"If I were healthy, I would be willing to wait for my pension. Now that I am sick, I just want to receive back the 17 years of social insurance contributions," said Ms. Hua Thi Mai, in Son Duong district (Tuyen Quang) with difficulty.

The 58-year-old woman's voice was tearful, discouraged and "didn't want to wait any longer" as her health deteriorated and her finances were exhausted after 5 years of treatment for ovarian and colon cancer. After three surgeries and dozens of chemotherapy sessions, Ms. Mai now maintains her health every day with medication. For all those years, she paid for health insurance herself.

Ms. Hua Thi Mai is on the list of thousands of individual business owners who were illegally collected social insurance despite not being eligible to pay, from 2003 to 2021, according to the Petition Committee of the National Assembly Standing Committee. As of May 2023, there are still 3,567 business owners waiting for their benefits to be resolved, 37% of whom have paid social insurance for over 15 years.

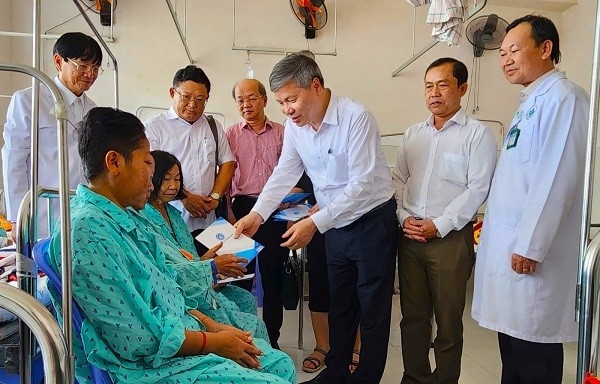

After many years of suffering from cancer, Ms. Mai no longer wants to wait for the policy but wants to receive the money she has paid into social insurance. Photo: Cuong Pham

In the Resolution issued in June 2023, the National Assembly requested the Government and agencies to completely resolve the problem in 2023 to ensure the rights of these household owners. Nine months after the Resolution, the relevant parties are still discussing and calculating solutions. In a report sent to the Government at the end of January, Vietnam Social Security proposed three options: calculating the payment period to receive benefits according to regulations and including it in the revised Law on Social Insurance; returning the collected money without interest and integrating the above two contents in the final option.

After nearly a year of waiting for a solution without any action, Ms. Mai wants to get back the money she paid for social insurance to pay off the bank debt and pay for medicine. She accepts even if the refund amount is only one-tenth."

In 2005, the woman selling groceries and grains joined the compulsory social insurance after many times the insurance officers of Son Duong district came to her house to persuade her. She saved up a few dozen profits after each market session selling a few kilos of peanuts and beans. She collected the money to pay in installments, hoping to have a pension so as not to bother her children when she got old.

After 14 years of mandatory contributions, Ms. Mai switched to the voluntary social insurance group in 2017, according to the announcement of the social insurance agency. That was the time when the Vietnam Social Security requested localities to stop collecting after discovering that individual business owners were not subject to mandatory contributions. However, the incorrect collection continued until 2021.

In May 2020, she received a notice from the social insurance agency that she was "not eligible, stop paying to reserve, wait for a decision". Although Ms. Mai did not understand, she "just followed and waited". Up to now, she does not remember how many government agencies she and other individual households paying social insurance in Tuyen Quang knocked on the doors to ask for benefits. Unable to move after chemotherapy, she transferred the petition to other households to submit on her behalf.

According to current regulations, Ms. Mai has paid 17 years of compulsory and voluntary social insurance and is still three years short of being eligible for a pension. She had planned to pay all the remaining years to receive her pension, but her illness made her change her mind. "Now she is struggling to pay for medical expenses, she just wants to receive the money as soon as possible.

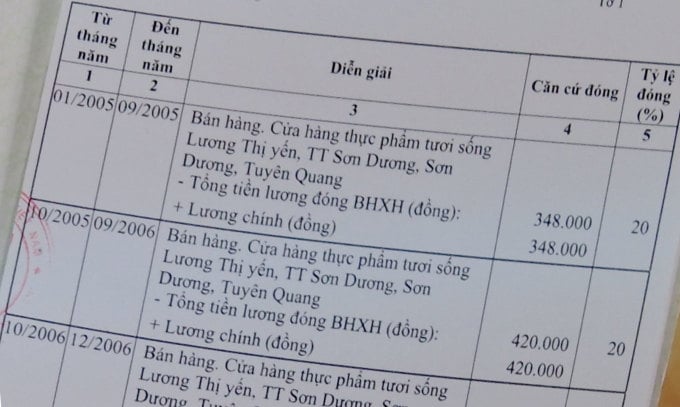

The process of participating in compulsory social insurance of an individual business owner in Tuyen Quang. Photo: Pham Cuong

Sharing the same impatience, Mr. Nguyen Viet Lam (Tuyen Quang City) has entered the fourth year of waiting for his pension book. He has waited twice, since Tuyen Quang Social Insurance "closed the book" in April 2020, now continuing to wait for the industry level to announce the plan after the National Assembly's Resolution.

