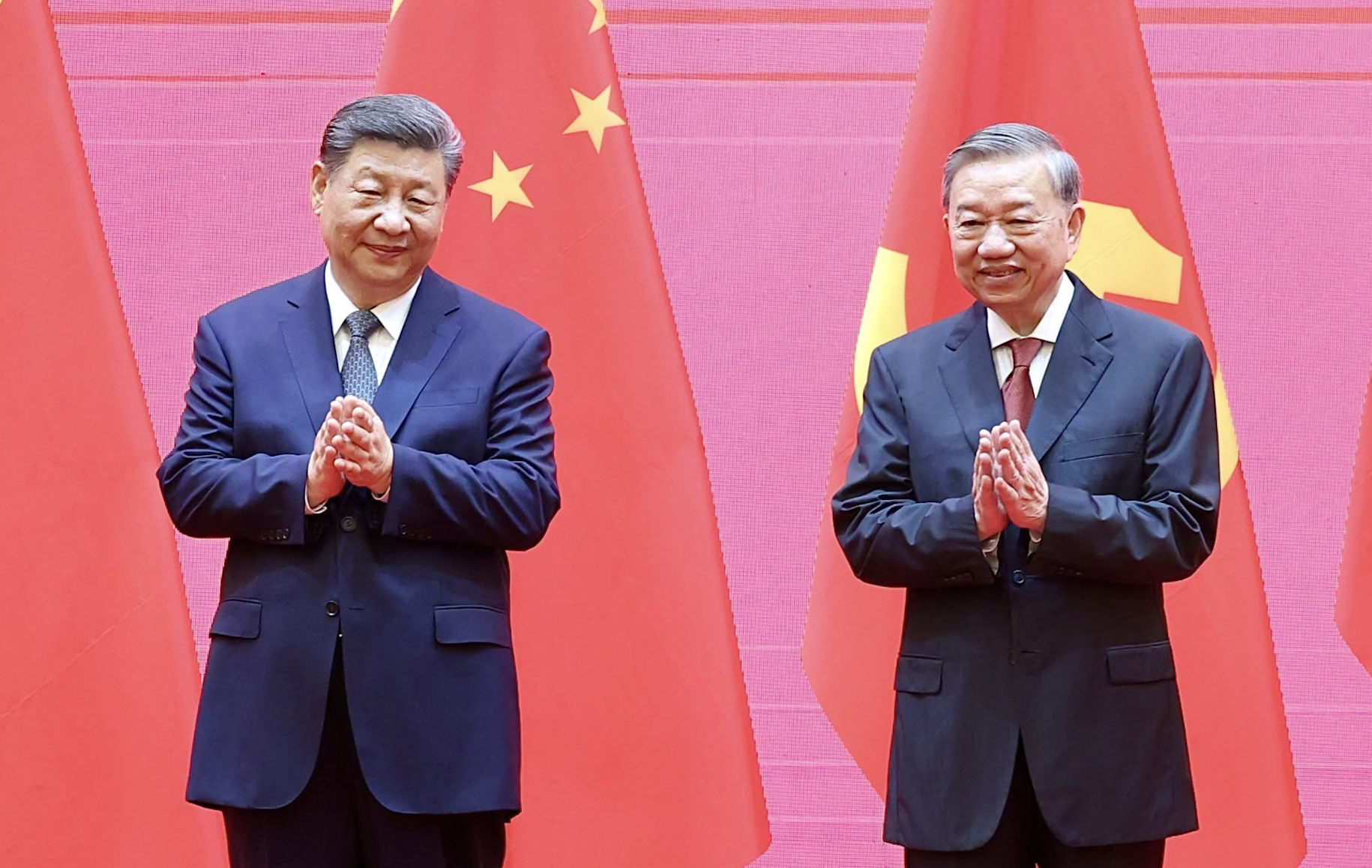

General Secretary and President To Lam "felt very sad" when there were poor students who did not have enough money to go to school and suggested that the Ho Chi Minh City government consider a loan policy to support students going to school.

MAN NHI (2nd year student of a medical college in Tan Binh district, Ho Chi Minh City)

The aspirations of disadvantaged students

The suggestion of General Secretary and President To Lam is the wish of thousands of students with difficult circumstances in Ho Chi Minh City, including the family of Huynh Bao Anh (from An Giang).

In the recent university entrance exam, Bao Anh scored 21 points in block D1, and wished to study maritime science at Ho Chi Minh City University of Transport. However, due to difficult family circumstances, the story of tuition fees for four years of university became a big concern for Bao Anh.

Taking advantage of the time before school started, Bao Anh applied for a part-time job at a store in Tan Phu district (HCMC), but the meager hourly wage was probably only enough for her to cover her living expenses.

Recently, Bao Anh also applied for the Tuoi Tre newspaper's "Tiep suc den truong" scholarship, but this is only a temporary solution. In the long term, Bao Anh's parents will have to consider borrowing money for their child to go to school. Bao Anh's family is still waiting for preferential loan policies from the State.

Or the story of Man Nhi, a second-year student at a medical college in Tan Binh District (HCMC). Because the school is financially autonomous, the three-year tuition fee is quite high compared to the family's budget (9-10 million VND/semester), not to mention the cost of books, textbooks, and medical equipment for practice... Man Nhi recalls that when she entered school, she had to run around everywhere to borrow 15 million VND to pay for tuition, rent, and buy books at first.

