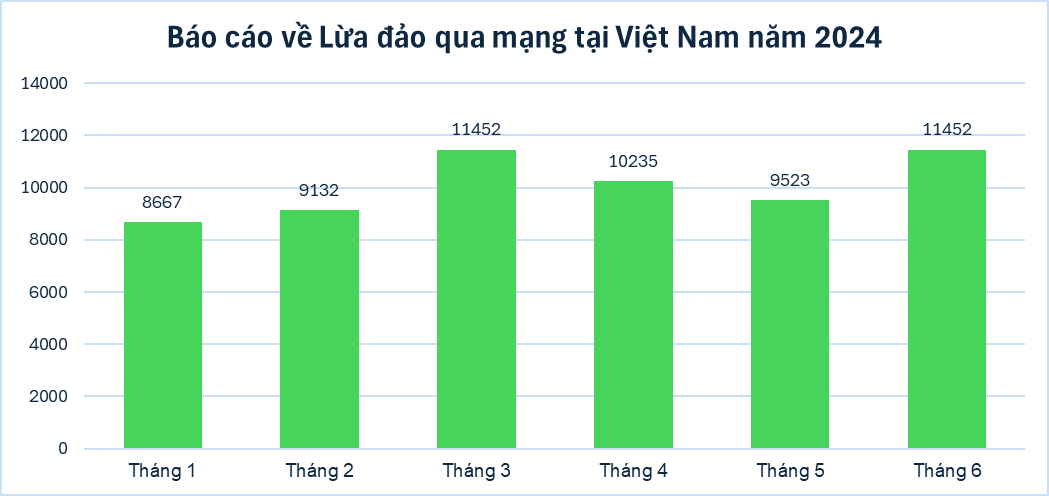

A series of measures implemented by the authorities in 2024 have helped raise public awareness of money transfer fraud. Will the number of fraud cases leading to loss of money in bank accounts decrease in 2025?

Scams warn many people

The year 2024 witnessed many cases of money loss and lawsuits that shocked public opinion. Typically, a PhD in banking was scammed out of more than 400 million VND in his account, and a businesswoman was scammed out of tens of billions of VND in her bank account opened at two major banks.

This is a lesson in raising awareness against sophisticated scams. It shows that anyone can be scammed out of money if they do not comply with account security regulations.

In the case of a famous PhD in the field of finance and banking who lost more than 400 million VND, he later filed a complaint with the Thanh Xuan District Police but the culprit has not yet been found. Before that, this PhD received a call from a person pretending to be a police officer, asking him to transfer money to an account provided by the subject many times. This money has "gone forever".

Commenting on the incident, Dr. Le Xuan Nghia said: "Even a person with a PhD in banking can be fooled by very basic knowledge."

Among the series of large and small scams that have occurred recently, the most prominent is the scam whose victim is businesswoman Tran Thi Chuc (born in 1974, residing in Tu Son, Bac Ninh).

According to Ms. Chuc, on April 22, 2022, she received a phone call from a person who introduced himself as an investigator of the Da Nang City Police Department informing her of the results of the criminal investigation and sending her an emergency arrest warrant for being involved in a drug trafficking ring.

This person instructed Ms. Chuc to open an account at Vietcombank and an account at Techcombank, then transfer 40 billion VND equally into the two accounts to prove that she was not involved in a criminal ring, and told Ms. Chuc that by April 25, 2022, the freeze would be unblocked and she could go to the bank to withdraw the money.

On April 22-23, 2022, Ms. Chuc went to Vietcombank Kinh Bac Branch and Techcombank Tu Son Branch to open two new accounts; at the same time, she borrowed from friends, customers, and mobilized money from relatives to transfer 11.9 billion VND to Vietcombank and 14.6 billion VND to Techcombank.

However, on the morning of April 25, 2022, when Ms. Chuc went to Vietcombank Kinh Bac Branch and Techcombank Tu Son Branch to withdraw money, the staff of these two banks informed her that her account was empty, while she did not make any direct or indirect withdrawal transactions.

