Oil prices today April 1, 2025: Oil prices climbed to a 5-week high due to concerns about supply from Iran and Russia.

Gasoline price today April 1, 2025

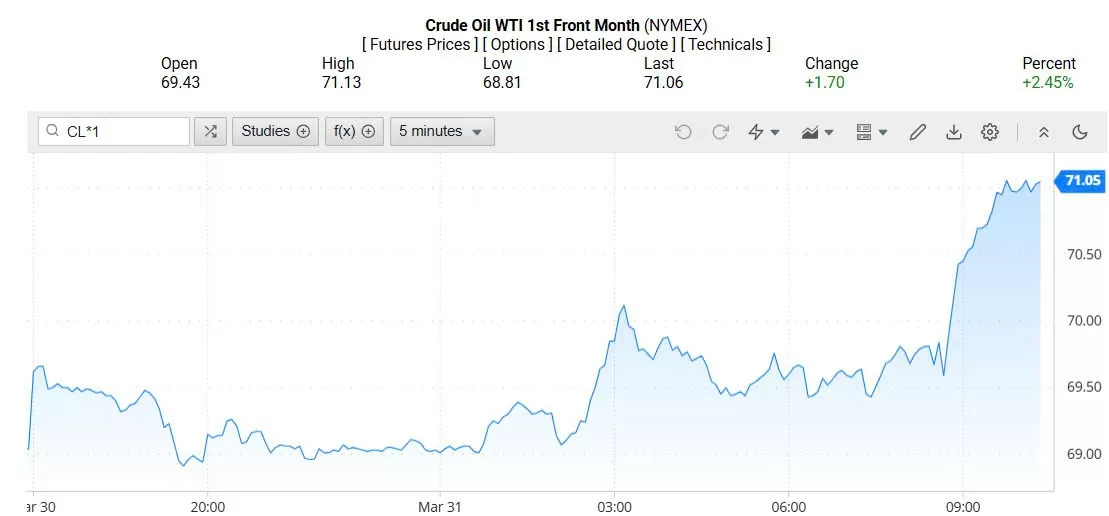

Recorded on Oilprice at 4:00 a.m. on April 1, 2025 (Vietnam time), WTI oil price was at 71.05 USD/barrel, up 2.45% (equivalent to an increase of 1.70 USD/barrel).

WTI oil price on the world market in the early morning of April 1, 2025 (Vietnam time) |

Similarly, Brent oil price was at 74.68 USD/barrel, up 1.43% (equivalent to an increase of 1.05 USD/barrel).

Brent oil price on the world market early morning April 1, 2025 (Vietnam time) |

Oil prices rose about 1% on Monday, hitting a five-week high, on concerns that supplies could fall if former US President Donald Trump carries out his threat to impose more tariffs on Russian oil buyers, as the war in Ukraine shows no significant progress toward ending.

The market is also worried that global oil supplies could be affected if Mr Trump carries out his threat to take military action against Iran, in case Tehran does not agree to sign a deal on its nuclear programme.

Brent crude futures rose $1.04, or 1.4%, to $74.67 a barrel at 10:50 a.m. EDT (1450 GMT). U.S. West Texas Intermediate (WTI) crude rose $1.69, or 2.4%, to $71.05 a barrel.

The gains brought Brent close to its highest close since February 24 and WTI to its highest since February 25.

“Trump’s threat of secondary tariffs on Russian and Iranian oil is a factor the market is watching closely, although he has said there are no immediate plans to impose them. However, the risk of future supply disruptions is increasing,” said UBS analyst Giovanni Staunovo.

On Sunday, Mr Trump declared that he was “very angry” with Russian President Vladimir Putin and would impose secondary tariffs of 25% to 50% on buyers of Russian oil if he believed Moscow was obstructing his efforts to end the war in Ukraine.

The Kremlin said on Monday that Russia and the United States are working on options to reach a peace deal in Ukraine.

China and India are Russia's two biggest oil customers, and whether they accept secondary sanctions will play a decisive role in whether they actually hurt exports from Russia – the world's second-largest oil supplier.

Trump also threatened Iran on Sunday, warning that Tehran could face military strikes and secondary tariffs if it fails to reach a nuclear deal with Washington.

Iran's Supreme Leader, Ayatollah Ali Khamenei, said on Monday that the US would receive a "hard blow" if it acted on Mr Trump's threat.

Some analysts believe Mr Trump may not follow through on these threats, which is helping to curb the rise in oil prices.

Tony Sycamore, an analyst at IG, said the market believes Mr Trump will not go so far as to actually impose heavy sanctions. He warned that if that happens, it could plunge the world into a new trade war, affecting global economic growth and crude demand.

On Monday, some Chinese traders appeared unperturbed by Trump’s latest threat. Three traders who spoke to Reuters said his constant “playing for time” rhetoric had made them take his words less seriously.

"We expect WTI oil prices to remain in the range of $65-75/bbl as the market assesses the impact of Trump's tariffs on oil supplies and the global economy, as well as the supply situation from the US and OPEC+," said Yuki Takashima, an economist at Nomura Securities.

In another development, talks to restart oil exports from the Kurdish region via the Iraq-Türkiye pipeline have hit a snag due to payment and contractual issues, two sources with direct knowledge of the situation told Reuters.

Separately, the US government has also notified Spanish oil company Repsol (REP.MC) that its license to export oil from Venezuela is about to be revoked, which could further reduce oil supplies on the global market.

In China, the world’s second-largest economy, manufacturing activity grew at its fastest pace in a year in March, a factory survey showed on Monday. Rising new orders helped production rebound, providing some positive signs for the Chinese economy amid escalating trade tensions with the United States.

In Germany, Europe's largest economy, inflation fell more than expected in March, strengthening the case for further interest rate cuts at the European Central Bank (ECB).

Lower interest rates reduce the cost of consumer borrowing, thereby stimulating economic growth and increasing demand for oil.

Domestic gasoline prices today April 1, 2025

Domestic retail gasoline prices on April 1, 2025 will be applied according to the adjustment session from 3:00 p.m. on March 27 by the Ministry of Finance - Ministry of Industry and Trade.

Item | Price (VND/liter/kg) | Difference from previous period |

E5 RON 92 gasoline | 20,032 | +337 |

RON 95 gasoline | 20,424 | +337 |

Diesel | 18,217 | +324 |

Oil | 18,524 | +406 |

Fuel oil | 16,902 | -53 |

Specifically, the price of E5 RON 92 gasoline increased by VND337/liter, to VND20,032/liter; RON 95 gasoline increased by VND337/liter, to VND20,424/liter.

Similarly, the price of diesel 0.05S: increased by 324 VND/liter, to 18,217 VND/liter; kerosene increased by 406 VND/liter, to 18,524 VND/liter; mazut 180CST 3.5S decreased by 53 VND/kg, to 16,902 VND/kg.

Gasoline prices today April 1, 2025. Photo by Dinh Tuan |

In this management period, the Ministry of Industry and Trade - Ministry of Finance did not set aside or use the Petroleum Price Stabilization Fund for E5RON92 gasoline, RON95 gasoline, diesel oil, kerosene, and mazut oil.

Thus, from the beginning of 2025 to now, domestic gasoline prices have undergone 13 adjustment sessions, including 5 decrease sessions, 5 increase sessions and 3 opposite sessions.

Ngoc Hung

Source: https://congthuong.vn/gia-xang-dau-hom-nay-01042025-cham-muc-cao-nhat-5-tuan-380853.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)