Three-month copper on the London Metal Exchange (LME) CMCU3 rose 1.1% to $9,730 a tonne, while the most-traded November copper contract on the Shanghai Futures Exchange (SHFE) SCFcv1 rose 1.3% to 77,620 yuan ($10,910.42) a tonne.

China cut its benchmark lending rate as expected at its monthly meeting, after cutting other policy rates last month as part of a package of stimulus measures to revive the economy.

Data showing slowing economic growth also bolstered hopes that China will roll out more stimulus measures, potentially helping lift demand for physical metals.

“People are expecting something next year,” said analyst Matt Huang at brokerage BANDS Financial.

Despite Monday's gains, LME copper is still 4.2% below its near four-month peak of $10,158 hit on September 30, while Shanghai copper has fallen 2.3% over the same period.

Copper inventories at SHFE warehouses rose 8% last week to 168,425 tonnes, the highest since September 13, raising concerns about physical demand during traditionally strong consumption months in China.

“Most of the trading firms and smelters we met with... last week were bearish on prices amid high downstream inventory levels and accumulated social inventories,” Huang said, noting there was optimism about copper demand from green energy transition sectors.

LME aluminium CMAl3 rose 1% to $2,637.50 a tonne, nickel CMNI3 rose 0.9% to $17,055, zinc CMZN3 rose 1.1% to $3,123, tin CMSN3 rose 0.2% to $31,380, while lead CMPB3 fell 0.1% to $2,071.

SHFE aluminum SAFcv1 rose 1.7% to 20,940 yuan/t, nickel SNIcv1 rose 1.4% to 130,720 yuan, zinc SZNcv1 rose 1% to 25,230 yuan, lead SPBcv1 rose 0.6% to 16,740 yuan and tin SSNcv1 edged up 0.1% to 256,780 yuan.

Source: https://kinhtedothi.vn/gia-kim-loai-dong-ngay-22-10-hau-het-cac-kim-loai-co-ban-deu-tang-gia.html

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

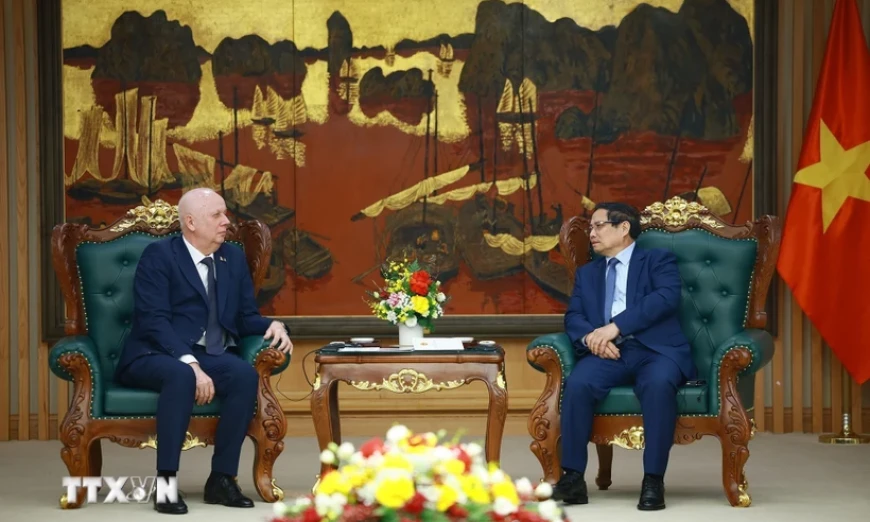

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Podcast] News on March 26, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/c3d9c3c48b624fd9af79c13ff9e5c97a)

Comment (0)