In both the first instance trial (tried by Tu Son District People's Court in March 2024) and the appeal trial (tried by Bac Ninh Provincial People's Court (July 2024), the panel of judges rejected Ms. Chuc's request that the two banks compensate her the above amount.

Representatives of Vietcombank and Techcombank both affirmed that the bank's officers and employees fully complied with the State Bank's regulations on professional expertise when consulting on procedures and preparing documents to open accounts and provide services to customers.

The bank was not at fault in the fraud that took away Ms. Chuc's money from her account opened at the bank, so it did not accept to compensate Ms. Chuc for her damages.

Speaking to VietNamNet , the director of retail banking at a large commercial bank said that the outcome of the lawsuit was not only a “victory” for Vietcombank and Techcombank but also for the entire banking industry. Thereby, it contributed to raising people’s awareness of being vigilant against new fraud methods.

Changes to prevent fraud

In 2024, there will be many changes in institutions and new policies in the payment sector such as Decree 52/2024/ND-CP, Circulars 17, 18 and related circulars on non-cash payments.

In particular, from July 1, 2024, banks and payment intermediary organizations have deployed biometric authentication according to Decision 2345 and Circular 50 of the Governor of the State Bank.

These are fundamental changes and are the foundation to enhance security and safety in online payments, helping the Vietnamese payment system develop more sustainably.

According to Mr. Le Van Tuyen, Deputy Director of the Payment Department (SBV), as of January 6, 84.7 million individual customers have been verified for biometric authentication, accounting for over 72% of the total number of customers making transactions on digital channels.

Some banks have achieved very high rates of biometric customer registration. At VietinBank and BIDV, the rate is 83%, Vietcombank is 92% and Agribank is 66%.

Mr. Tuyen also said that by the end of 2024, the number of fraud cases of appropriating money in accounts had decreased by more than 50% since Decision 2345 took effect from July 1, 2024.

Regarding Circular 17 and Circular 18, which will take effect from January 1, 2025, to meet this timeline, the banking industry has proactively and actively implemented many communication plans, instructions, and encouraged customers to implement biometric information verification; at the same time, arranged and increased resources and equipment to directly serve at transaction counters to support customers who have difficulty updating biometrics.

“Many banks have arranged for staff to work long hours on weekends and holidays to support the updating of biometric information at the counter, meeting the number of customers coming to update biometric information which has increased by one and a half times, double the normal days. Some banks have committed to continue to increase the number until the end of January 2025 to serve customers,” said Mr. Le Van Tuyen.

Banks such as Vietcombank, Agribank, VietinBank, and BIDV opened many transaction points over the weekend to support customers in updating biometrics as well as updating new CCCD numbers until January 15.

At BaoVietBank, transaction offices are required to work through lunch until the last day before the Lunar New Year holiday to support customers.

In addition, banks are also constantly increasing warnings to customers about new fraud methods and tricks. Warnings are carried out in many forms such as: sending emails, posting on websites, bank fanpages, sending SMS messages, messages via mobile banking applications, etc.

With the above solutions, along with people raising their awareness, there is reason to believe that by 2025 the number of fraud cases will decrease.

Source: https://vietnamnet.vn/nam-2025-so-vu-lua-dao-mat-tien-trong-tai-khoan-ngan-hang-se-giam-2365643.html

![[Photo] Prime Minister Pham Minh Chinh receives delegation from the US-China Economic and Security Review Commission of the US Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/ff6eff0ccbbd4b1796724cb05110feb0)

![[Infographic] Cross exchange rates of Vietnamese Dong with some foreign currencies to determine tax value from May 8-14](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/348c4541f6d34a93aafcb691c565caa2)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the victory over fascism in Kazakhstan](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/dff91c3c47f74a2da459e316831988ad)

Comment (0)