Struggled forever

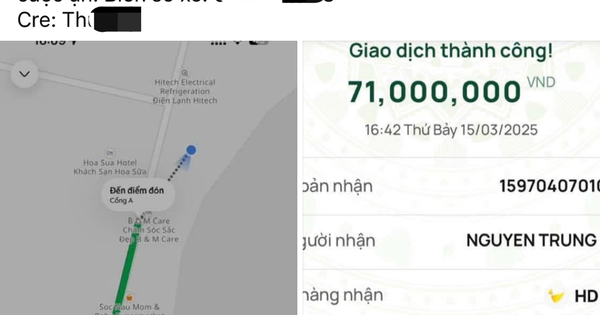

From July 1, customers must authenticate their biometrics when making their first banking transaction using Mobile Banking. Accordingly, online money transfers of over VND10 million at a time or over VND20 million accumulated per day are required to authenticate their faces.

After banks simultaneously required customers to register for biometrics, many people reported that self-updating data on banking applications often failed, especially for older customers who were not familiar with technology or had problems with their phones.

Ms. Hoang Quyen (34 years old, Cau Giay, Hanoi) said that, following the steps instructed by the bank, she took photos of both sides of her chip-embedded citizen identification card (CCCD) and updated it. However, when it came to the step of putting the CCCD on the back of the phone to scan the information, she struggled to do it over and over again but still could not do it. Ms. Quyen had to ask her husband for help, and after many attempts, she was able to successfully scan the information.

Not to mention, most older people who are not tech-savvy often struggle to complete the biometric authentication registration steps.

Many people said they could not scan their faces as required by the banking app to match the data in the CCCD.

Reflecting to VietNamNet Newspaper, reader Le An said: The State Bank requires facial recognition to match the CCCD). But the face saved in the CCCD may not match the current face, so the phone cannot scan it. Not to mention, when performing biometric registration, many people have to change their phones because they do not have the NFC chip reading function.

Reader Tinh nguyenvan reflected: "I don't know about everyone else, but I find it too difficult. I've done it over 10 times but it hasn't worked. The CCCD chip scanning step always fails to connect."

Reader Cao Quoc Hoa said: "I have done facial biometrics but it takes a lot of time, sometimes it takes 30 to 40 minutes but still cannot be recognized. Maybe because the photo in the CCCD is too bad, it doesn't look like real life."

Reader Thoa Nguyen reported, "The Oppo Reno 3 phone cannot register biometrics because it does not have a chip reading function. I went to the bank for support. The bank staff could not do it and told me to change or buy another phone. Is there no other way? My husband and I suddenly have to buy a new phone. Since we don't have money yet, I don't know what to do?"

Data collection is difficult

Banks admit that data collection is still difficult, especially for older customers who are not familiar with using smartphones, or customers who have not yet renewed their chip-embedded ID cards, or those who have had cosmetic surgery.

"It is very difficult for them to collect because the personal data at that time and the CCCD may not match," a representative of VPBank Digital Banking shared on Hanoi Radio and Television .

OCB Bank representative also admitted that during the process of implementing biometric registration for customers, OCB also found difficulties in some customers using mobile devices that do not support NFC to read the chip of the CCCD card.

The common point that makes banks and e-wallets worried during the authentication process is the step of touching the CCCD to the chip reader on the phone. Currently, each type of phone has different chip locations. There are many smartphones with powerful configurations but still do not have NFC readers.

In addition, some bank tellers admitted that the step of using the app to scan information on the CCCD chip often fails. This makes it impossible for customers to perform the next steps.

Sharing on VTC News , Ms. Nguyen Tuyet Nhung, representative of Kalapa Company - a unit specializing in biometric solutions believes that, in reality, when implementing eKYC (electronic identification) steps, biometric authentication has a situation where people are not satisfied. Typically, authentication requires people to have a phone capable of reading the NFC chip integrated on the CCCD and to know how to place the CCCD on the phone to read the chip. These requirements are quite unfamiliar to most users and require users to accept its necessity.

According to Ms. Nhung, because of the above new things, the software integrating authentication services must have superior performance, high processing speed, and concise instructions. The software must be easy to use so that even the elderly can use it.

Ms. Duong Mai Anh, CEO of Vidiva Technology JSC - owner of Ting e-wallet - said that users are often confused when determining the chip location on the CCCD and the chip location on the phone. On the CCCD, the chip is usually located at the red stamp position. Each phone has different chip locations, which can be next to the camera or in the middle of the phone.

Customers should move the CCCD up and down vertically on the phone until the two chips find each other and hold it for a few seconds - she shared on Cong Thuong Newspaper .

In the current market, there are many smartphones with powerful configurations but still do not have NFC readers. There are no exact statistics on the percentage of customers using these devices, but this is also an obstacle for the e-wallet customer group.

“In addition to online registration, bank account holders can bring their ID cards directly to a branch to receive support for initial authentication. As for e-wallets, due to the limited network of branches and offices, this is still a problem,” said Ms. Mai Anh.

For foreign customers residing in Vietnam who are not issued a chip-embedded ID card, customers can use their passport and go directly to a bank branch to have staff support them in checking and updating biometric information.

Avoid the risk of fraud when updating facial data

According to banks, to avoid the risk of fraud and fraud, customers should not update their biometric data via any other website or application. Banks do not ask customers to provide OTP, password, card number, security code or any personal information over the phone or via a link.

Source: https://vietnamnet.vn/cai-xac-thuc-khuon-mat-de-chuyen-tien-lo-phai-doi-dien-thoai-2294319.html

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)