(NLDO) - Depositors can enjoy interest rates exceeding 6%/year on e-wallets and digital banks with long terms.

On December 7, according to reporters, not only did many commercial banks increase deposit interest rates beyond 6%/year, but users can also deposit savings via e-wallets with the highest interest rate of 6.1%/year.

Zalopay said it is mobilizing savings products with flexible terms from 3, 6, 9 to 12 months, with interest rates up to 6.1%/year for a 12-month term. This is a product that Zalopay cooperates with CIMB Bank Vietnam, helping users have more options for savings channels, with good interest rates without having to download many applications or complicated registration.

"Savings products on Zalopay allow for partial withdrawal of principal multiple times while still maintaining interest rates. The early withdrawal portion applies non-term interest rates, while the remaining portion still enjoys the original term interest rate," said a Zalopay representative.

Today's interest rate exceeds 6%/year at many banks, e-wallets...

In the trend of increasing interest rates, some banks continue to implement promotional programs to attract deposits at the end of the year.

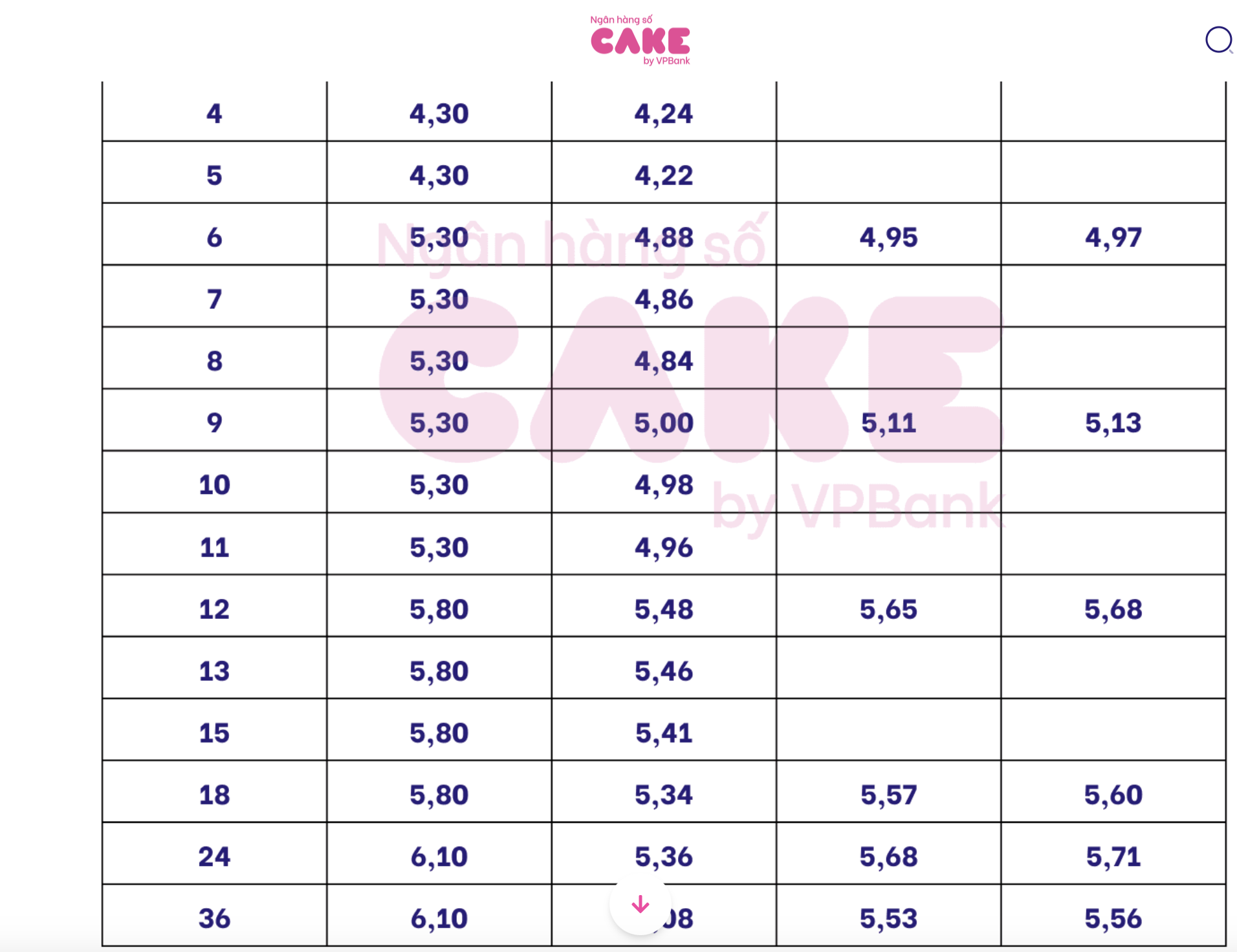

Digital bank Cake by VPBank said it is implementing a birthday program, when customers deposit from 100,000 VND or more for a term of 6 months, they will receive an additional interest rate of 0.6%. Currently, the highest interest rate at Cake is 6.1%/year when customers deposit terms of 24 months or more.

"During the promotion period, customers also have the opportunity to receive additional gifts, tickets to hot shows, Tet shopping vouchers, and bonuses of up to 100 million VND for the highest value deposit" - said a representative of Caky by VPBank.

Cake by VPBank's latest interest rate table

BVBank is also implementing a promotion program. When customers open an account and deposit savings online at the Digimi digital banking application, they will immediately receive an additional 0.6%/year interest rate. When depositing savings here, customers will enjoy a deposit interest rate of up to 5.8%/year with a term of 6 months.

According to records, from the beginning of December 2024 until now, a series of banks have continued to adjust their deposit interest rates with an average increase of about 0.2 - 0.3 percentage points compared to before, such as Techcombank, MSB, VPBank, TPBank, IVB...

Interest rates of over 6%/year are being applied at many banks, such as BVBank, GPBank, BacABank, Dong A Bank, OceanBank, ABBank.

Source: https://nld.com.vn/lai-suat-hom-nay-7-12-gui-tiet-kiem-vi-dien-tu-ngan-hang-nao-lai-cao-nhat-196241207122628489.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)