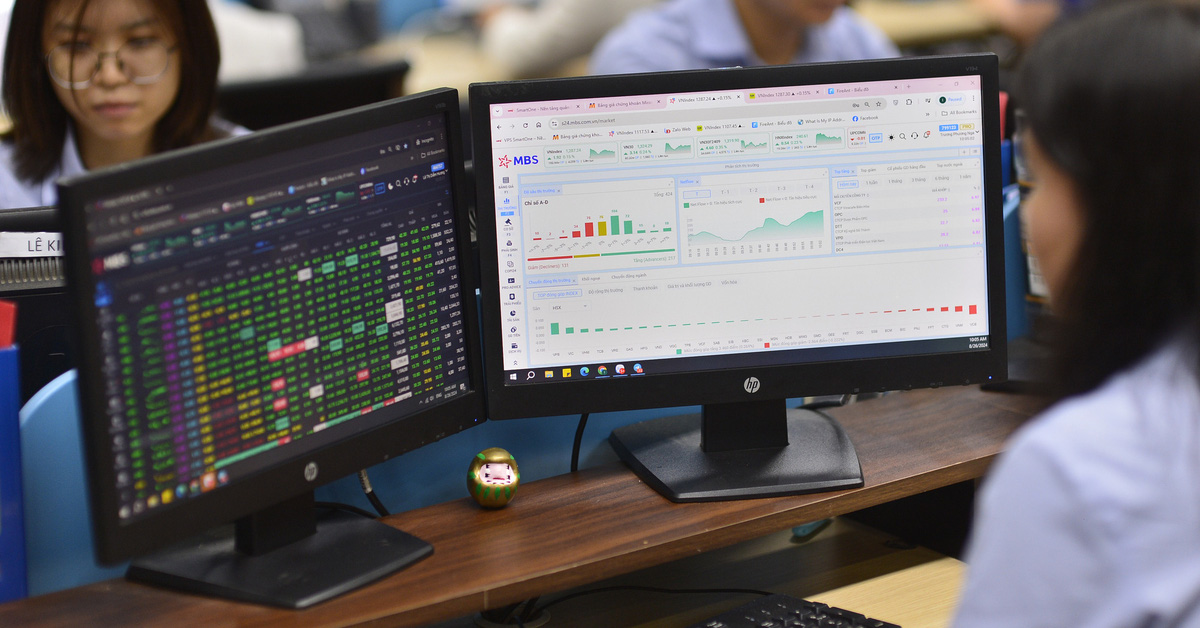

Investment Comments

Saigon - Hanoi Securities (SHS) : In the short term, the market continues to maintain an accumulation base. SHS still expects the next uptrend. If the VN-Index forms a new uptrend, it will create the first uptrend in the medium-term accumulation channel, with resistance levels at 1,080 - 1,200 points and further at the upper resistance of the accumulation channel at 1,250 points.

On the other hand, the sideways session moves tightly and VN-Index is likely to form a new short-term uptrend. Short-term investors who disbursed during the volatile session on January 17 continue to hold their portfolios with an average proportion.

Yuanta Vietnam Securities : The market is likely to continue its upward momentum in the session of January 18 and the VN-Index will still fluctuate narrowly around the current level in the next session.

At the same time, the market is still in a short-term accumulation phase, so the price chart of the VN-Index may not be able to completely surpass the resistance level of 1,169 points in the session of January 18, but short-term risks show signs of increasing in large-cap stocks, indicating that large-cap stocks may continue to adjust in the coming trading sessions.

In addition, the sentiment indicator increased slightly but is still in the pessimistic zone, showing that investors are still cautious ahead of the derivatives expiry date.

Beta Securities : From a technical perspective, the short-term positive trend of VN-Index is still maintained when the index line is above the MA10 and MA20 lines. Currently, the 1,140 - 1,150 point area will act as support for VN-Index.

The January 18 trading session is a derivatives expiration session, so the market is likely to have strong and unpredictable fluctuations. Therefore, investors should be careful in trading and limit chasing stocks that show signs of overheating to avoid correction pressure when profit-taking demand increases.

Stock news

- US stocks fall as bond yields rise, oil prices struggle. The US stock market fell as government bond yields rose and investors digested the latest financial reports. At the close, the Dow Jones index fell 231.86 points, or 0.62%, to 37,361.12 points. The S&P 500 index fell 0.37% to 4,765.98 points. The Nasdaq index fell 0.19% to 14,944.35 points.

- The world's second-largest economy released its latest report, revealing GDP growth in 2023, fourth-quarter figures did not match market forecasts. China's National Bureau of Statistics has just announced that the country's fourth-quarter GDP in 2023 grew 5.2% compared to a year earlier. This figure is lower than the forecast of 5.3% in a Reuters poll .

Source

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

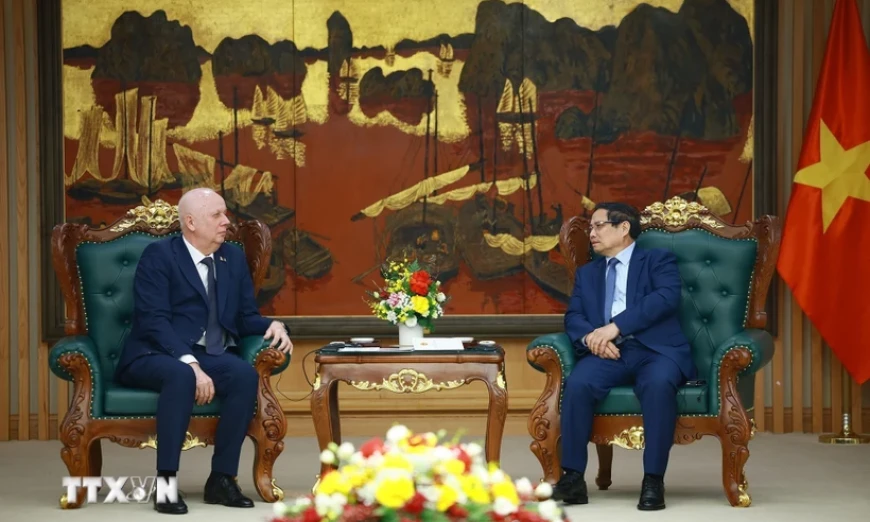

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Podcast] News on March 26, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/c3d9c3c48b624fd9af79c13ff9e5c97a)

Comment (0)