The food industry, especially rice exports, is going through a difficult period. The world rice market has been volatile after India lifted its ban on rice exports, increasing supply and pushing rice prices down.

Transaction at the bank - Photo: QUANG DINH

Vietnamese rice prices have fallen from an average of $650-$700/ton in 2024 to $550-$600/ton in early 2025.

Meanwhile, the real estate market has yet to show signs of recovery after a long period of stagnation. As a result, the construction materials and interior decoration industry has also fallen into a slump.

Figures from the Vietnam Real Estate Association show that the number of housing transactions in the first two months of the year decreased by more than 35% compared to the same period last year, causing many businesses in the industry to face the risk of bankruptcy.

In large cities such as Ho Chi Minh City and Hanoi, a series of retail brands have had to close down and return their business premises because they could not bear the high rental costs while purchasing power decreased.

The exit of many businesses from the market has led to thousands of workers losing their jobs, increasing pressure on social security.

In that context, access to capital has become an urgent need for businesses. To solve the "capital thirst" of businesses, breakthrough solutions and specific support policies are needed.

The State Bank needs to continue directing credit institutions to cut costs and balance resources to reduce lending interest rates, especially for industries that are being negatively impacted such as food, real estate, and retail.

Loan procedures need to be reformed to be simpler and more transparent, reducing barriers to collateral and documents proving financial capacity.

In addition, there needs to be a green credit policy to encourage businesses to invest in sustainable business models.

The strong implementation of green credit packages with lower interest rates will motivate businesses to invest in environmentally friendly projects, while reducing dependence on non-renewable resources.

Another important solution is to develop funds to support small and medium enterprises, especially in the fields of agriculture, manufacturing and trade services.

The establishment of credit guarantee funds or preferential loan programs will help reduce financial pressure on businesses during difficult times.

It is necessary to promote bank-business connection programs in a more substantial and effective manner.

Instead of just organizing formal conferences, there needs to be a direct dialogue mechanism between businesses and banks to resolve specific problems.

Localities can learn from the model of Ho Chi Minh City, which last February held three conferences connecting banks and businesses, with committed loan capital of more than VND20,000 billion, helping many businesses overcome difficult times.

Finally, solving the capital problem for businesses is not only the responsibility of the banking sector but requires close coordination between state management agencies, industry associations and businesses themselves.

Enterprises also need to proactively improve their financial capacity and make their business operations transparent to increase access to capital from credit institutions and investment funds.

Source: https://tuoitre.vn/giai-con-khat-von-cho-doanh-nghiep-20250302084058774.htm

![[Photo] Ho Chi Minh City after 50 years of national reunification through buildings and symbols](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a224d0b8e489457f889bdb1eee7fa7b4)

![[Photo] Prime Minister Pham Minh Chinh works with state-owned enterprises on digital transformation and promoting growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f55bfb8a7db84af89332844c37778476)

![[Photo] Air Force actively practices for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16fdec3e42734691954b853c00a7ce01)

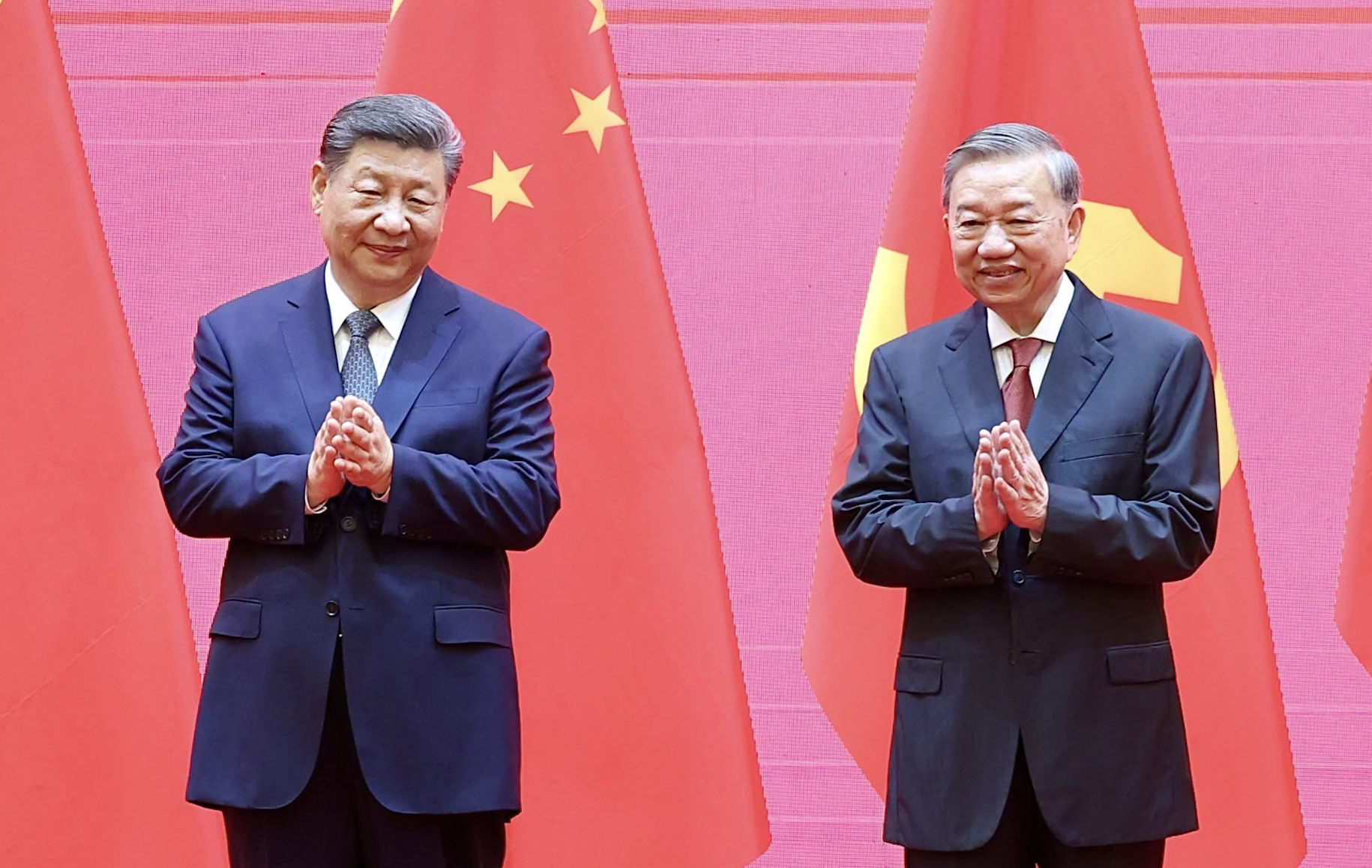

![[Photo] President Luong Cuong holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f7e4c602ca2f4113924a583142737ff7)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)