The 64-year-old man sued the Social Insurance Agency in court when he paid enough years of social insurance and reached the required age but still did not receive the benefits. For nearly a year, he continued to knock on the doors of government agencies to update on the progress of the settlement, but some were silent and others told him to wait.

He said that Tuyen Quang Social Insurance said that if the industry agreed to add the payment time, they would refund all the money he had bought for health insurance in the past years. He kept all the receipts, anxious because he did not know when he would receive them, "while the industry said it had to be completely resolved in 2023". With his old age being uncertain, Mr. Lam still chose to wait for his pension instead of "paying and that's it". Because if he paid, he had to receive it "not ask for it".

Like Mr. Lam, Ms. Le Thi Ha (Yen Son district) chose to wait for her pension rather than receive her pension back without interest. Having participated since 2005, Ms. Ha has paid a total of 13 years of compulsory social insurance, 3 years of voluntary insurance and deducted more than 72 million VND to pay at once for the remaining 45 months to close the book and wait for her pension.

"The price of one kilo of rice used to be 100,000 VND, but now it costs double that amount to buy it. If I pay it back without interest, it would be a huge loss," she said, deciding to take her pension so that "I won't become a burden on society in the future."

Ms. Ha said she had great confidence in "strong statements from all levels" about resolving the rights of household owners. But after nearly a year of waiting for action from all parties, she filed a second lawsuit with the People's Court of Tuyen Quang province against the local Social Insurance. She first filed a lawsuit in 2021, then accepted mediation to wait for a solution but still "no news". To have money to travel, Ms. Ha maintains a small grocery store while she could have received her first month of pension on May 1, 2020.

After four years of waiting for her pension to be lost twice, the 59-year-old woman was "very tired" but did not want to give up. In addition to waiting without seeing any results, she also had a lingering sadness when at the end of 2019, she asked her relatives to borrow money from the bank, collecting enough 72 million VND to pay in one go for the remaining time to have enough for 20 years of social insurance. At a time when the amount of money could buy nearly two taels of gold, she still owes her relatives more than 20 million VND.

"Many other companies also offered to buy life insurance, but I refused them all, choosing only social insurance because it is state-owned," she said, upset that she had to pay interest for every penny if she was a few days late, and had yet to receive her pension after years of waiting.

Individual business owners gathered at Mr. Nguyen Viet Lam's house in Tuyen Quang City, May 2023. Photo: Pham Cuong

According to the proposal of Vietnam Social Security in the report sent to the Government, there are three options to resolve benefits for individual business owners.

Option 1 : Calculate the period of time the household head has paid compulsory social insurance and unemployment insurance to enjoy the regime according to regulations. At the same time, add the content that the business household head is subject to compulsory payment to the Draft Law on Social Insurance Amendment to report to the National Assembly for decision. The payment cost is covered by the Social Insurance Fund from the amount the household head has paid, according to the payment-receipt principle, not taken from the state budget.

Vietnam Social Security chose this option because it expands the safety net, strengthens trust and motivation for people to participate in social insurance. "According to legal regulations over the years, participation and payment of compulsory social insurance, health insurance, and unemployment insurance by household heads are not prohibited acts," the report stated.

Option two is to refund the contributions and recover the money spent on compulsory regimes such as sickness, maternity, and unemployment insurance. These recoveries and refunds will not be charged interest.

The agency is concerned that this could easily lead to prolonged complaints and lawsuits because many householders do not agree. Currently, 200 householders are eligible for pensions when they reach retirement age and have paid social insurance for over 20 years; 380 people are of retirement age and have paid social insurance for over 15 years, and want to voluntarily pay a lump sum for the remaining years to receive pensions. Current law also does not stipulate how much interest must be paid if refunded.

Option three , integrating the two contents mentioned above , calculates the mandatory social insurance payment period for household heads and includes the content in the revised Law on Social Insurance. In case the household head changes his/her wishes and wants to refund the payment, the Social Insurance agency will pay but will not charge interest. Vietnam Social Insurance said that it will apply the 2016 guidance document of the Ministry of Labor, War Invalids and Social Affairs, but is concerned that it will be difficult to implement because many household heads have received short-term benefits such as sickness and maternity, if refunded, these amounts will also have to be collected.

Mr. Nguyen Viet Lam said that in case the competent authority decides to withdraw and return money to the households, it is necessary to calculate the full principal and interest because the value of money 20 years ago is different from now.

"If I return the money without interest, I won't accept it because that's not social security," he said firmly.

Hong Chieu

Source link

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)