"At that time, tuition fees were my biggest obstacle in pursuing my dream. In the following years, the commune had a loan program for poor students, and I was able to study with peace of mind until now. Tuition loan programs are really necessary, so that students in difficult circumstances like me can have more confidence in their choice, because when born into families that could only make ends meet, going to university was still a luxury," Nhi confided.

Students work part-time to pay for their studies - Photo: NGOC PHUONG

Motivation for students to study

Speaking to Tuoi Tre, Mr. Tran Nam - Head of Student Affairs Department, University of Social Sciences and Humanities, Ho Chi Minh City National University - said that for a long time, there have been policies to support tuition fees for students with difficulties, but they have not met the demand. In fact, there are many students who cannot go to school for financial reasons despite their excellent academic performance and clear future orientation.

The University of Social Sciences and Humanities (Vietnam National University, Ho Chi Minh City) currently has some majors that, although partially subsidized by the budget for tuition fees, many students are still unable to pay on time. Many families currently do not have assets to mortgage to borrow money from the bank for their children to go to school.

Recently, Ho Chi Minh City National University has a program to provide credit loans to disadvantaged students of schools in the system with 0% interest rate, creating resources and motivation for them to study. However, the target audience for this program is limited and the level of support is still low.

"If Ho Chi Minh City can develop a specific program with clear resources and sustainability, it would be great. The city can also consider mobilizing resources from the private sector and social organizations to increase resources for the program," said Mr. Nam.

Currently, Ho Chi Minh City has about 600,000 students studying at universities, colleges and academies. Of these, more than 50% come from other provinces and cities. In addition to tuition fees, these students also have to pay for food, travel, living expenses, etc., causing a lot of pressure, especially for students with difficult circumstances. Therefore, supporting disadvantaged students to access loans and credit sources is always a concern of the city's leaders.

Recently, the City has assigned the State Bank of Ho Chi Minh City, the City Youth Union and relevant departments to advise on a project to support students in accessing credit capital to serve their study needs in Ho Chi Minh City in the period of 2024 - 2028.

Ms. Tran Thu Ha, Deputy Secretary of the City Youth Union and President of the Ho Chi Minh City Vietnamese Student Association, said the goal of this project is to create conditions for students in need to borrow capital from banks and support interest rate compensation during their time studying in Ho Chi Minh City.

The city will also provide knowledge and introduce part-time jobs to limit students from getting caught up in black credit. In addition, it will build a proactive spirit among students in borrowing credit for studying and the awareness of repayment after finding a job, continuing to accompany the program to support students in the following classes.

According to Ms. Tran Thu Ha, this project not only specifically aims to support students with loans for their studies but also aims to ensure and improve the quality of future human resources in Ho Chi Minh City and the whole country.

Nearly 50% of students need loans

Recently, the Ho Chi Minh City Youth Union conducted a quick survey of 18,988 students and 8,735 students agreed to be willing to borrow if there was a form of unsecured loan support, accounting for 46%. Ms. Tran Thu Ha said that building a separate credit policy, creating conditions for students to access and receive support to ensure they can continue their studies, such as the project to support students to access credit sources to serve their study needs in Ho Chi Minh City is very necessary.

To achieve the above goal, the Ho Chi Minh City Youth Union and the Vietnam Student Association are taking steps to establish a pilot Social Fund according to Decree No. 93 on the organization and operation of social funds and charity funds to receive resources and support interest rate compensation for students borrowing credit from commercial banks. In addition, working with a number of units to develop pilot plans, credit packages, and specific loan programs.

1,000 interest-free loans for students of University of Technology

In early 2024, the Board of Representatives of the Phu Tho - Polytechnic Alumni Community (BKA) announced that it will lend 1,000 students of the University of Technology (Ho Chi Minh City National University) 0% interest rate loans per semester, with a total amount of more than 15 billion VND.

Mr. Tran Ba Duong, Chairman of the BKA Board of Representatives for the 2024 - 2028 term, said that BKA's operating plan for the next term will include many great support policies for students and schools. Specifically, in the first term (2021 - 2023), the BKA Board of Representatives established the "Bach Khoa Scholarship and Development Support Fund". The fund has mobilized a total of 22.7 billion VND, of which 7.4 billion VND is from the faculties/centers.

"In particular, the fund supports students with 0% interest loans with the view of building a spirit of independence for students and not letting their studies be affected by tuition fees. In the past 5 pilot semesters, the fund has supported 344 students with a total amount of nearly 4 billion VND. In the second term, we will continue to deploy and expand the loan target with the goal of 1,000 loans/semester, a total amount of over 15 billion VND," Mr. Duong added.

Source: https://tuoitre.vn/mong-cho-chuong-trinh-cho-sinh-vien-vay-von-20240820091808013.htm

![[Photo] Air Force actively practices for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16fdec3e42734691954b853c00a7ce01)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] Ho Chi Minh City after 50 years of national reunification through buildings and symbols](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a224d0b8e489457f889bdb1eee7fa7b4)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Video] On April 15, candidates can try to register for the High School Graduation Exam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/8b898ec7b2994006b9cefcf53d6916f5)

Comment (0)