Big profit when buying gold

Although the difference between buying and selling gold prices is still listed at a high level by trading units, if investors had bought gold from the beginning of the year, they would have made a huge profit.

Specifically, in the trading session on January 1, 2023, DOJI Group listed the buying price at 65.65 million VND/tael; the selling price was 66.65 million VND/tael. The difference between the buying and selling price of gold at DOJI is 1 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the buying price of gold at 66 million VND/tael; the selling price was 67 million VND/tael. The difference between the buying and selling price of SJC gold was also at 1 million VND/tael.

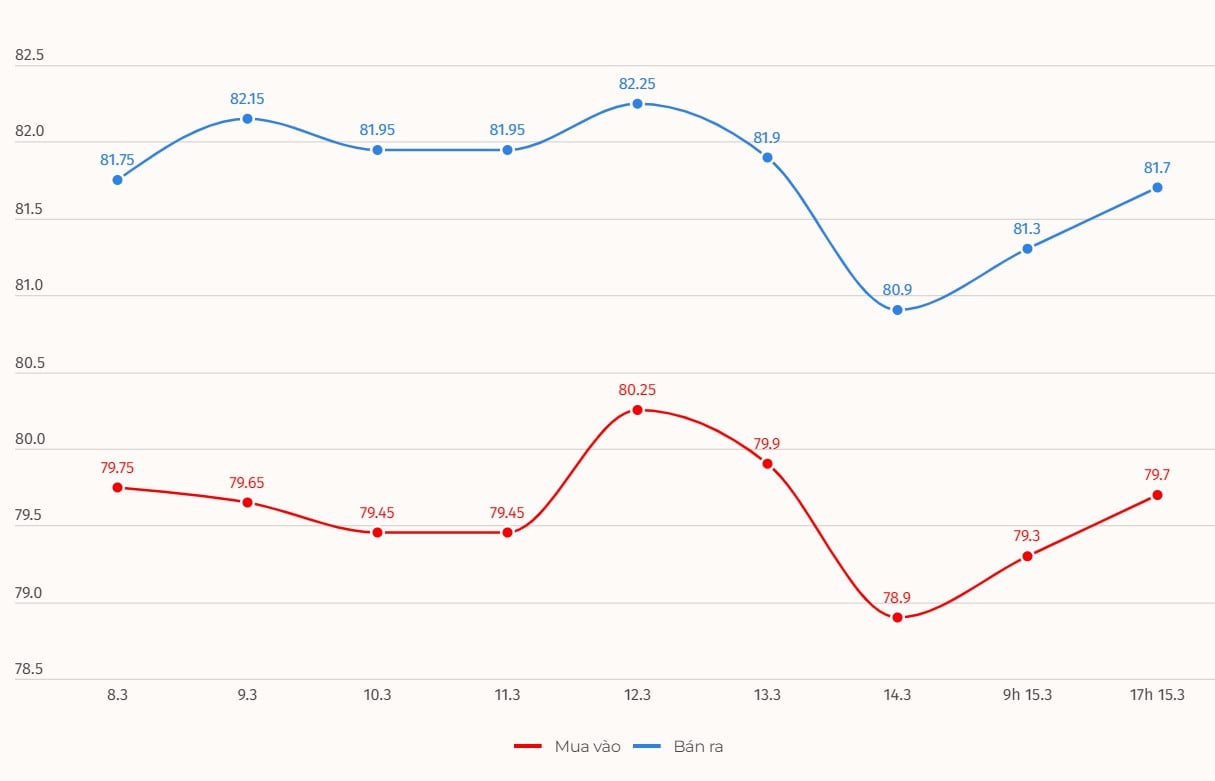

To date, the gold price at DOJI Group has increased to 79.7 million VND/tael; the selling price is 81.7 million VND/tael. If sold at this time, investors would have made a profit of more than 13 million VND/tael.

Similarly, the gold price at Saigon Jewelry Company SJC increased sharply to 79.7 - 81.7 million VND/tael (buy - sell). If sold in today's session, investors will also earn a profit of 12.7 million VND/tael.

Currently, the difference between buying and selling SJC gold is listed at around 2 million VND/tael. Experts say that the safe difference for investors is less than 300,000 VND/tael. However, in reality, this difference rarely appears.

Not only SJC gold, the price of gold rings is also listed at a very high level. As of 5:00 p.m. on March 15, 2024, the price of smooth round gold rings listed by Bao Tin Minh Chau is 68.28-69.58 million VND/tael (buy - sell).

Meanwhile, Saigon Jewelry listed the price at 67.8-69 million VND/tael for buying and selling. Phu Nhuan Jewelry (PNJ) listed the price at 67.9-69 million VND/tael for buying and selling.

In the world market, according to Kitco, from the beginning of 2023 until now, the price of gold has increased by more than 345 USD/ounce. As of 5:00 p.m. on March 15, 2024, world gold was listed at 2,169.9 USD/ounce.

Experts make surprising predictions about gold prices

Sharing in an interview with Bloomberg TV, Natasha Kaneva - head of commodity research at JPMorgan Chase - expressed confidence that "a gold price of $2,500 is possible" after the price of gold reached an all-time high of $2,195.15 on March 8.

This expert said that factors that could lead to gold prices reaching the threshold of 2,500 USD are data on inflation, employment as well as confirmation that the US Federal Reserve (FED) is indeed cutting interest rates.

The Fed’s shift toward easier monetary policy is expected to boost the appeal of gold over other yield-bearing assets such as bonds. Policymakers say they need more evidence that inflation is moving toward their 2% target before cutting borrowing costs.

Meanwhile, Mr. Florian Grummes - CEO at Midas Touch Consulting - commented that the current "dancing" gold price is "signaling the beginning of a major uptrend" in the gold sector.

He said the gold price increase to $2,200 an ounce ended a 13-year period in which world gold prices continuously traded between $1,900 and $2,075 an ounce.

With rising risks in the stock market and potential economic uncertainty, it is only a matter of time before investors start to take notice and view gold as a safe haven asset, Grummes pointed out.

Source

Comment (0)