What is bank interest rate?

Interest is the percentage of the loan amount that the borrower is responsible for paying to the lender within a specified period of time. Interest includes deposit interest rates, lending interest rates, and interbank interest rates.

In which, the mobilization interest rate is the ratio between the interest amount and the mobilized capital. The mobilization interest rate is classified into mobilization interest rates in VND and foreign currency, including interest rates on demand deposits and term deposits; the mobilization interest rate by issuing valuable papers includes the mobilization interest rate by issuing valuable papers with terms of less than 12 months and those with terms of 12 months or more.

Lending interest rate is the ratio between the interest amount and the loan amount. Lending interest rates are classified into VND and foreign currency lending interest rates, including short-term lending interest rates and medium-term and long-term lending interest rates.

Interbank interest rates are the interest rates of capital transactions between banks. Interbank interest rates are classified by terms, including overnight, 1 week, 2 weeks, 1 month, 3 months, 6 months, 9 months and 12 months.

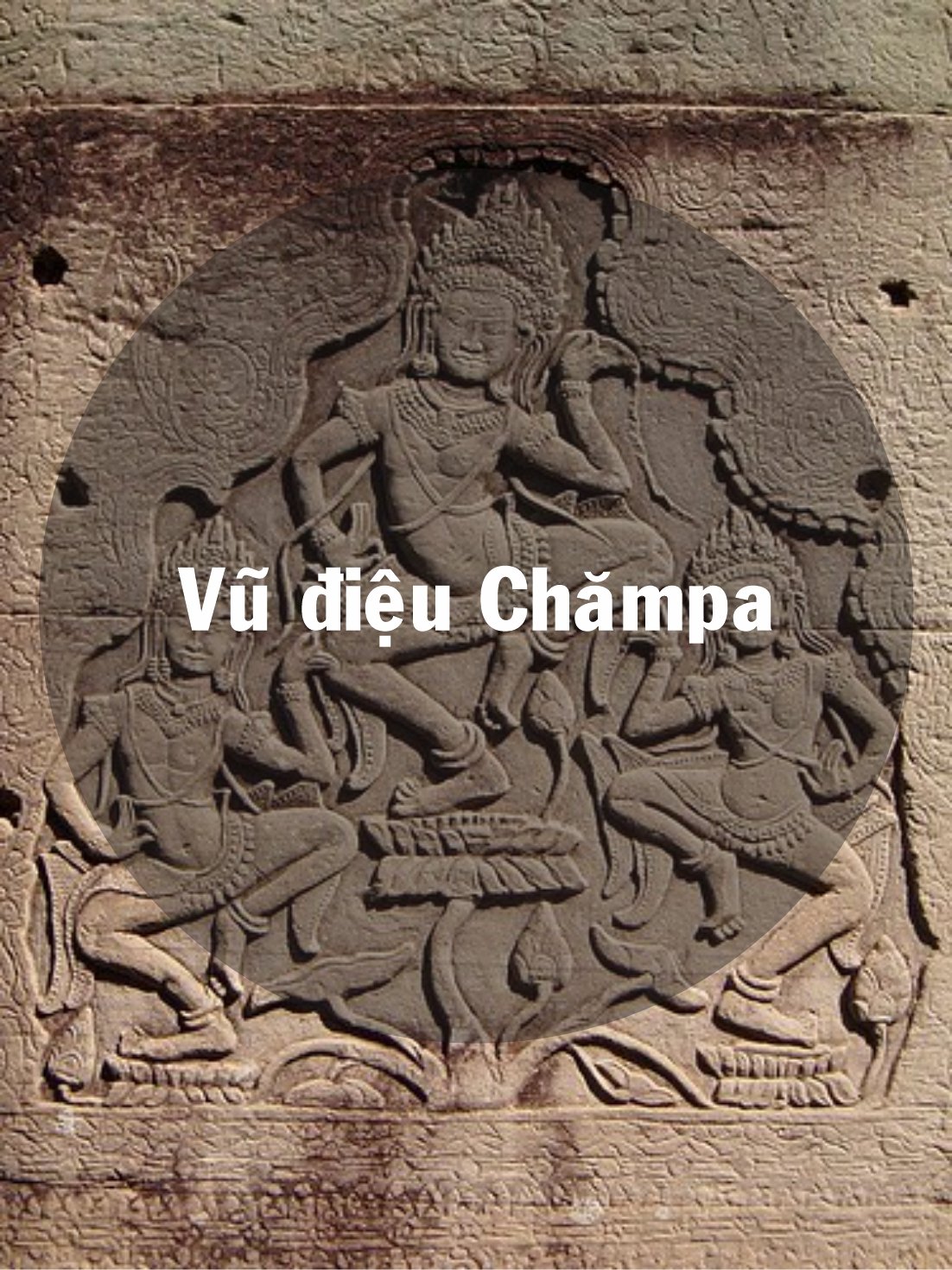

(Illustration)

According to Decision 1124/QD-NHNN, from June 19, 2023, the maximum interest rate for deposits in Vietnamese Dong of organizations (except credit institutions, foreign bank branches) and individuals at credit institutions, foreign bank branches as prescribed in Circular 07/2014/TT-NHNN is as follows:

The maximum interest rate applicable to demand deposits and deposits with terms of less than 1 month is 0.5%/year.

The maximum interest rate applied to deposits with terms from 1 month to less than 6 months is 4.75%/year; People's Credit Funds and Microfinance Institutions apply the maximum interest rate applied to deposits with terms from 1 month to less than 6 months at 5.25%/year.

12-month savings interest rate, which bank has the highest?

As of April 8, under normal conditions, 12-month savings interest rates of banks mainly fluctuated between 3.75 - 5.3%/year. Of which, Nam A Bank is listing the highest interest rate for 12-month term at 5.3%/year.

Next is VietBank with an interest rate of 5.2%/year for a 12-month term. Next are LPBank and SaigonBank with an interest rate of 5%/year. Some banks have a 12-month savings interest rate of 4.9% such as OCB, Eximbank, SHB, OceanBank.

Banks listing interest rates of 4.8%/year for a 12-month term include Viet A Bank, PVcombank, and Kienlongbank.

Notably, for a 12-month term, PVcomBank is listing the highest savings interest rate at 9.5%/year, for mass savings products, applied to savings deposits at the counter for newly opened deposit balances of VND 2,000 billion or more.

Source

Comment (0)